Bitcoin was lower around $13,400 though on track to gain 24% in October, an impressive performance since U.S. stocks declined 1.6% on the month and gold slid 0.5%.

“With the U.S. election just days away, we are going to have to be patient when it comes to headwinds lifting BTC to new multi-year highs,” Matt Blom, head of sales and trading for the cryptocurrency-focused financial firm Diginex, wrote in a note to clients.

In traditional markets, European stocks fluctuated and U.S. futures pointed to a lower open. The dollar was steady in foreign exchange markets and 10-year U.S. Treasury yields rose 0.01 percentage point to 0.83%.

“Our short-term risk appetite indicator is firmly in negative territory,” said Jean-Francois Paren, head of global markets research at Credit Agricole CIB, in a note to clients, according to Bloomberg News.

Market moves

There’s an undercurrent in the crypto industry where true believers like to paint the future of money as less about, well, money than about truth and exposing the flaws and failings and abuses and wrongs of the traditional financial system and economy.

It’s not just about getting rich. It’s about reimagining the entire system, starting from scratch with state-of-the-art technology and fresh ideas, a complete reset.

It’s also about convincing everyone else that the mission is worthy, perhaps inevitable – on the right side of history.

Such is the backdrop for the latest monthly letter from Dan Morehead, a former Goldman Sachs derivatives trader and hedge-fund manger who now runs the cryptocurrency investment firm Pantera Capital in San Francisco.

The missive includes a clever table intended to demonstrate just how succinct, concise, laconic, crisp, efficient and compact Bitcoin founder Satoshi Nakamoto was when he penned the white paper that served as the intellectual, logical, economic and mathematical foundation for the original and still-largest blockchain-cum-cryptocurrency.

Nakamoto needed just 3,192 words for the blueprint, or less than a tenth of the book of Genesis from the Jewish and Christian Bible. The number is half as many as it took to pen the U.S. Constitution and about 1% of Adam Smith’s seminal “Wealth of Nations.”

“Blockchain for Dummies,” a simplified instructional book on blockchain, needed 20 times as many words to explain the technology as Nakamoto’s white paper.

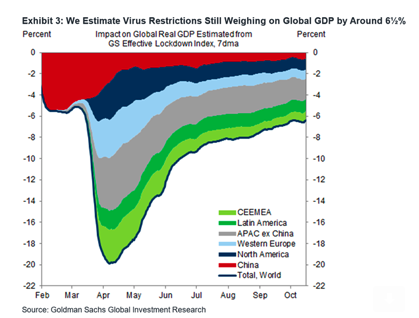

But aside from pointing out the elegant genius of bitcoin’s (possibly?) pseudonymous founder, the essential crypto viewpoint is one of trying to look at the world in just the right way. According to Morehead, the following chart offers a key reminder that as global economies bounce back from the coronavirus-triggered lockdowns earlier this year, the loss of output remains severe:

The point was to illustrate the lack of context for Thursday’s U.S. government report that the world’s largest economy surged 33% in the third quarter, as the lockdowns eased. To put it in market terms, it was perhaps the biggest dead-cat bounce in world history, measured in dollar terms.

With the economy in shambles, the thinking goes, massive stimulus will be needed from the government and Federal Reserve, eventually debasing the dollar and pushing up prices for bitcoin. (Deribit, the biggest cryptocurrency options exchange, just listed a contract that allows traders to bet on a price rally to $40,000 next year, triple the current price.)

Morehead wrote in the letter that a recent rush into bitcoin by big players like PayPal, MicroStrategy and Paul Tudor Jones might ultimately give more big players cover to follow.

This isn’t about greed, or the future of money. It’s about right and wrong, or rather who’s right, and who’s wrong.

“A movement doesn’t succeed because of its initial leader,” Morehead wrote. “Rather, it’s the first follower and the subsequent followers who make it work. The more who join in, the less risky it is to take part in it. Those who were on the fence before, have fewer excuses as the movement grows.”

For anyone wondering, Pantera’s full monthly newsletter clocked in at about 3,130 words. For what it’s worth.

Bitcoin watch

While the market environment is currently not conducive for bullish price action in bitcoin, the cryptocurrency is unlikely to see a meteoric fall, according to analysts.

“Given the upcoming U.S. elections and meltdown in the legacy markets, traditional investors will maintain a risk-off mindset,” trader and analyst Nick Cote told CryptoX in a Telegram chat.

Some observers say the U.S. could face a constitutional crisis if Democratic candidate Joe Biden wins by a thin margin and President Donald Trump tries to cast doubt on the results. The election uncertainty, coupled with coronavirus resurgence in the U.S. and across Europe, has triggered risk aversion in stock markets this week and applied brakes to bitcoin’s price rally.

The anti-risk mood could prevail at least till the U.S. election on Nov. 3. As such, Patrick Heusser, senior cryptocurrency trader at Crypto Broker AG, is calling for caution on the part of short-term speculators. “I am expecting an increase in volatility and would be careful with setting stop losses too tight,” Heusser said. “Traders should maintain a low risk profile right now.”

Bitcoin is currently trading in the red near $13,300, representing a 1% drop on the day. Should the risk aversion in traditional markets worsen, the cryptocurrency may revisit support at $12,500-$12,000.

“If prices were unable to hold the bullish throwback [bull market pullback] to $12,200-$12,000, the focus would shift to next major support levels at $11,100 and $10,800,” Cote said.

That said, a price crash looks unlikely, as major central banks are already printing massive amounts of fiat money, and the cryptocurrency is currently backed by a strong bullish narrative of increased institutional participation.

Besides, if there are widespread lockdowns and renewed economic slowdowns, central banks are expected to step in with additional stimulus, fueling inflation fears and boosting demand for bitcoin, according to Cote.

All things considered, dips in bitcoin could be short-lived.

On the higher side, the June 2019 high of $13,880 is the immediate resistance, followed by the next daily resistance block at $15,800-$16,000. There are large offers near $14,000 on cryptocurrency exchange Bitfinex, according to Heusser.

Token watch

Bitcoin (BTC): Cryptocurrency’s price rally spurs increase in transactions just as end of China’s rainy season prompts bitcoin miners to pare back, creating congestion and pushing up transaction fees to the highest in 28 months.

Bitcoin Cash (BCH): Crypto exchange OKEx, still paralyzed by founder’s arrest, details plans for how to handle November hard fork.

Uniswap (UNI): Uniswap’s $40M governance vote closes on Halloween and some holders fear for price.

Harvest Finance (FARM): DeFi yield aggregator boosts bounty to $1M from $100K for information leading to return of $24M in funds siphoned via this week’s exploit.

Ripple (XRP): Blockchain payments firm put $9.3M into partly-owned remittance giant MoneyGram in 3Q.

Analogs

The latest on the economy and traditional finance

ECB signals further stimulus ahead to prop up struggling economy (WSJ)

Central banks were net sellers of gold in third quarter for first time in decade as prices neared record (Bloomberg)

Small-cap stocks buoyed by bets on Biden-led stimulus (WSJ)

Swiss bank Credit Suisse targets share buyback up to $1.6B even with loan-loss provisions running at 8 times the 10-year average (WSJ)

Sales of $5M-plus homes in New York’s The Hamptons quadruple in third quarter as rich New Yorkers flee city (WSJ)

Exxon Mobile to slash 15% of global workforce, including 1.9K jobs in U.S., as anemic economy dents oil demand (WSJ)