The Joint Research Centre at the European Commission has just published a new Blockchain tome (128 pages) called ‘Blockchain Now And Tomorrow – Assessing Multidimensional Impacts Of Distributed Ledger Technologies’ in order to help Brussels politicians with the European policymaking process when it comes down to Blockchain. The EC has taken a holistic approach and is aiming to position Europe at the forefront of blockchain innovation and uptake.

Overall the report avoids the FUD normally associated with blockchain technology vis-à-vis cryptocurrency and remains positive – pushing for more funding for a diversity of blockchain industry stakeholders including universities, research centres, industry, SMEs and start-ups.

The European Commission via the Horizon 2020 platform (running from 2014 to 2020 with a whopping €80 billion budget) has already invested €180 million to support research & innovation in blockchain and the report makes it clear they will likely invest more.

In addition, the Connecting Europe Facility (CEF) has been funding the EU Blockchain Services Infrastructure deployment since 2018 – including use cases agreed under the EU Blockchain Partnership by the EU Commission with 27 EU Member States, Norway and Liechtenstein. Projects include DECODE – blockchain for privacy and MHDMD – blockchain for ehealth. In February 2018 the European Commission, in collaboration with the European Parliament, also launched the European Blockchain Observatory and Forum. This year, on April 3, 2019, the EC launched the International Association for Trusted Blockchain Applications (INATBA) is a multi-stakeholder organisation based in Brussels bringing together suppliers and users of Distributed Ledger Technologies with representatives of governmental organisations and standard-setting bodies from all over the world.

There are a few open calls where blockchain startups can pitch their concept for funding from EU coffers right now including:

Here’s a list of 8 hot FinTech and Blockchain companies that were funded by the EU via the Horizon 2020 SME Instrument:

Signaturit solutions SL Spain Sign and certify your documents and digital communications Signaturit is the first e-signature service that guarantees 100% legal validity in business digital transactions, minimises the risk of cybercrimes and drastically improves productivity. Adding advanced biometric and blockchain encryption tools to ensure an unreachable level of cyber security in e-mail transactions, while Smart contracts will ensure that productivity is optimised. Signaturit received € 1.22 million under SME Instrument Phase 2.

Authenteq EHF Iceland Blockchain-based 100% automated Know Your Customer service

Authenteq has developed a smartphone-based 100% automated and tamper-proof online identity verification service (Authenteq ID) that uses multifactor biometric authentication, fitting the needs of online/mobile marketplaces, as well as other websites that require or benefit from ID verification such as betting, gaming or dating sites. Authenteq ID uniquely combines a smartphone app, where the end-user creates its certified ID by scanning its passport and taking a selfie, backend proprietary services that perform face match recognition, image analysis of ID security elements and third-party security checks, and Blockchain data storage for validation purposes (impossible to reverse-engineer and hack).

Authenteq got € 50.000 in funding under SME Instrument Phase 1.

Billon Warsaw Poland Secure, low-cost and simple bank-free payments

A distributed ledger technology for creating free current accounts enabling making ultra-low cost payments with real currencies (EUR, GBP, PLN) in a regulated manner. The disruptiveness of Billon arises from: (1) distributed architecture developed on blockchain by our specialists, (2) compliance with the EU regulations upon the agreements with banks and ongoing FCA Regulatory Sandbox in the UK. The project is addressing market segments of mass payouts for corporate customers and social & media online payments for online users.

Billon received € 1.96 million under SME Instrument Phase 2

I-MOVO Ltd United Kingdom International productisation of a disruptive digital vouchering technology

i-movo are a fintech SME commercialising a disruptive vouchering technology to solve problems for consumer-facing companies such as publishers, brand-owners, retailers and loyalty scheme operators. They need to send valuable offers, reward vouchers or make cash-payments to their readers, consumers, customers or members. Previously, they may have used paper vouchers, a century-old means of accomplishing this. These are prone to fraud and slow to process, meaning retailers who accept them must wait, sometimes over many months to be paid. Our technical solution- Secure Digital Vouchers- are a new financial services industry payment method that can be distributed using any digital format such as mobile phones, email or payment cards. They are validated in real-time to limit or prevent over-use, fraud or viral spread and give instant feedback on the success of any campaign or activity. They are more convenient for consumers, protect the financial risk of the issuer and ensure retailers get paid promptly. This has removed the last remaining technical barrier in the development of this market by developing a method of retail integration that requires no new software or hardware. The i-movo method uses Industry Standard payment messages so the system can be implemented anywhere in the world. To date, the company has processed over 17 million transactions, worth over €350 million at over 62,000 retail outlets and has managed over 1500 promotional and payment campaigns for over 270 customers.

I-movo received €50.000 funding under SME Instrument Phase 1

IXARIS TECHNOLOGIES Ltd United Kingdom Open Payments Eco-system

The aim is to enable the widespread development of innovative payment applications with the active involvement of financial institutions (e.g. banks) providing supporting transaction services by creating an Open Payments Eco-system (OPE). The OPE is the critical step in widening access to payment services and to alternative, open, collaborative, lower cost methods of delivering payment applications to end users (particularly SME’s) who want to make use of payment services within their business. The Eco-system enables the SME developer community to provide creative new payment applications to the market and offers a high degree of re-use of common application components. OPE has the potential to fundamentally disrupt the current creation and delivery mechanisms for payment services, by providing for the low-cost creation of quality assured payment applications and the building and delivery of payment services, in a controlled and regulatory-compliant environment. Ixaris specialises in the development of innovative global applications based on open-loop prepaid card schemes and the OPE will add a unique infrastructure to its product portfolio.

Ixaris received €1.97 million under SME Instrument Phase 2

MONESE United Kingdom Instant accounts for mobile people

Monese has launched a prototype of a mobile-first banking service that validates customer’s identity fully online, enabling access to banking even for customers with poor credit history or no formal proof of address. Account opening takes place in real-time, enabling 3-3000x faster onboarding (3 minutes). Monese aims to provide local bank accounts across European Economic Area for a transparent low-cost fixed-fee pricing (4x less expensive). The service is currently launched only in UK and has attracted >6000 customers, with 60 000 people waiting to get access. MONESE project aims to scale up the technical capability of the service for reaching and being able to serve growing number of users – to increase the level of automation of user identification, scale up service architecture and introduce features required for EU-wide reach. Combining these innovations with business model innovation (fixed-fee pricing, streamlined value proposition, value chain deconstruction, focus on underserved people) enables to achieve EU-wide scale in a profitable manner. Improving the access to bank account services is becoming a primary policy objective, pushing the drive for new products and business models.

Monese received €1.13 million under SME Instrument Phase 2

ENSYGNIA United Kingdom Interact securely online, in-store, or on-the-go

Ensygnia’s progress so far has already been recognised within the mobile and payments industries: • Mobile Industry Awards: “Best Software Solution” – Ensygnia [June 2014] • UK winner in the “Innotribe start up” challenge 2014 organised by SWIFT – the banking industry group. We will now take part in the global Innotribe finals in Boston later this year • Voted by the audience at the Mobile World Congress as one of the top three companies most likely to have “the greatest impact on the global mobile industry over the next ten years” (March 2013).

Ensygnia received €2.5 million under SME Instrument Phase 2

PETAFUEL GMBH Germany One-size-fits-all mobile based solution for cashless payment for Europe

With VIMpay petaFuel develops a mobile based payment solution for European market entry. The product will enable all smart phone users to participate in cashless payments, consolidating both card based payments (contactless as well as contact-based) and SEPA payments. The main USPs of the products are (1) that it enables users to do payments without the need for a bank account and (2) does so in a secure and convenient way without (3) requiring additional payment infrastructure, i.e. it is based on open and already established standards.

PetaFuel received €1.65 million under SME Instrument Phase 2

From the report:

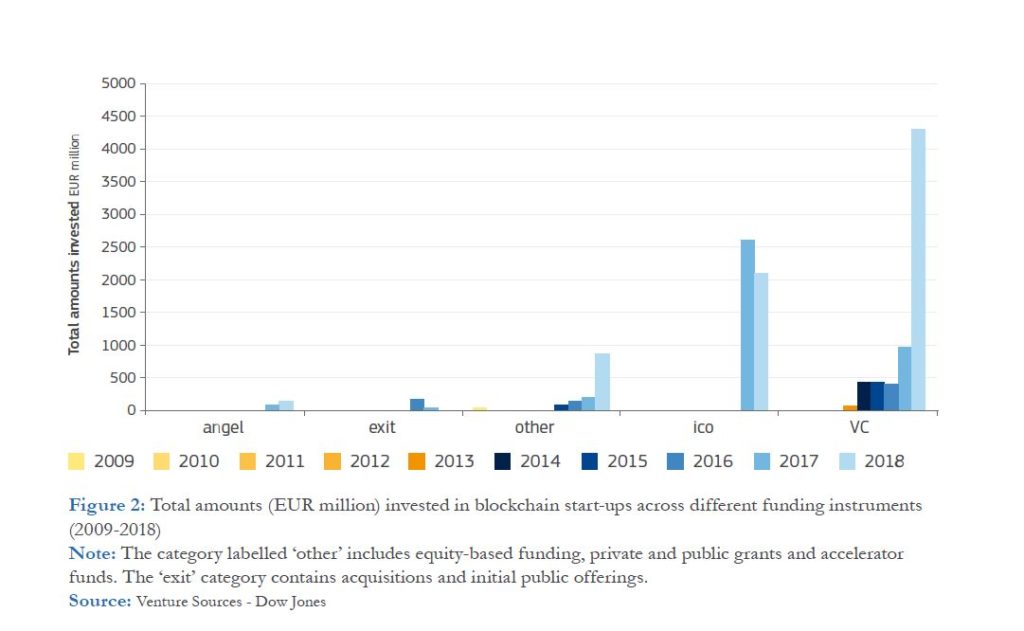

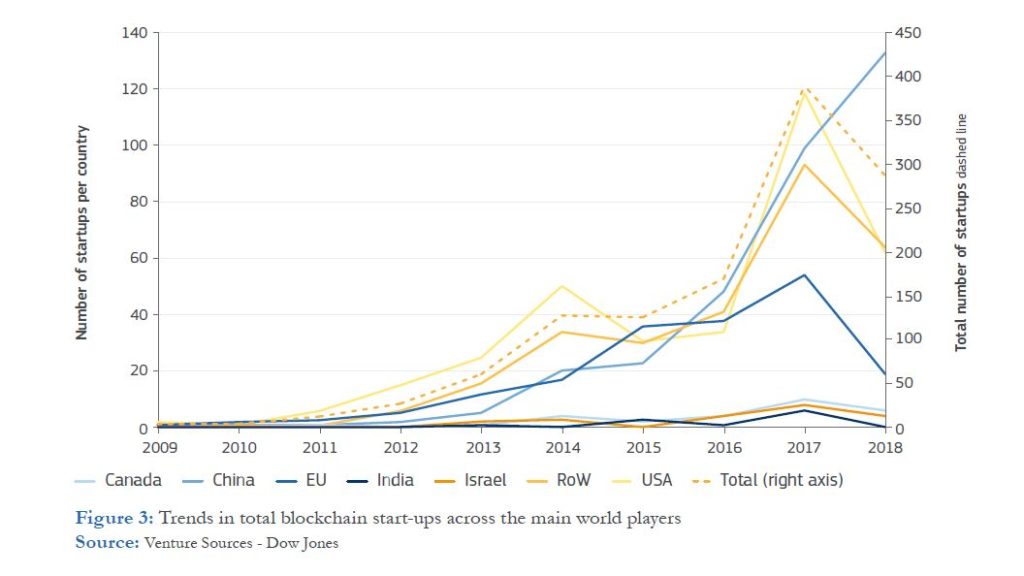

The rise of blockchain is witnessed by both the sharp growth in blockchain start-ups and the volume of their funding. Massive funding started in 2014 with EUR 450 million and rapidly increased to EUR 3.9 billion in 2017 and over EUR 7.4 billion in 2018.

In 2017, the amount of invested capital grew at an unprecedented scale due to the explosion of ICOs and venture capital investments which continued at a high level in 2018 (Figure 2). There is strong competition from the USA and China, as they now appear to lead in terms of blockchain start-ups (Figure 3). The UK has a key role in Europe both in terms of numbers Total. of blockchain start-ups (hosting almost half of them, Figure 4), and in funding (attracting about 70 % of EU investments, Figure 5). A broader look at international players shows Switzerland and Singapore displaying particular dynamism followed by Japan and South Korea.

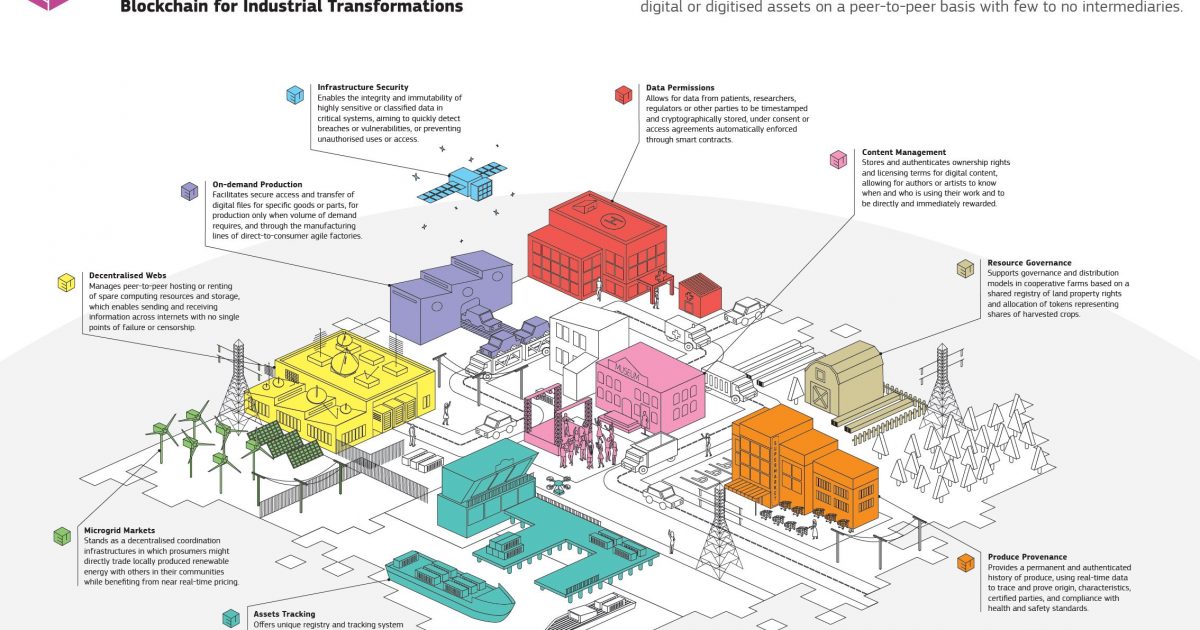

There is space beyond cryptocurrencies and financial applications

It is the technology behind cryptocurrencies – blockchain – that has been capturing most of the attention. Beyond its financial applications, its potential has come to the foreground in many other sectors, such as trade and supply chains, manufacturing, energy, creative industries, healthcare, and government, public and third sectors.

A global ecosystem is on the rise from start-ups to capital investment

The rise of blockchain technology is witnessed by both the sharp growth in blockchain start-ups and by the volume of their funding. International players in the United States are taking the lead, followed by China and the European Union. Funding reached over EUR 7.4 billion in 2018 due to the explosion of ICOs and venture capital investments.

Blockchain does not follow a ’one-size-fits-all’ model

The potential opportunities and challenges of deploying blockchain technology are strongly related to context, application or sectorial issues. That is why organisations should not develop solutions looking for problems, but instead should find existing or foreseeable problems in their operations or business, and then look for possible blockchain solutions.

Bottlenecks and complex challenges lie ahead

Blockchain technology is still at the embryonic stage and facing many challenges, such as performance and scalability, energy consumption, data privacy, integration with legacy infrastructures, or interoperability between different blockchains. Still based on a limited set of proven use cases, blockchain often entails additional risks and barriers for firms, businesses and organisations piloting it or interested in its deployment.

The concepts of trust and disintermediation are changing

Despite widespread misconceptions, blockchain does not imply the total elimination of intermediaries or third parties. Some intermediaries may disappear but new ones will appear and traditional ones, like governments, will continue to play a long-term role, not least to guarantee equal conditions for participation, check the quality and validity of data, decide on responsibility and liability, or settle disputes and enforce rules.

Regulatory frameworks and guidelines are catching up

Policymakers and regulators need to progress in assessing whether existing policies and laws are fit for purpose or if new frameworks will be required. Pressing discussions include, for instance, the legal classification of tokens and coins, validity of smart contracts, applicable jurisdictions, consumer and investor protection, enforcement of anti-money laundering requirements, and data protection and privacy safeguards.

Integration with digitisation initiatives and programmes is key

Blockchains will be complementary or will work together with other key digital technologies, such as artificial intelligence, internet of things, data analytics, cloud computing, robotics and additive manufacturing. The development of blockchain should be connected to existing digitisation initiatives and programmes to avoid overlaps and to maximise impact.

Piloting and experimentation spaces are needed

As an emerging technology, blockchain requires the multiplication of use cases to test its added value in specific applications and sectors. Further support and funding for frontier pilots and experimentation spaces must bring together a diversity of stakeholders from universities, research centres, industry, SMEs and start-ups.

Capacity building and knowledge sharing can be decisive

Environments such as regulatory sandboxes and other experimentation spaces can promote more direct exchanges between policymakers, regulators and supervisors, on the one hand, and blockchain companies, start-ups and entrepreneurs, on the other. Key benefits can include testing new solutions and business models and improving the quality and speed of policy guidance.

Blockchain calls for an interdisciplinary and comprehensive approach

Blockchain applications can have far-reaching implications at policy, economic, social, technical, legal or environmental level. Potential changes, for example, in economic and business models, governance mechanisms or trust between parties, can only be grasped through a mix of different areas of knowledge, including computer science, economics, law, public finance, environmental sciences, and social and political sciences.

Monitoring should be combined with an anticipatory outlook

Policy dilemmas today involve a balance between adequate enforcement of existing regulations from day one, and the flexibility to accommodate an evolving technology with both foreseeable and unforeseeable benefits. This balance can be grounded in a foresight and trend monitoring approach to enable preparedness and adaptation to an increasingly rapid pace of change.

- European Commission Releases New Support Paper on Blockchain – Further Funding for Startups Encouraged – September 19, 2019

- Bitpay Opens Up Doors For Ethereum Payments – September 16, 2019

- Neufund Launches Blockchain-Driven Equity Token Sale for Retail Investors Out of Lichtenstein – September 16, 2019

- London Blockchain Accelerator Academy Looking for Partners – September 13, 2019

- Blockchain Startup Blockstack Raises a Whopping $23 Million In SEC-Qualified Reg A+ Token Offering – September 12, 2019

- France Vows to Block Facebook Libra Cryptocurrency in Europe – September 12, 2019

- R3 and Mastercard Team Up Mastercard to Build Overseas Payments System Build on Blockchain – September 12, 2019

- ConsenSys Officially Joins Hyperledger Project – Adding Public Blockchain Capability to Hyperledger – September 11, 2019

- Telegram Open Network Labs Releases Development Suite for TON Blockchain – September 11, 2019

- Whale Alert: USD One Billion+ BTC Was Transferred in One Transaction Last Week – September 11, 2019

- New Professional API Trading Program AlgoX Prime API Launched by eToroX – September 11, 2019

- Bitcoin.com’s Roger Ver Steps in to Operate Node on Cryptographer David Chaum’s New Elixxer Project – September 11, 2019

- Seychelles Heats Up With a First for a National Stock Exchange – MERJ Exchange Goes Live with Tokenized IPO – September 10, 2019

- Computing Legend Steve Wozniak To Launch Blockchain Energy Project – EFFORCE – September 10, 2019

- Hollywood Star Wesley Snipes To Tokenize $25 Million USD Movie Fund with Liechtenstein Blockchain Innovator LCX – September 9, 2019

- Netki Extends TransactID Solution For FATF “Travel Rule” Compliance – September 9, 2019

- Market Demand For Sophisticated Crypto Trading Methods Drives Singapore’s Broctagon Fintech Group To New Heights – Pushing Them Past $5 million – September 5, 2019

- London-based Custodian For Digital Assets, Copper, Reach $500m In Transactions In Just Three Months – September 5, 2019

- UN Meeting: Gibraltar Lawyers Call For A Global Regulatory Framework For Cryptocurrencies – September 4, 2019

- Michael Terpin’s BitAngels Investor Network Partners with Bitcoin Bay to Expand Blockchain Investment Ecosystem in Toronto, Canada – September 3, 2019

Also published on Medium.