After months of volatility and extreme fear, crypto markets turned a positive corner in the second half of April, highlighting the industry’s big sentiment shift.

For venture capital, it was business as usual, with investors continuing to pour money into promising startups across layer-1 blockchains, infrastructure, real-world asset tokenization (RWA), and Web3 social media.

This edition of VC Roundup highlights six notable funding deals from April.

Unto Labs raises $14.4M for layer-1 blockchain

Blockchain R&D company Unto Labs raised $14.4 million to continue developing its scalable layer-1 network called Thru. The pre-seed and seed funding was led by venture firms Electric Capital and Framework, with support from angel investors in the Solana engineering community.

The company is led by former Solana contributor Liam Heeger, who argues that “blockchains painted themselves into a corner by inventing custom Virtual Machines (VMs),” which he believes has prevented mainstream adoption.

Thru is built on the RISC-V standard, an open-source computer architecture not limited to blockchain and crypto-specific use cases.

An Electric Capital partner named Ren called Thru the “next logical step” in blockchain development after Ethereum pushed smart contracts and Solana raised the standard on network performance.

Related: VC Roundup: 8-figure funding deals suggest crypto bull market far from over

MIT-incubated Optimum closes seed round

Blockchain infrastructure developer Optimum closed an $11 million seed round with participation from at least 16 venture capital firms, including 1kx, Robot Ventures, Spartan, Longhash, and Animoca.

Optimum is building a high-performance memory layer for the blockchain using Random Linear Network Coding (RLNC) technology, which was developed at MIT by protocol founder Muriel Médard.

Médard, a professor at MIT, told Cointelegraph in March that RLNC is akin to “breaking a puzzle into small pieces, mixing those pieces together into equations, and sending them to your friends.”

“Even if a few pieces get lost, your friends can still put the whole puzzle together from the pieces they receive,” she said in describing how RLNC can help blockchains overcome scalability issues.

Octane launches with $6.75M in funding to bring cybersecurity to crypto

Archetype and Winklevoss Capital led a $6.75 million seed round for Octane, an AI cybersecurity startup focused on detecting vulnerabilities in blockchain systems. Additional investors included crypto exchanges Gemini and Circle.

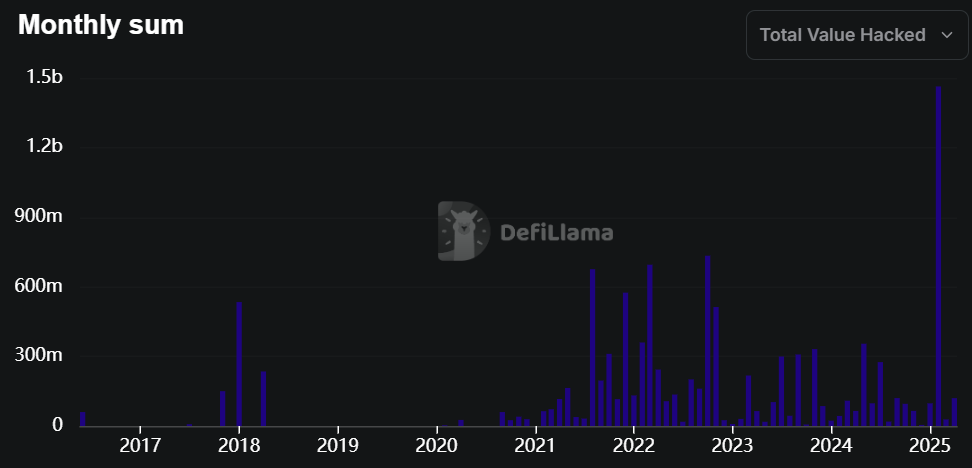

In its announcement, Octane pointed to data from DefiLlama’s exploit tracker, which shows that crypto attacks have caused over $11.3 billion in losses, more than half of which stem from DeFi hacks.

Octane’s platform is designed to continuously analyze smart contracts for potential vulnerabilities and offers AI-powered tools to help developers identify emerging threats.

a16z backs Inco’s $5M raise

Blockchain confidentiality protocol Inco has closed a $5 million funding round led by Andreessen Horowitz’s Crypto Startup Accelerator, also known as a16z CSX. Additional investors included Coinbase’s venture capital arm, 1kx Capital, OrangeDAO, Script Capital, and South Park Commons.

Inco leverages cryptography to develop confidential computing technology for blockchains. Its first product, Inco Lighting, is designed to bring privacy to onchain applications.

Inco founder Remi Gai said blockchains have successfully solved issues like scalability and abstraction, but “confidentiality remains the final challenge.”

The announcement referenced a Paradigm research report identifying privacy as one of the three main barriers preventing traditional finance from adopting blockchain technology.

Related: VC Roundup: Investors continue to back DePIN, Web3 gaming, layer-1 RWAs

a16z, Coinbase Ventures contribute to Towns Protocol’s $10M raise

Towns Protocol, a Web3 social media platform, raised $10 million in a Series B round led by a16z, with additional backing from Coinbase Ventures and Benchmark. The Series B brings Towns’ cumulative funding to $25.5 million since early 2023.

Shortly after announcing the fundraise, Towns revealed plans to launch 10 billion TOWNS tokens on Base and Ethereum in the second quarter of this year.

Towns is an open-source protocol that allows users to build messaging apps for their digital communities. As of April 29, it has generated $11.5 million in total revenue, with 90% paid out to the creators of individual Towns, according to developer Ryan Cooley.

RWA-focused Colb raises $7.3M to boost pre-IPO equity opportunities

Switzerland-based fintech firm Colb Asset SA raised over $7 million in an oversubscribed seed extension to advance the tokenization of pre-IPO equity in companies like SpaceX and OpenAI.

While Colb did not identify its backer, it said the round was funded by a single private investor managing over $20 billion in assets.

The new capital will support Colb’s efforts to expand its tokenization platform and cross-border payment infrastructure, potentially boosting adoption of its USC stablecoin, which it says is the first Swiss-compliant, US dollar-pegged stable asset.

Related: ‘Contrary to popular belief,’ regulation isn’t slowing tokenization — Prometheum CEO