Price point

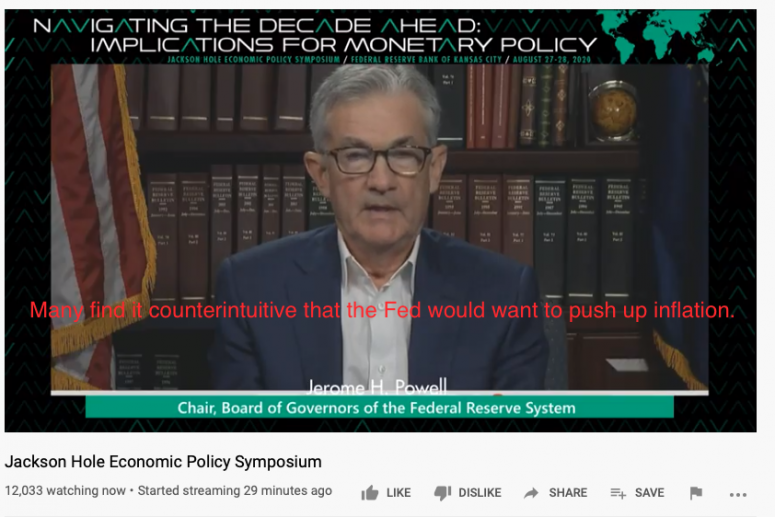

Bitcoin was rising along with gold and U.S. stock futures early Friday as traders reacted to Federal Reserve Chair Jerome Powell’s plan to let inflation run hot in coming years as the economy heals from the coronavirus-induced recession.

The largest cryptocurrency, seen by some investors as a hedge against inflation, changed hands around $11,451, staying in the range between $10,900 and $12,400, where it has been stuck since late July.

In Asian markets, the Japanese yen jumped on haven buying after Prime Minister Shinzo Abe, who has pursued inflation-boosting policies, said he would resign due to an illness.

You’re reading First Mover, CryptoX’s daily markets newsletter. Assembled by the CryptoX Markets Team, First Mover starts your day with the most up-to-date sentiment around crypto markets, which of course never close, putting in context every wild swing in bitcoin and more. We follow the money so you don’t have to. You can subscribe here.

Market moves

Getting in and out of a large bitcoin trade on cryptocurrency exchanges like Binance or BitMEX isn’t costing as much as it used to. That might be a healthy sign that digital-asset markets are maturing.

At Binance, the world’s biggest cryptocurrency exchange by trading volume, the daily average spread between buy and sell orders on bitcoin futures for $10 million quote size declined to a record low of 0.25% on Monday, according to data provided by research firm Skew. The spread, which typically narrows as an exchange’s order book depth increases, spiked to 7.95% during the March crash but dropped shortly after. It has been in a declining trend ever since.

The so-called bid/offer spread is the difference between the best available price to sell or buy something in a market. It essentially represents liquidity – the degree to which an asset can be quickly bought or sold on a marketplace at stable prices.

A narrower spread implies a deeper market where there is sufficient volume of open orders so buyers and sellers can execute a trade without causing a big change in the price. That’s in contrast to a weak liquidity environment, where large orders tend to move the price, increasing the cost of executing trades, and deterring traders – especially institutions – and, in turn, causing a further decline in liquidity.

Binance and BitMEX offering record low spread on a $10 million quote is a healthy market development, according to Denis Vinokourov, head of research at London-based crypto prime broker Bequant.

“The tighter the spread, the deeper the order book, the more the market is able to withstand shocks [price volatility],” Vinokourov told CryptoX in a Telegram chat.

Bitcoin watch

Bitcoin and gold are reversing losses seen on Thursday following Federal Reserve’s (Fed) announcement of a more relaxed approach to fighting inflation.

- The top cryptocurrency has recovered to levels above $11,450 on Friday, erasing nearly 70% of the post-Fed decline from $11,594 to $11,141, according to CryptoX’s Bitcoin Price Index.

- Gold, too, has risen back to $1,960, having dropped from $1,976 to $1,910 following Powell’s inflation speech, as per data source TradingView.

- Both assets fell on Thursday, as the U.S. dollar gained ground despite the Fed unveiling an aggressive inflation strategy.

- The greenback, however, is facing renewed selling pressure at press time.

- The dollar index, which gauges the greenback versus a basket of its main competitors, is currently trading at nine-day lows near 92.35, representing a 0.68% decline on the day.

- “Powell’s speech suggests that there is no end in sight [for easy monetary policy]. In parallel, safe havens or dis-inflationary assets continue to offer investors an alternative from playing that central bank manipulated game, bitcoin among them,” John Kramer, trader at GSR told CryptoX in a Telegram chat.

- “Powell has shown that there is ZERO tolerance for deflation so they will do ANYTHING to stop it, and that is good for the two hardest assets – gold and bitcoin,” Raoul Pal, founder and CEO of Global Macro Investor and Real Vision Group tweeted early Friday.

- Put simply, the speech strengthened bitcoin’s long-term bullish case.

- While bitcoin has regained some poise, it is yet to cross the descending trendline hurdle, as seen above.

- A break higher would imply an end of the pullback from the Aug. 17 highs above $12,400.

- On the downside, $11,100 is crucial support. That area around that level has consistently restricted losses over the past two weeks.

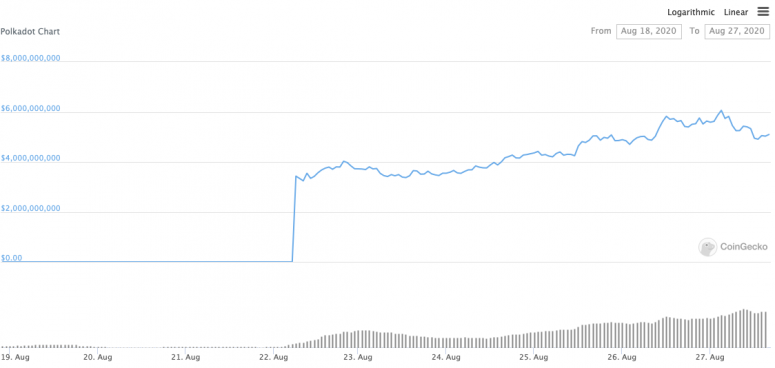

Token watch

Polkadot (DOT): With “protocol of protocols” weeks away from release of bridge to Ethereum blockchain, token’s market cap tops $5 billion, now in top 10 of all cryptocurrencies.

Analogs

The latest on the economy and traditional finance

Selected commentary on Fed Chair Jerome Powell’s Jackson Hole speech Thursday:

- Matt Blom, Diginex: “The initial market reaction was positive, but now the real fun begins. If stocks head south, the Fed will step up the printing machines.”

- Ian Shepherdson, Pantheon: “Powell and his colleagues have given themselves significantly more room to maintain zero rates and a swollen balance sheet over the next couple of years.”

- Mati Greenspan, Quantum Economics: “If their intention was to cool down the markets, then they failed miserably.”

- Bank of America: “Price action in the foreign currency market today reinforced to us that Powell’s speech marked no revolutionary policy change but rather a shift that, to an extent, has already been the Fed’s de facto approach for some time.”

- Simon Peters, eToro: “With interest rates not looking to move any time in the near future, the Fed’s new monetary policy could impact savers as they hold potentially fruitless investments such as fixed income assets.”

- QCP Capital: “Powell’s backpedaling and fuzzy inflation framework has disappointed the market that was hoping for a formalization of inflation policy in this speech itself.”