Four Main Reasons Behind the Falling Bitcoin Price

October 22, 2019 by Jeff Fawkes

A thought that makes most Bitcoin veterans nervous: that the price may never jump back over the $14,000 USD level. Why is this? Because the industry needs some new code before it can move on to wider adoption.

Also read: Electron Cash Wallet Gets ‘Mecenas’ Recurring Payments Plugin for BCH

For BTC Price to Move Up, We Need New Technology

The blockchain revolution that was promised by many experts back in 2017 is approaching its end. Company CEOs need to show their investors that the code is working, but their efforts seem to be not so successful.

What we see is that ICO projects continue to blow up, leaving people from around the world without any hope for recovering funds. While many of the blockchain developers were spending investment money on whores and bathhouses, planes and yachts, they were supposed to write the code.

Where is this code? It’s non-existent. To grow and attract users, Bitcoin needs:

- New code, that will increase Fungibility and Privacy of the coins

- Block size increase, or some other solution (definitely not the Lightning Network due to its horrible lack of development transparency and dozens of unrevealed bugs) to increase Scaling and Adoption

It’s hard to believe, but Bitcoin Core developers have been discussing things like MAST, Schnorr signatures, Compact Blocks, CoinJoin, and block propagation time optimizations since July 2017. Yet, they don’t add any new code to the system. Minor improvements, like Lightning and Liquid support, is all we have today.

Development of Code or Good Old Politics?

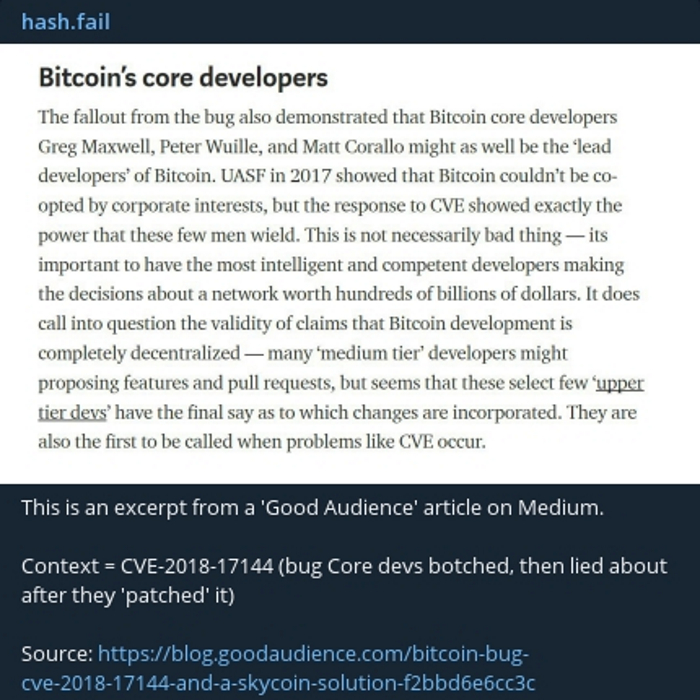

You’ve been fed with the fairy tales about Bitcoin’s hardcore decentralization. In fact, it appears that there is no procedure that obligate outside devs to peer review the Bitcoin code, and there are no such devs at all.

Blockstream, a private company, can turn Liquid on and off to cut users’ access to their bitcoins at any moment. Let us remember Jeff Garzik’s insight that Blockstream and Chaincode Labs had obtained veto power over any new change to the BTC code repository:

So the first reason behind the non-rising Bitcoin price is that it’s not scalable, and this is the political will of the developers. We don’t even know the majority of them. How many times has anyone seen Wladimir van der Laan at some crypto conference? Just look for a single video featuring him on YouTube. Can you not find one? Hell yeah, he’s a ghost, and he is a key maintainer now with the highest access and has over 5,000 commits to BTC’s codebase behind his back.

Pick any Bitcoin developer and you will be able to find something strange about him on the Web. For instance, Luke-jr has six kids but he restricts them from watching Disney movies and cartoons. He also thinks that the Sun revolves around the Earth, and that slavery is not a bad thing. Also, people aren’t really bothered by the fact that one of the most famous developers, Gregory Maxwell, is banned by Wikipedia admins for vandalism.

The NYAG Investigation Against Bitfinex and Tether

Don’t try to guess why some news websites keep writing about Tether, while others collect information about Anthony Pompliano’s strange theories or Craig Wright’s favorite drinks. When Bitfinex is your sponsor, you cannot write anything stupid, right?

Since January 2019, Bitcoin’s price has risen significantly almost every time Tether issued a new batch of 100 million USDT tokens. Some market analysts say the Tether guys have been minting the coins in a fast manner and selling them for BTC. This is because, as you may already know, when some crypto business starts dealing with American regulators, the law always wins.

Smart investors and insiders know that Bitfinex is on its way to oblivion. And Tether management knows they’re on fire, and it’s their last chance to make lots of cash and escape before it’s too late.

The theory goes that Tether was used back in 2017 to pump the BTC price significantly. And the situation is similar in 2019, with a slight difference. This time, the NYAG is after Bitfinex, and they have stopped printing vast amounts of Tether since July 2019. It has become clearer that this time, iFinex Ltd. and its subsidiaries won’t escape the law that easy.

Bakkt Launch Proves Institutional Investors Are not Interested in Bitcoin

As you may remember, the Bitcoin price went $2K down from $10,000 zones to $8,000 zones right after the community saw the Bakkt futures trading volume. On the first day of the trades, Bakkt had only 12 BTC in their “Vault”. If there’s something indeed crucial in this launch: we finally understood that law-abiding capital is not interested in cryptocurrencies.

Since Bitcoin is not something that attracts institutional investors right away even in 2019, it cannot be worth $100,000 per unit. Or whatever price is bouncing back and forth in regular prediction news this week. Instead, Bitcoin seems to be a means of illegal exchange, or legal capital doesn’t want to trust their Bitcoin keys with the Bakkt team.

Crypto Exchanges’ Fake Orgasms and Wash Trading

Just take into consideration the fact that the QuadrigaCX investigation did shed light on a web of undercover connections between the top exchanges.

Some of the famous exchanges conduct wash trading. Deal with it. All of those exchanges are connected in some way or another, and many of them perform dirty ops, behind their customer’s backs. Sometimes, exchanges even freeze users’ funds for a few weeks or exploit their personal data to create bank accounts in offshore zones, and to launder money through them.

It’s not only crypto exchanges trying to make it look like nothing wrong is happening under the table. They also engage with a broad set of inner activities, sometimes just dirty, occasionally illegal.

Stealing a database with millions of users is not a crime – you can always draft up a press release to note that the exchange “was hacked”. And the user agreement says that users have agreed to any crap the exchange could dish out to them, so it’s all OK.

Faking the trades is not a crime – especially when you work at the exchange’s office. You know some insider information. Like, when the newly hyped ICO starts off on the platform and how the price will move in the first couple hours. Also, trading bots and fake volumes are the pumper’s best friends. According to some researchers, 90 percent of Bitcoin trading on most exchanges could be false.

What To Do in a World of Lies?

Never give up. The simple facts that we have featured in this quick writeup show that people in the industry have drowned in corruption and laziness. If you look at the famous people from the crypto sphere, many of them seem to divide the community for easy control, pump tokens, and speak bullshit at conferences.

Look at how Adam Back says crypto businesses should use a tab, it’s from 2017. Almost 2.5 years have passed and there is no solution to the question from this video. Strange feeling, right?

At the same time, everybody misses the real progress made by separate developers working in different communities. For example, the Monero and Bitcoin Cash communities have active developers. They made big efforts to make crypto transactions more private and the coins more fungible.

Although the industry is now at the edge of destruction, we should never stop fighting for the principles. Especially when it comes to decentralization and the things every one of us can make to help it survive.

Bitcoin is centralized in every possible way… and we won’t even start considering Ethereum’s metrics here. Like the top “rich addresses” ownership. What will you do to change the situation, and should you?

Share your position on the main reasons behind the falling crypto prices in the comments below.

Images by Jeff Fawkes, Mr. Freeman