YFI crashed towards $12,000 on Thursday and unconfirmed evidence shows that Sam Bankman-Fried was behind the plunge.

A Weibo-based profile, operating under the pseudonym of “Crypto Apprentice,” published a string of screenshots that connected the FTX crypto exchange CEO with the YFI’s massive price meltdown. Per the images, Mr. Bankman-Fried deposited FTX’s native token FTT and Serum decentralized exchange’s governance token SRM into Cream’s liquidity pool as collateral.

In retrospect, Cream is an Ethereum-based lending platform that allows users to borrow or lend from a pool of assets. Mr. Bankman-Fried allegedly used their service to borrow three decentralized finance tokens: UniSwap’s UNI, Curve’s CRV, and Yearn Finance’s YFI.

Cream profile allegedly linked to the FTX CEO borrowing YFI tokens. Source: CryptoApprentice

“If you want to look for yourself, the [Cream] wallet might be Alameda’s [a cryptocurrency trading firm also founded by Mr. Bankman-Fried] because it has $72M in FTT,” noted Julien Thevenard, an investor with Fabric Ventures in London.

“They have borrowed 2.7M UNI + 165 YFI (+ no CRV) yesterday and sent them to Binance/ They have repaid 1.3M UNI since. Interestingly they hold 14M Sushi there,” he added.

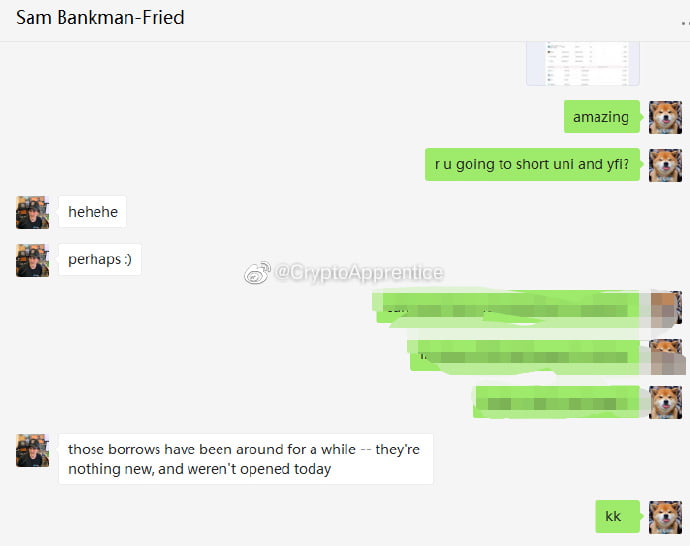

One of the screenshots then showed the CEO in conversation with an unidentified individual. In there, the anonymous person can be seen asking Mr. Bankman-Fried that whether or not he would short “UNI and YFI,” to which Mr. Bankman-Fried responds: “perhaps” followed by a smiley.

The image shows the FTX CEO claiming that he may short his UNI and YFI holdings. Source: CryptoApprentice

Mr. Bankman-Fried has not released a clarification or response to the said allegations so far.

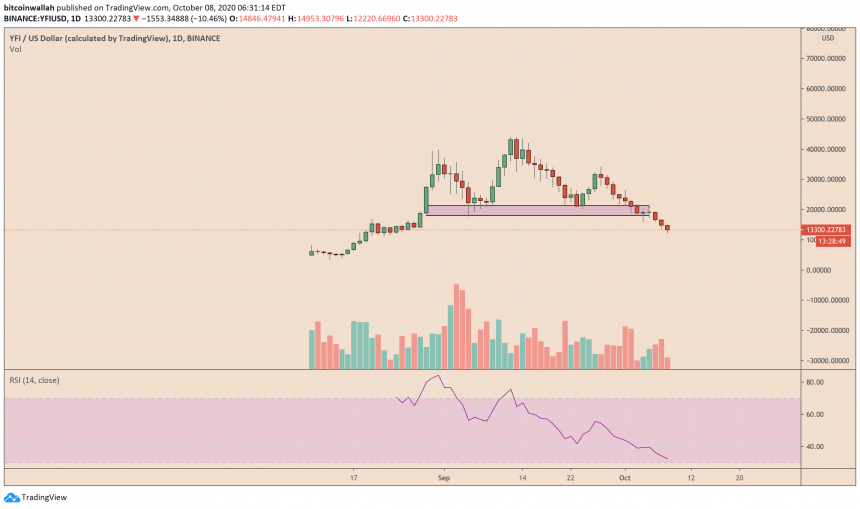

YFI Capitulation Continues

None of the screenshots showed the exact date on which Mr. Bankman-Fried discussed his plans to short YFI. Nevertheless, with the Yearn Finance token dropping in eight out of ten daily sessions, the community smells a rat.

It is also because Mr. Bankman-Fried allegedly commits that he borrowed UNI and YFI tokens earlier, without mentioning the date, however. Meanwhile, YFI has now crashed by almost by 64.34 percent from its September 27 high of $34,272.

YFI undergoes massive sell-off. Source: TradingView.com

Another factor that has contributed largely to the YFI breakdown is Andre Cronje, the founder of Yearn Finance. Not too long ago, he founded ‘Eminence’ (EMN), a project that lost about $15 million to hackers even before the launch.

Market analyst Alex Krüger said that EMN’s failure rippled negativity across Mr. Cronje’s successful Yearn Finance project. He wrote:

“The main reason IMO was Yearn’s blatant negligence around the EMN launch, and how poorly the aftermath was handled. Said so when it happened, not in hindsight later. Many exited/reduced YFI positions because of it.”

The total value locked inside the Yearn Finance pool now stands near $600 million, a 40 percent drop from its all-time high.