sponsored

2022 was one of the roughest years in the crypto industry, which saw the collapse of Terra LUNA, Celsius, and FTX, consequently wiping out over $2 trillion from the crypto market. However, the dark horse in the face of these ugly events was the crypto exchange – Bitget.

Despite the hardships in the market, Bitget grew in all aspects; the company made great strides in building our team, brand, and business over the last 12 months during the crypto winter. The exchange expanded its services to the global Web3 market for the first time in 2022. This effort pushed its business velocity beyond bounds, making it one of the fastest-growing exchanges with the best business momentum.

Some key development areas of the company included:

- Climbing the chart ranked as the Top 3 exchange according to the Boston Consulting Group report, in terms of the crypto derivative trading volume.

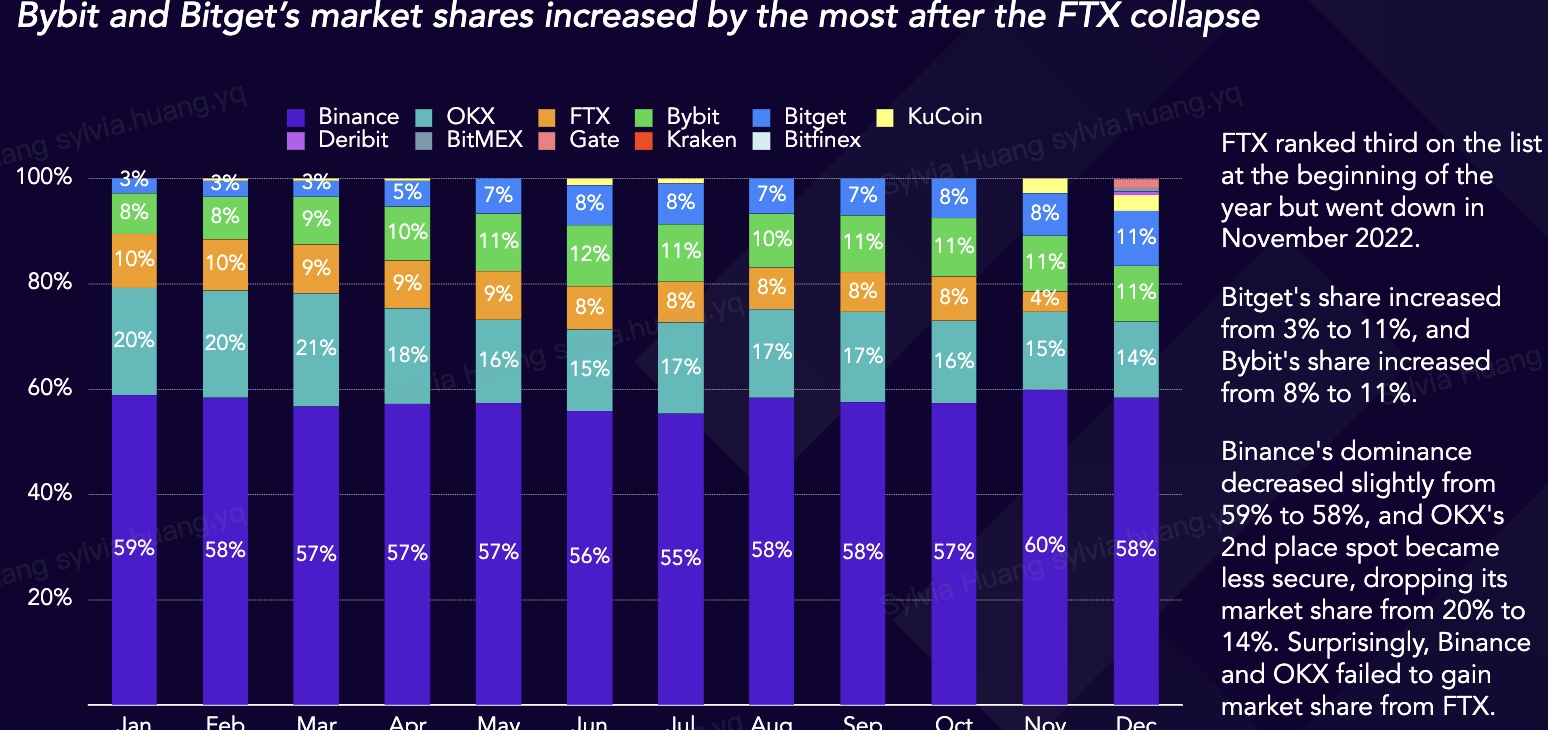

- According to the latest TokenInsight report, Bitget’s market share in the derivative market increased from 3% to 11% after the collapse of FTX

- Over 300% increase in total transaction volume, with the popularity of copy trading products

- The workforce grew from barely 200 people at the beginning of 2022 to over 1100 employees in Jan 2023

- Became the exclusive crypto exchange partner with Lionel Messi

Looking at the Numbers

Previously, the company focused on serving customers from a few Asian countries alone. However, by the end of 2022, the exchange had acquired over 8 million users in more than 100 countries, with footprints in Turkey, Southeast Asia, Latin America, and Europe.

Bitget saw an over 300% increase in total transaction volume with more than 4.2 million profitable trades. The platform’s on-chain data shows that 100,000 plus traders shared a profit of over 9.7 million US dollars with its copy trading products.

According to the latest data shared by the TokenInsight report, Bitget’s market share increased dramatically from 3% to 11% after the collapse of the former second-largest exchange, FTX, which marked the single largest market share growth in the crypto derivatives sector. At the end of 2022, the top 10 exchanges’ total daily open interest had dropped by 27.1% from January and 41% from its peak in April of the same year. Among the exchanges, only Bitget achieved a significant increase in open interest, from $841 million to $3.74 billion, representing a 344% total increase.

Regardless of the bearish market, the exchange attained these numerous figures when some other industry players went bankrupt. Bitget beat the industry trend because they did four things correctly.

1. Defined Copy Trading

The platform spent the last four years perfecting its infrastructure and products for copy trading to provide the most outstanding social trading experience.

One-click Copy Trade, the flagship social trading product, which enables customers to execute trades automatically, shadowing orders and strategies from the experienced traders of their choice, has worked wonders for its business and users. The exchange saw many traders moving funds from other leading crypto exchanges to Bitget to enjoy the ease of copy trading.

The One-click Copy Trade feature streamlined the whole process of crypto trading to a single click, eliminating human errors in price fluctuations and providing a good starting point for everyone to get into the game.

In 2022, the company launched Bitget Insights and Strategy Plaza, where users can find more ways of maximizing their yields. These features on the site help users choose the most lucrative trading methods to subscribe to.

Innovative copy trading products and social trading services are Bitget’s quintessential attributes and have made Bitget the largest crypto copy trading platform.

2. Protection and Security for Users

The company have also taken many security measures to ensure users can trade with ease and comfort, as demonstrated by the following:

- In the past four years, Bitget almost achieved zero accidents despite the various market conditions. This feat was the inevitable result of the day and night monitoring and continuous advancement in our IT and security system in the past four years. As a result, the exchange has set almost one of the best records in the industry.

- Bitget also launched a 300 million Protection Fund that the company pledged no withdrawal in the next three years in case of emergency. However, no emergency cases have been observed in the four years of the platform’s operations.

- The company’s Merkle Tree Proof of Reserves tracking page updates our snapshot monthly, ensuring a 1:1 reserve ratio of customer funds. Bitget has also developed an open-source tool, ‘Merklevalidator,’ available on GitHub. This resource reveals our on-chain data on third-party platforms like Nansen, CoinGecko, and more, as well as provides a tool for its users to verify their account reserve information.

3. Equal Priority to Retail Investors

The company has consistently adhered to the philosophy of putting our retail users first, going against many similar businesses in the industry as most value institutional and VIP users more. But Bitget is more willing to serve retail users, so when designing product attributes, interest protection mechanisms, and product thresholds, the company always has retail users in mind.

At Bitget, retail customers get better services and more favourable rates. The company believes retail investors are an essential momentum driver in the development of the crypto industry, which is very different from traditional finance.

4. Working closely with Influencers

Bitget accumulated highly motivated Key Opinion Leaders (KOL) and affiliates over the past four years and has a network of over 100,000 close KOL partners worldwide.

The company was the most friendly platform for KOL and Key Opinion Consumers (KOC) in the industry. Together with these influencers, the company spreads the most professional trading strategies and high-quality content with users.

Social trading is one of the crucial parts of Bitget’s system. The company found a distinct development path that suits the platform’s characteristics and remains focused. Therefore, although many achievements have only manifested this year, it is indeed the result of the team’s continuous efforts over the past four years.

The Advice for Fellow Builders in the Bear Market

- Create a product with distinguishing qualities and become a leader in the field: people are naturally drawn to number one in the industry for all the right reasons.

- Security and protection is the most critical aspect of blockchain businesses. Ensure users that their funds are always theirs and are withdrawable at request. This way, everyone will be willing to store assets with the product.

- Every business decision should be made from the consumers’ perspective. For example, a product that provides users benefits and real use cases will eventually succeed because users will naturally stick around.

MD’s Vision for the Crypto Industry in 2023

“As macro liquidity continues to affect the crypto market, the interest rate spike is expected to slow down in 2023 gradually. Although we are not sure when the interest rate cuts will happen, the impact of the Fed on macro liquidity will also continue to affect investors’ expectations for the crypto market.

In addition, the number of locked positions in DeFi is expected to increase slowly in 2023. Regardless of the decline in the value of popular blockchain tokens, the number of active users and new wallet addresses on chains like Polygon, Ethereum, and BSC has remained on the rise.

As more DeFi blue chips slowly transform into the ecosystem’s infrastructure, the lock-up volume and TVL of DeFi are expected to continue to rise in 2023. Therefore, I look forward to seeing how it will play out in 2023!

Hopefully, my speech has been able to give some inspiration and confidence to the industry. If Bitget could still achieve steady growth in the bear market, fellow industry businesses can accomplish the same. So, we will build the industry with healthy competition and continued userbase growth together!”

This is a sponsored post. Learn how to reach our audience here. Read disclaimer below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.