Here’s what on-chain data reveals regarding the profitability of the different segments of the Dogecoin, Shiba Inu, and Pepe investors.

Dogecoin, Shiba Inu, & Pepe Compared In Terms Of Investor Profits

In a new insight post, the on-chain analytics firm Santiment has discussed how the three biggest memecoins in the sector, DOGE, SHIB, and PEPE, have been doing in terms of different indicators.

Among these, one of the metrics that the analytics firm has talked about is the Market Value to Realized Value (MVRV) Ratio Intraday, which tells us about the percentage of profit or loss the investors hold right now.

Related Reading

When the value of this metric is greater than 0%, it means the overall market is in a state of profit. On the other hand, the indicator being under this cutoff suggests the holders are carrying a net loss.

In the context of the current topic, the MVRV Ratio Intraday of the entire market isn’t of interest but rather that of two specific segments: the 30-day and the 365-day investors.

The MVRV Ratio Intraday for the 30-day investors would naturally only keep track of the profitability of the addresses who bought their coins within the past month. Similarly, the 365-day version of the metric would tell us about the profit/loss status of the buyers from the past year.

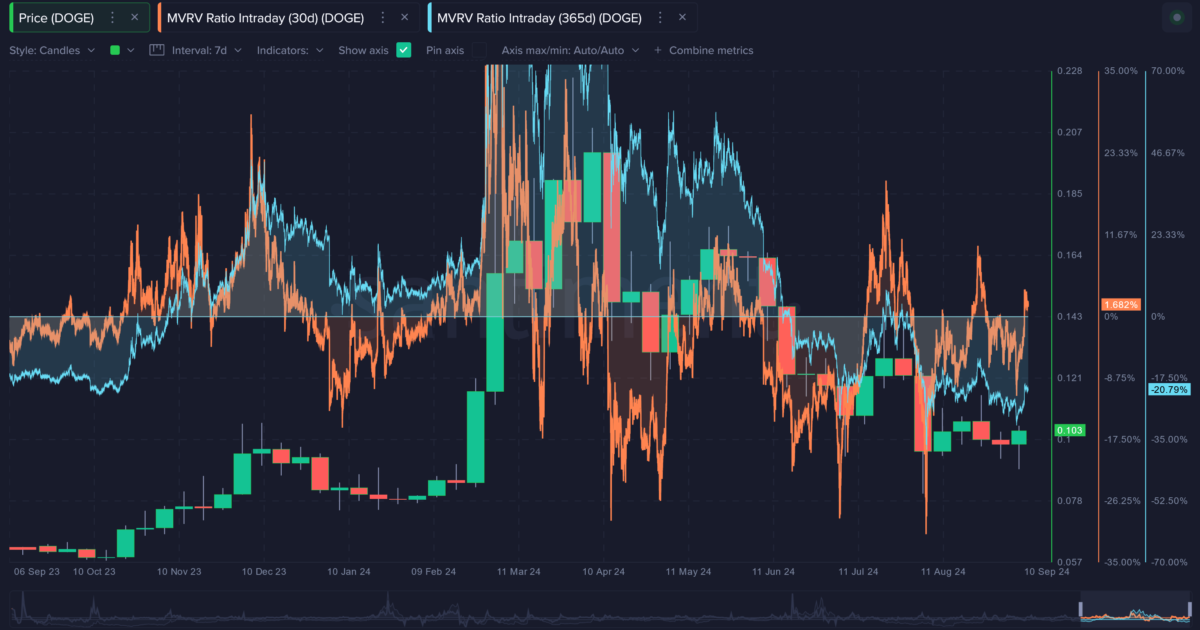

Now, here is first the trend in these two indicators for the original memecoin, Dogecoin, over the past year:

As displayed in the above graph, the Dogecoin MVRV Intraday for the 30-day investors currently has a value of just 1.7%, which means this cohort is only slightly in the green.

Usually, the long-term holders enjoy higher profits than those who recently bought, but in the case of DOGE, it’s the reverse right now. The investors who bought during the past year are in the red, with their holdings being almost 21% underwater.

“With prices dropping significantly since its top in mid-April, there is an argument for a price rebound to bring this long-term deficit back to break-even,” notes Santiment.

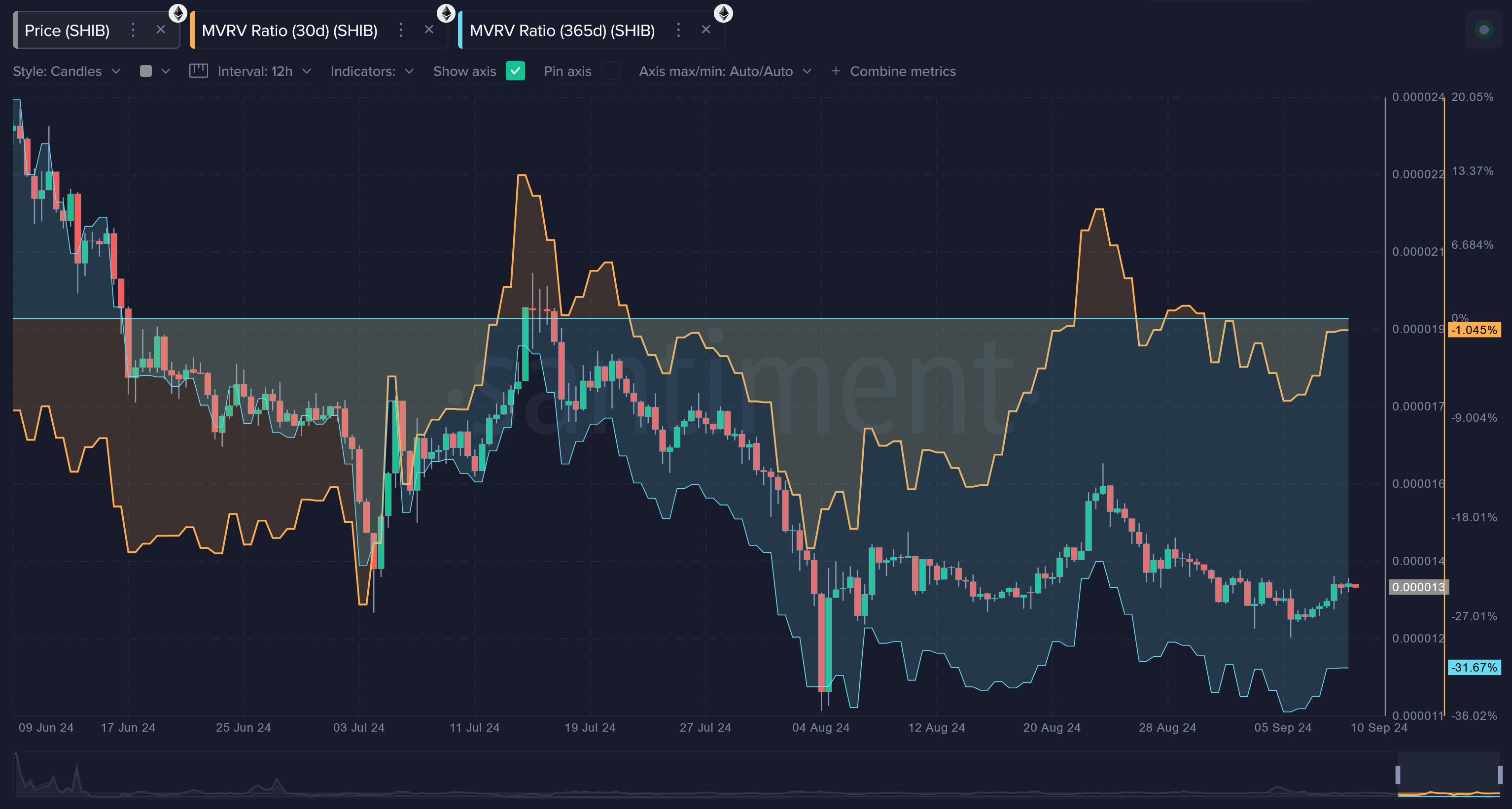

Dogecoin’s rival, Shiba Inu, has been doing even worse in these metrics, with both classes of investors being in loss.

The 30-day Shiba Inu investors are holding their tokens at a slight loss of 1%, while the 365-day buyers are more than 31% below their average cost basis.

Related Reading

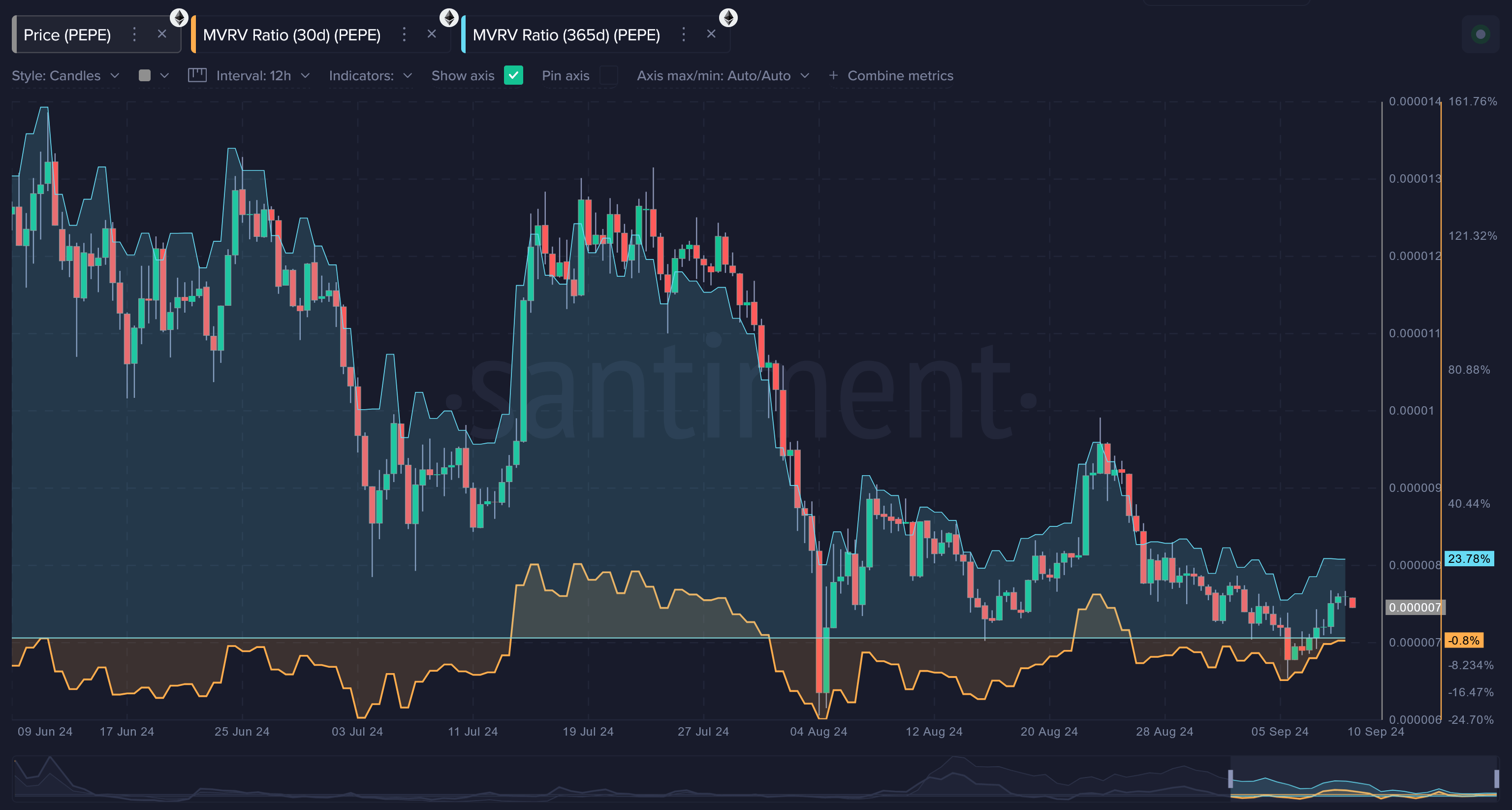

Interestingly, Pepe’s situation is opposite to that of SHIB and DOGE, with the memecoin’s long-term holders having their patience rewarded.

The monthly investors are down around 0.8% for PEPE, while the yearly ones are enjoying gains of almost 24%. According to the analytics firm, this indicates “there is still a bit of profit that patient traders may need to wait to see evaporate before there is a clear buy signal.”

DOGE Price

When writing, Dogecoin is trading around $0.988, down almost 4% in the last 24 hours.

Featured image from Dall-E, Santiment.net, chart from TradingView.com