- Goldman Sachs expects profit margins to jump in 2021.

- Goldman’s forecast is based on strong U.S. and global economic growth in the coming year.

- The stock market is facing many downside risks that we shouldn’t overlook.

Goldman Sachs is optimistic about corporate profitability in 2021. The bank expects the U.S. stock market’s margin to jump sharply next year.

Goldman expects a key financial measure to improve strongly on the back of a continued economic recovery in the fourth quarter and into 2021.

Goldman Forecasts Strong Margin Growth for 2021

The bank said in a note that ten of 11 S&P 500 sectors saw a return on equity decline this year, but the numbers are expected to rebound once revenues return.

Goldman released a list of stocks best positioned for significant growth in this earnings-growth metric over the next 12 months. Chipotle Mexican Grill, Tapestry, Discover Financial Services, and Align Technology are on the list.

Goldman expects the U.S. stock market’s profit margin to rise sharply in 2021:

We expect S&P 500 net margins will sharply rebound by 181 bp to 10.9% in 2021, slightly below 2019 levels. This forecast primarily reflects our economists’ expectation of strong U.S. and world GDP growth in the coming year, driven in part by vaccine approval and distribution.

The firm noted that cost-cutting and automation would help boost margin recovery.

Goldman’s Forecast Is Too Optimistic

Goldman Sachs is way too optimistic about corporate profitability in 2021. The bank seems to underestimate ongoing stock market risks that could limit its rally.

Six months after the pandemic started, the U.S. economic outlook is deteriorating. Life has not fully returned to normal.

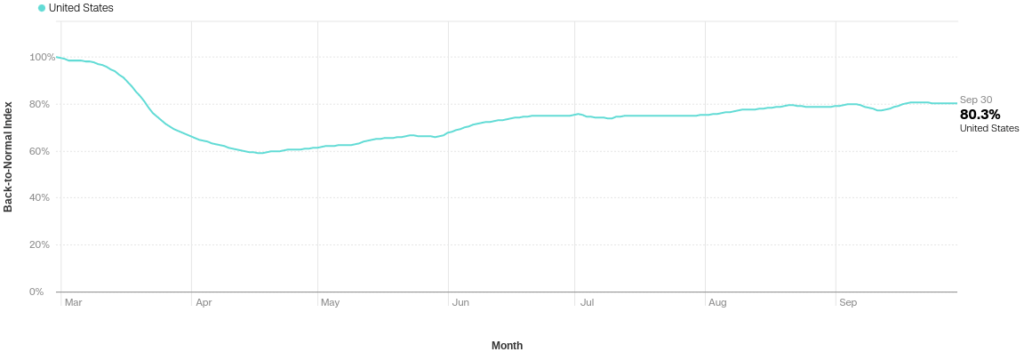

The Back-to-Normal index created by CNN Business and Moody’s Analytics estimates that as of last week, the economy was functioning at about 80% of where it was before the pandemic.

Mark Zandi, chief economist at Moody’s Analytics, said:

I think it’s pretty clear the Back-to-Normal Index indicates this is not a V-shaped recovery. Six months in, we’re still a long, long way from getting back to normal.

The travel, leisure, and hospitality industries were particularly affected. Restaurants welcome 35% fewer customers than before the pandemic.

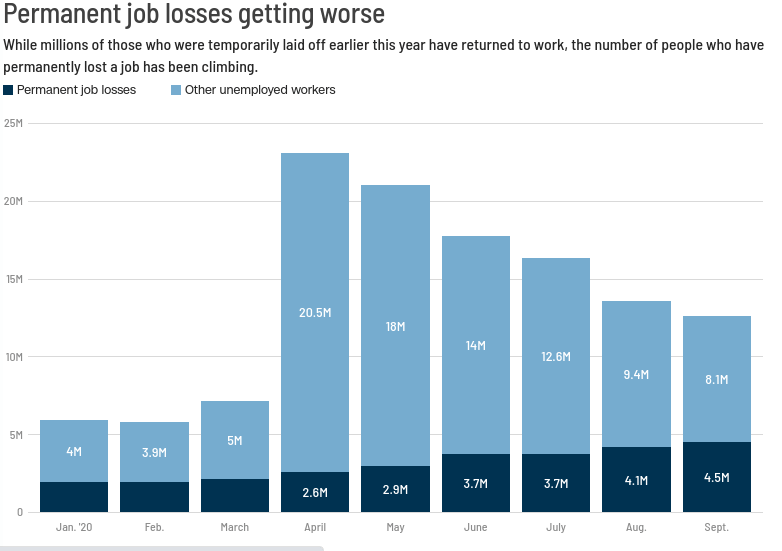

An increasing number of temporary layoffs are turning into permanent job losses.

Permanent job losses will probably continue to increase.

American and United Airlines cut 32,000 jobs Thursday alone. Disney has announced plans to permanently remove 28,000 workers already on temporary leave at its U.S. theme parks.

Mark Zandi doesn’t think America will return to full employment until the second half of 2023.

That forecast could happen if the virus slows down its course and fiscal policy comes to the rescue. If not, things could get even worse.

The outlook is presently poor on both fronts. After weeks of decline, virus cases are on the rise again in the United States, just ahead of flu season. Lawmakers remain stuck in a stalemate over yet another fiscal stimulus package.

JPMorgan Isn’t As Optimistic as Goldman About the Stock Market

JPMorgan said a viable COVID-19 vaccine would help to accelerate the return to normal. But chances that a potential vaccine will be available by October or November are very slim, which is likely to create stock market disappointment.

Nine of the leading drugmakers in the fray to produce the vaccine have recently signed a pledge stating that they will not apply for regulatory approval until the vaccine is proven to work safely and effectively through late-stage clinical testing. This could potentially delay the rollout of the vaccine.

JPMorgan sees an increase in corporate delinquencies, mortgage delinquencies, and bankruptcy filings in the United States as a sign of caution despite unprecedented fiscal and monetary support from Congress and the Fed.

It also said the rising odds of a no-deal Brexit, the potential for heightened trade disputes between the U.S. and China, and the recent deterioration in relations between Russia and Germany could put negative pressure on the stock market.

Disclaimer: This article represents the author’s opinion and should not be considered investment or trading advice from CCN.com. The author holds no investment position in the above-mentioned securities.