Compared to the trading action of earlier this week, Bitcoin’s (BTC) price was relatively muted on Saturday as the digital asset traded between $5,045 and $5,641. Although the digital asset dropped more than 50.8% on March 12, it has since regained 37.5% to trade at $5,200.

Crypto market daily price chart. Source: Coin360

Many in the crypto space are still attempting to piece together a narrative that explains the carnage of the past week and for the time being, the weekend closure of major equities markets appears to be mitigating some of the Coronavirus fear, which has negatively impacted both markets for weeks.

Some traders and analysts continue to point accusatory fingers at BitMEX, claiming foul play on their part allowed the situation to escalate to near catastrophic levels.

BTC USDT daily chart. Source: TradingView

At the time of writing, there is a neutral Doji candlestick on the daily timeframe, showing traders remain uncertain on the direction the price may take and the candlestick by itself is neither bullish or bearish.

Referring to other indicators helps provide a better picture of the prevailing trend and a glance at the relative strength index (RSI) shows the indicator flat in oversold territory

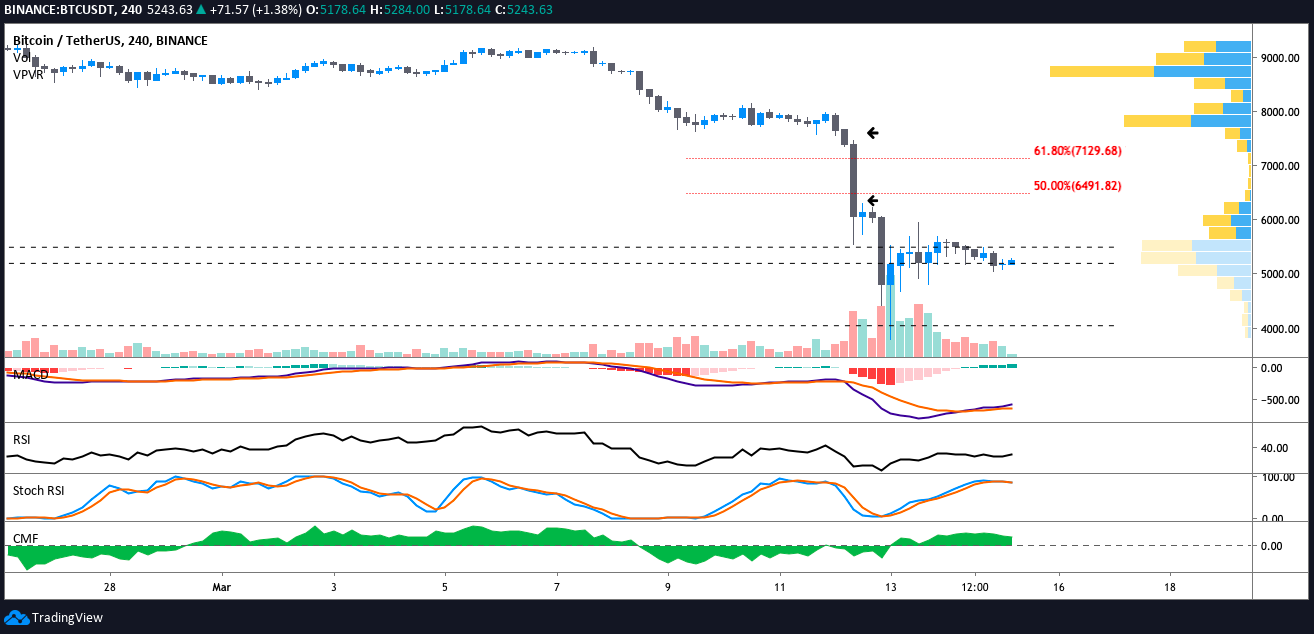

BTC USDT 4-hour chart. Source: TradingView

On the shorter, 4-hour timeframe, traders will notice that the RSI remains flat as buy and sell volume decrease and Bitcoin trades within a narrowing range between $5,517 and $5,021.

Some traders would argue that the short-term frame supports a bullish case for Bitcoin as each 4-hour candlestick has formed a lower-high as price descends lower but the moving average convergence divergence, Stochastic RSI and RSI trend upward, and the MACD histogram shows an increase in positive momentum.

Such bullish divergences have been the signal du jour for crypto traders for some time and the drop in trading volume and tightening Bollinger Bands also signal that an explosive move is bound to occur before the weekly close.

Currently, the price is pinned beneath $5,500 where there is a high volume node on the volume profile visible range (VPVR) and there is support at $5,200 and $4,850. If Bitcoin price could push above $5,500 there is open-air overhead and the price could rise to $7,650 but this is dependent on sustained volume and traders’ confidence that the event which catalyzed to drop to $3,770 has ended.

The current price action suggests that traders are taking profits as the range top is reached instead of opening long positions and buying on breakouts.

Bullish scenario

BTC USDT 4-hour chart. Source: TradingView

If the price can break above the $5,500 resistance and reclaim the former support at $6,300 to $6,400 this would be an encouraging step. As mentioned earlier, given Bitcoin’s oversold position and the volume gap from $5,500 to $7,650 could easily be exploited by a high volume spike.

Such a move would set the price back in the $7,750 range Bitcoin traded in prior to last week’s meltdown and also set the asset up for a move back to $8,500.

Bearish scenario

As shown by the daily time frame, losing the $5,200 support would be far less than ideal, even though the price Bitcoin bounced higher when the price dropped to $3,770 on March 13.

BTC USDT daily chart. Source: TradingView

To date, there is sufficient interest in Bitcoin at $3,769, a zone Bitcoin price nearly pierced during the precipitous drop. Below this level, the price of Bitcoin would look to form a double bottom at $3,384 and $3,177.

One must remember that while not uncharacteristic of the sector, Bitcoin price is being heavily impacted by the financial crisis created by the COVID-19 pandemic.

As the situation grows worse, investors expected that the markets will worsen and so a self-fulfilling cycle driven by fear and threat or long-term economic slowdown impact asset prices.

Over the coming weeks, one should expect to see a series of multilateral stimulus packages launched by various governments, thus as equities markets possibly rise from financial bailouts, investor sentiment for risk-on assets, commodities and stocks could improve.

Until then, it might be wise to either wait along the sidelines until a bottom is found in traditional markets or for those trading, play clearly defined ranges and rest in cash by the closing market bell or bedtime each day.

Obviously, some Bitcoin investors will advise taking long positions and accumulating as a range develops but with the current global economic uncertainty, perhaps it is better for those with limited capital to rest in cash in order to live to trade another day.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of CryptoX. Every investment and trading move involves risk. You should conduct your own research when making a decision.