All JD stablecoins today are scams

All services claiming to offer access to JD.com’s stablecoin are fraudulent, the Chinese e-commerce giant said in a statement posted on Weibo, a microblogging platform.

JD.com said entities are misleading the public by claiming to have partnered with its Hong Kong subsidiary, JD CoinLink. The company emphasized that it has not issued a stablecoin at this point or formed any such partnerships.

Fraudulent campaigns are emerging in parallel, according to multiple WeChat accounts warning against stablecoin scams. Fraudulent campaigns are promising users 5,000 JD.com stablecoins for signing up and additional rewards for referring friends.

JD.com has recently shown strong interest in stablecoins. It plans to apply for a stablecoin license in Hong Kong, where a new regulatory framework comes into effect on Aug. 1. The company has also been among several Chinese tech firms lobbying the People’s Bank of China to allow yuan-pegged stablecoins in the region.

China has banned crypto trading and mining, instead promoting its central bank digital currency, the digital yuan. But recently, some academics and policy advisers have begun advocating for a more open approach to crypto.

In May, the state-backed International Monetary Institute republished an article discussing Bitcoin’s potential as a reserve asset. The following month, a commentary in a paper affiliated with one of China’s top research bodies warned that US dollar-backed stablecoins pose a threat to China’s monetary sovereignty and that Beijing should take part in global discussions.

On the same day the US Senate passed the stablecoin-focused GENIUS Act, People’s Bank of China Governor Pan Gongsheng announced the creation of an international operations center to promote the digital yuan.

At a recent panel discussion among legal experts on stablecoins hosted by Magazine, Winston Ma, former managing director of China’s sovereign wealth fund, noted that Pan’s speech referenced “CBDC stablecoins,” suggesting that Beijing may view central bank digital currencies and stablecoins as a single concept.

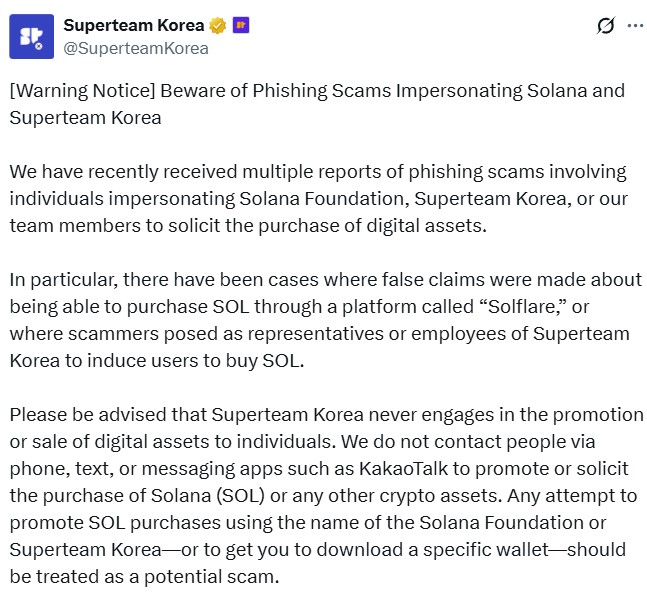

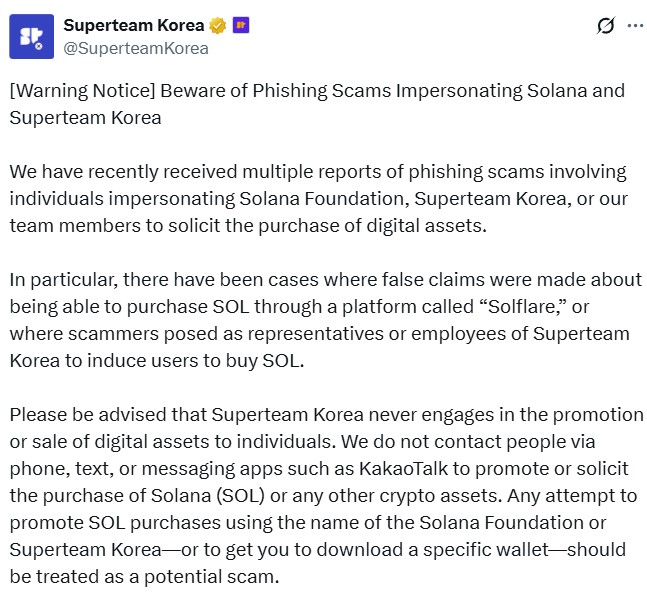

Solana dev impersonators target South Korean chat groups

The debut of a SOL staking ETF in America has coincided with a wave of phishing scams in South Korea targeting users through fake Solana-related groups.

Victims were lured with phishing links that redirected them to counterfeit websites mimicking Solflare, a popular Solana wallet. The sites promised free SOL rewards for creating a wallet. Once set up, users were encouraged to stake their tokens with the promise of daily interest payouts, leading many to deposit their SOL.

Scammers impersonated Superteam Korea, the local chapter of Solana’s developer community, by creating fake group chats on the messaging app KakaoTalk. These chats were styled to appear legitimate, using official Solana branding, partnership announcements and event updates. Fraudulent accounts in the groups even used the real names and photos of individuals affiliated with Superteam Korea.

Some victims went further, transferring fiat currency to bank accounts provided by the scammers. The fake wallet interfaces displayed fabricated balances, giving the illusion that SOL had been deposited.

When victims attempted to withdraw profits or move their tokens to real wallets, the scammers either removed them from the chat groups, stopped responding, or shut down the fake websites to eliminate traces of the fraud.

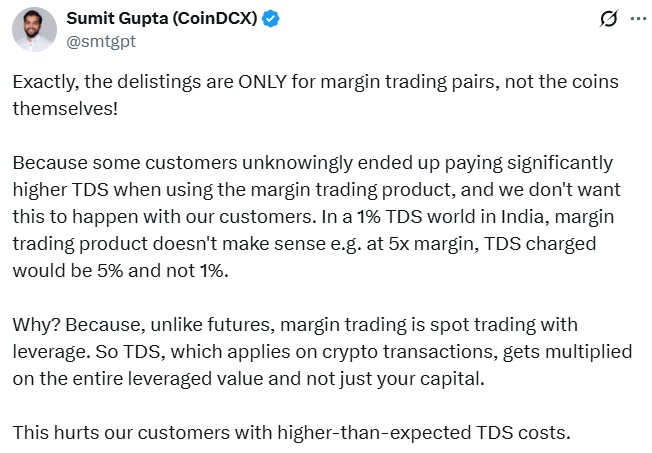

Indian crypto exchange CoinDCX under fire for sudden delistings

Indian cryptocurrency exchange CoinDCX is facing a backlash after it announced its decision to delist around 50 trading pairs without prior notice.

Users took to social media to complain that they were forced to sell their holdings, but CoinDCX CEO Sumit Gupta clarified that the delistings affected only margin trading pairs, not spot trading. The tokens in question remain available for spot trading, he said.

According to Gupta, the move was driven by India’s harsh tax regime on crypto. Margin trading, he explained, results in a higher tax deducted at source (TDS) than customers typically expect. India currently imposes a 1% TDS on crypto transactions above 10,000 rupees (about $115), meaning those above the threshold incur additional tax payments. In addition, crypto investors face a 30% flat tax on capital gains, making India one of the most punitive crypto tax environments in the world.

Recently, CoinDCX was forced to reverse a decision on the delisting of several spot trading pairs after community backlash. Gupta acknowledged that the exchange’s communication “could have been done better.”

Read also

Crypto investigators join probe into South Korea’s former first lady

A team of prosecutors specializing in crypto-related financial crimes has reportedly been deployed to support South Korea’s investigation into former first lady Kim Keon Hee, as the probe expands to cover shamanic influence, overseas gambling by religious leaders and possible bribery at the presidential residence.

President Yoon Suk-yeol was impeached after declaring a short-lived martial law in late 2024. The investigation now centers on alleged bribery tied to his wife, Kim.

Three crypto-focused prosecutors have reportedly joined a new unit investigating Jeon Seong-bae, a shaman accused of acting as a behind-the-scenes power broker during Yoon’s 2022 presidential campaign. Jeon is suspected of meddling in high-level appointments, influencing policy decisions and delivering gifts to Kim.

The special counsel has also inherited a case from the crypto unit of the Seoul Southern District Prosecutors’ Office involving Han Hak Ja, leader of the controversial religious group Unification Church. Prosecutors allege that a former senior Unification Church official gave luxury bags and a diamond necklace to the shaman, who then gave them to Kim between April and August 2022, allegedly to influence political decisions.

Han allegedly lost large sums of money in Las Vegas casinos dating back to 2008. Investigators suspect church funds may have been misappropriated and funneled through illicit channels. The Unification Church has denied any wrongdoing, stating that overseas trips are part of routine missionary activity.

The probe has since widened to include allegations involving an unregistered “ghost building” at the presidential residence in Seoul. The structure, believed to be a screen golf facility built during Yoon’s presidency, was referred to prosecutors by the Board of Audit and Inspection earlier this year. Authorities are investigating who funded the construction.

The special counsel team officially launched its investigation on July 2. Under South Korean law, it has 60 days to conduct its inquiry, with a possible 30-day extension if approved by the president.

Subscribe

The most engaging reads in blockchain. Delivered once a

week.

Yohan Yun

Yohan Yun is a multimedia journalist covering blockchain since 2017. He has contributed to crypto media outlet Forkast as an editor and has covered Asian tech stories as an assistant reporter for Bloomberg BNA and Forbes. He spends his free time cooking, and experimenting with new recipes.