Ethereum achieved a new milestone this Thursday as its price almost touched $1,700 for the first time in history.

The ETH/USD exchange rate hit $1,699 on the Coinbase exchange after rallying 29.79 percent this week. Traders flocked into the Ethereum market in the wake of its futures contracts’ launch on the Chicago Mercantile Exchange (CME) and the prospects of an impending supply crunch.

The gains also appeared as Grayscale Investments, a crypto-enabled investment firm in New York, bought $70 million worth of Ethereum tokens, bringing its total holdings’ worth to $4.91 billion. The firm’s crypto accumulation typically leads the price higher, as the market has witnessed during its Bitcoin buying spree throughout 2020.

Grayscale just bougt $eth 47k and $ltc 12k 🚀👍 pic.twitter.com/63kfouIfEn

— Hendy Wiranata (@HieronimusHendy) February 3, 2021

Also, Grayscale’s accumulation points to an increase in institutional demand for Ethereum. As the Bitcoin rally turned overheated after recording its record high near $42,000, traders/investors started exchanging their profits for tokens with maximum long-term potential. The period saw Ethereum, UniSwap, AAVE, and Chainlink log their all-time high levels.

Breakout Underway

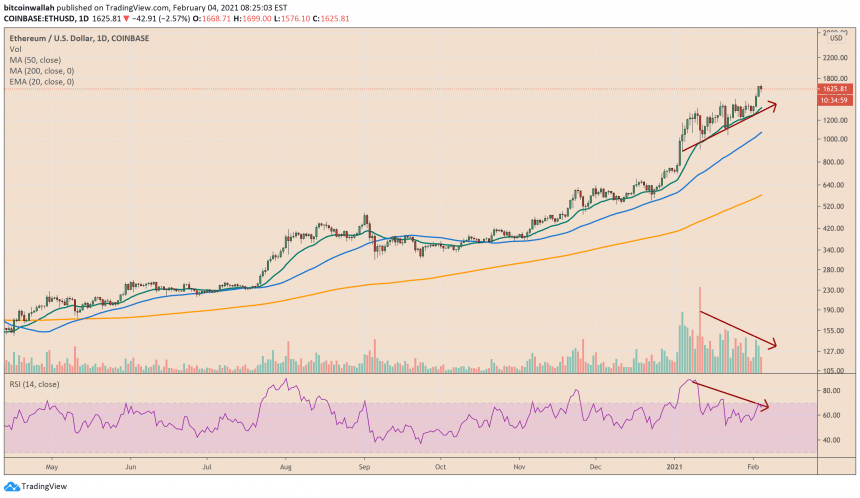

Meanwhile, supportive technical indicators also offered further tailwinds to Ethereum. The second-largest cryptocurrency’s latest upside move had it broke above a short-term resistance level that, in conjugation with an upward sloping support trendline, constitutes an Ascending Triangle.

In retrospect, Ascending Triangle patterns are bullish continuation signals in an uptrend. Traders typically wait for a high-volume price breakout above the resistance trendline to put long positions at higher price levels. Ideally, the upside target can be calculated by measuring the flagpole’s length—the upside move before the Triangle’s formation.

Ethereum Triangle breakout is underway. Source: ETHUSD on TradingView.com

In Ethereum’s case, the height of the flagpole that formed before the Ascending Triangle is slightly over $700. Meanwhile, the level from where the cryptocurrency broke out sits near $1,441. That ideally puts the Ethereum Triangle’s upside target at $2,141.

Ethereum Downside Risks

The prospects of higher price levels met offsetting catalysts that could turn Ethereum lower. The major among them is a growing bearish divergence between the cryptocurrency’s price and its volumes and momentum.

Ethereum's bearish divergence risks putting its price lowers. Source: ETHUSD on TradingView.com

It is because bearish divergences signal a slowdown in the ongoing momentum. Excerpts from Investopedia:

“Bearish divergences signify potential downtrends when prices rally to a new high while the oscillator refuses to reach a new peak. In this situation, bulls are losing their grip on the market, prices are rising only as a result of inertia, and the bears are ready to take control again.”