How Bitcoin rose amid soaring US debt

While Washington, DC printed trillions, Bitcoin mined block by block, quietly evolving from digital experiment to global asset class.

As policymakers increased government spending and implemented stimulus measures, the US national debt surged to over $37 trillion, sparking worries about inflation, currency devaluation and long-term fiscal stability.

Meanwhile, Bitcoin’s (BTC) limited supply and decentralized structure have drawn growing interest from individuals, institutions and even sovereign wealth funds looking for alternatives to traditional currency risks. Over time, as the US debt continued to climb, Bitcoin’s value soared, driven by speculation and increasing skepticism toward conventional financial systems.

Here is a summary of Bitcoin vs. the US national debt:

Did you know? In 2010, Bitcoin’s first recorded price was just $0.003. At that rate, $1 could buy over 300 BTC, which is worth millions today.

Bitcoin’s parallel ascent: From zero to trillion-dollar asset

Since its introduction in January 2009, Bitcoin has transformed from a small-scale experiment into a trillion-dollar asset, significantly impacting global finance and culture. Several key factors have contributed to this extraordinary growth.

Digital scarcity and reputation

- Bitcoin’s fixed supply of 21 million coins, secured by a decentralized proof-of-work (PoW) system, created digital rarity.

- Bitcoin gained a reputation as “digital gold” due to concerns over inflation, currency weakening and declining trust in banks, driving investors to alternatives.

Institutional and global adoption

- Major institutional milestones validated its credibility, including approval of Bitcoin ETF applications by BlackRock and Fidelity in January 2024.

- Companies like Metaplanet and GameStop entered the Bitcoin space, further legitimizing it.

- El Salvador adopted Bitcoin as legal tender, and Latin American regions expanded Bitcoin mining operations.

Market value and financial integration

- Bitcoin’s market cap ($2.1 trillion) rivals gold ($22.9 trillion), silver ($2 trillion) and major stock markets despite lacking central leadership, financial statements or physical boundaries.

- Mainstream acceptance grows through ETFs and Bitcoin-backed financial products. For instance, Strategy (formerly MicroStrategy) issued 2.5 million shares of 10% Perpetual Stride preferred stock to raise $250 million to buy Bitcoin.

- Initiatives like the Strategic Bitcoin Reserve (SBR), funded with seized Bitcoin, are intended to serve as enduring strategic assets for the nation.

- El Salvador has secured regulatory approval for its Bitcoin-backed “Volcano Bonds,” which are designed to help manage sovereign debt and fund the development of the planned Bitcoin City. While initial preparations have been completed, the issuance has yet to materialize.

Cultural impact

- Bitcoin discussions have moved from online forum discussions to corporate boardrooms. It has redefined how people think about money, trust and authority, fueling a global shift toward decentralization. Embraced by activists, technologists and even artists, Bitcoin symbolizes financial freedom and resistance to centralized control. From memes and slogans to political protests and celebrity endorsements, it has become part of global pop culture. Whether seen as digital gold or a movement, Bitcoin’s real legacy may be its role in reshaping how society views power and ownership.

- Bitcoin Ordinals and Runes have added a vibrant cultural layer to Bitcoin, enabling NFTs and fungible tokens directly on its blockchain. This expansion has attracted artists, collectors and meme communities, transforming Bitcoin from a purely financial asset into a broader platform for digital creativity and cultural expression. Symbols such as laser eyes and Bitcoin statues represent its role as a movement for economic freedom and digital autonomy.

Timeline of key milestones in Bitcoin’s history

- 2009: Launches at $0

- 2010: First market price ($0.003)

- 2017: Crosses $20,000 for the first time

- 2021: Hits $1-trillion market cap

- 2024: Returns to ~$70,000 range amid institutional adoption and ETF approvals

- 2025: Surges past $110,000 as sovereign adoption, ETF inflows and treasury strategies drive record highs.

Did you know? Bitcoin hit $1,000 for the first time in late 2013, driven by rising adoption in China and early excitement around crypto exchanges.

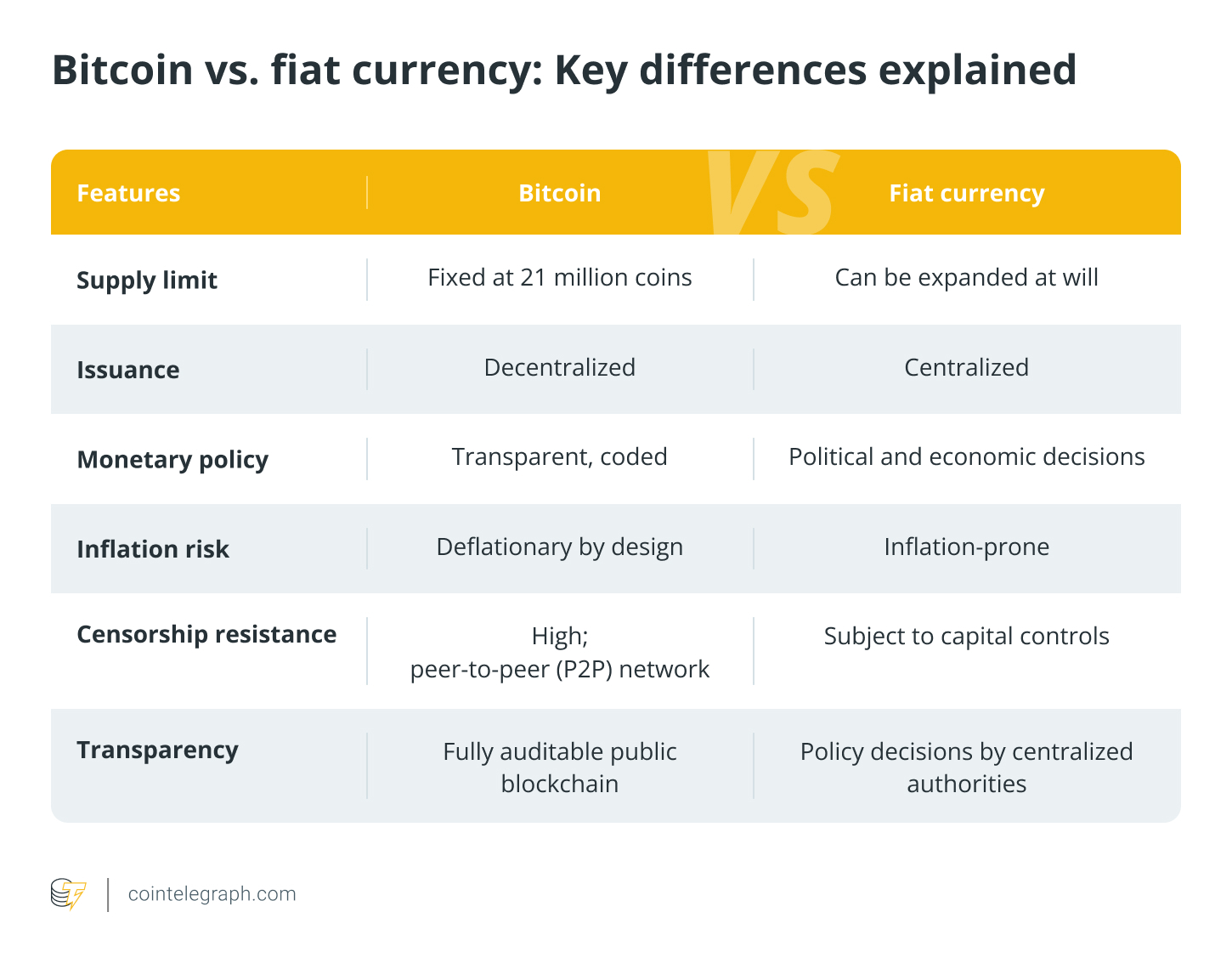

Bitcoin vs. fiat: Two conflicting monetary models

Bitcoin and fiat currencies embody two fundamentally different monetary systems. While fiat systems, like the US dollar, rely on centralized control and flexible money supply, Bitcoin offers a decentralized, fixed-supply alternative.

Governments and central banks, which issue fiat currencies, can increase the money supply at will by printing currency notes, borrowing and economic stimulus. While this approach allows flexibility in addressing economic challenges, it also results in inflation. Currency gets weakened and national debt rises, as evidenced by the US’s $37-trillion debt.

In 2025, Bitcoin’s market value is around $2.1 trillion, contrasting sharply with rising national debts. The UK’s debt has surpassed 2.8 trillion British pounds ($3.4 trillion), while the EU’s collective public debt exceeds $16 trillion. China’s public debt stands even higher at over $16.6 trillion.

On the other hand, Bitcoin operates on a decentralized model with a fixed supply of 21 million coins. It is designed to be immune to centralized control or monetary expansion. Bitcoin is released in circulation through a predictable, transparent mining process, ensuring scarcity. Unlike fiat currencies, which can lose value due to policy decisions, Bitcoin’s strength lies in its resistance to devaluation, censorship and manipulation.

As governments continue to rely on debt-driven spending, Bitcoin presents an alternative as a deflationary asset independent of traditional financial systems. This contrast fuels ongoing discussions about monetary independence, long-term wealth protection and the future of money.

A comparison of Bitcoin and fiat currencies as monetary models

What Bitcoin achieved while the US spent

Bitcoin quietly developed as a distinct financial system as the US government increased its debt. While fiat debt grew by trillions, Bitcoin progressed technologically, gained institutional support and expanded globally.

Here are various ways Bitcoin has grown:

- Institutional adoption: Major financial firms, including BlackRock, Fidelity, Metaplanet, Strategy and Tesla, added Bitcoin to their investment portfolios as a reserve asset. GameStop updated its treasury policy in March to hold Bitcoin, acquiring roughly 4,710 BTC (approximately $513 million) in May 2025. Once known for selling and renting video games, GameStop is following Strategy, which utilizes Bitcoin as a treasury reserve asset.

- Regulatory approval: In January 2024, spot Bitcoin ETFs gained regulatory approval, making it easier and more compliant for traditional investors to access Bitcoin. This milestone highlighted Bitcoin’s increasing acceptance by regulators and financial markets. By January 2025, spot Bitcoin ETFs saw $129 billion in inflows. In 2025 alone, inflows have reached about $45 billion, including a single-day increase of $408 million on June 16, 2025, primarily driven by iShares Bitcoin Trust ETF (IBIT) and Fidelity Wise Origin Bitcoin Fund (FBTC).

- Adoption of Bitcoin as legal tender: El Salvador became the first country to adopt Bitcoin as legal tender in 2021, paving the way for other nations to consider cryptocurrency. This step demonstrated Bitcoin’s potential as an alternative to traditional currency systems, especially for countries looking to reduce reliance on fiat.

- Network upgrades: The technology behind Bitcoin has improved significantly since its inception in 2009. Lightning Network (2016) enabled fast microtransactions, Taproot (2021) increased privacy and transaction efficiency, Ordinals (2023) allowed embedding digital content on the blockchain, and Runes (2024) expanded token creation, enhancing Bitcoin’s functionality.

- Global liquidity and market behavior: Bitcoin’s trading patterns began to resemble those of major macro assets, often compared to the “Magnificent 7” tech stocks like Apple and Nvidia. Its price now responds not just to crypto-specific news but also to broader risk-on and risk-off shifts in global markets. This alignment with high-growth equities reflects Bitcoin’s evolving role as a speculative yet strategic asset, drawing both opportunity and systemic risk alongside the broader market.

Did you know? In December 2017, Bitcoin skyrocketed to nearly $20,000 before crashing 80% in 2018, highlighting its extreme price volatility.

What if just 1% of every major federal stimulus package had gone into BTC

Since 2020, the US has passed several massive stimulus packages totaling around $7.6 trillion. If just 1% of that had been allocated to Bitcoin, the total investment would be: $7.6 trillion x 1% = $76 billion.

Let’s understand how.

Major stimulus packages

- CARES Act, officially the Coronavirus Aid, Relief, and Economic Security Act (March 2020): $2.2 trillion, meaning $22 billion into Bitcoin ($2.2 trillion x 1% = $22 billion).

- Consolidated Appropriations Act (December 2020): $2.3 trillion, meaning $23 billion into Bitcoin ($2.3 trillion x 1% = $23 billion).

- American Rescue Plan (March 2021): $1.9 trillion, meaning $19 billion into Bitcoin ($1.9 trillion x 1% = $19 billion).

- Other COVID-era and infrastructure programs (2021-2023): ~$1.2 trillion, meaning $12 billion into Bitcoin ($1.2 trillion x 1% = $12 billion).

- Total potential BTC investment: $76 billion (based on the amount allocated toward economic stimulus).

Market impact

Bitcoin’s market cap (June 2025) is $2.1 trillion.

Now, $76 billion ÷ $2.1 trillion = 3.62% of current market cap.

A capital injection of this size, especially concentrated, could lead to a 5%-15% price appreciation, amplified by Bitcoin’s low float and high sensitivity to large buys.

What would it change?

- Price effect: $76 billion could have added $100 billion-$300 billion in market cap via multiplier effects.

- Government validation: Crypto’s perception as a speculative fringe asset might have shifted to “sovereign-worthy.”

- Volatility: Broader ownership reduces retail-driven cycles.

- Policy implications: A bold move like this would have challenged global monetary orthodoxy.

Thus, even a 1% allocation would have transformed Bitcoin into a federally endorsed reserve-like asset, creating ripple effects across fiscal policy, global finance and digital asset adoption.

Trade-offs and risks

However, funneling public funds into Bitcoin has its drawbacks. Bitcoin is still a highly volatile asset, prone to sharp drawdowns (e.g., ~70% in 2022). Allocating taxpayer-backed stimulus into such an asset could provoke political backlash, especially during downturns. There is also the question of control; unlike bonds or infrastructure projects, Bitcoin offers no guaranteed yield, governance leverage or domestic job creation. While the upside could be massive, so would the scrutiny and systemic risk exposure.