Ethereum price peaked at $3,500 on Feb. 29, bringing its monthly gains to a remarkable 56%, market supply trends suggest another upswing toward $4,000 could follow in March 2024.

Ethereum dominated the price charts in February 2024, outperforming its rival mega-cap Layer-1 coins including Bitcoin (BTC), Solana (SOL) and Cardano (ADA).

On-chain analysis examines key data trends that put ETH in vantage positions for another dominant bullish price performance in March.

Ethereum supply declines; $2.1B transferred to long-term storage

The successful Dencun upgrade testnet execution and growing traction surrounding ETH ETF filings were major bullish catalysts for Ethereum’s 56% price growth performance in February 2024.

However, on-chain data trends suggest that lingering impacts of investors’ reaction to these key events could see ETH maintain its upward trajectory for the rest of Q1 2024.

Firstly, there has been a positive shift in Ethereum stakeholders’ penchant for a longer-term investment horizon, and passive income yield rather than short-term profit-taking.

To this effect, CryptoQuant’s Exchange Reserves monitors the real-time changes in investors’ ETH balances held on crypto exchanges and trading platforms.

The exchange reserves stood at 14,433,873 ETH at close of Jan. 31, as depicted in the chart below. But that figure has now dropped significantly by 663,322 ETH to hit 13,770,551 ETH at the time of writing on Feb. 29.

Valued at the current prices of $3,500, this implies that investors have shifted $2.3 billion worth of ETH from trading wallets into long-term storage and staking contracts.

Essentially, this massive decline in exchange reserves means $2.3 billion less supply of ETH is now available to be traded on the spot markets.

Notably, Ethereum offers a broad range of yield opportunities that could incentivize investors to pass up opportunities to book profits early. Whale investors can access the 4% APR passive income rewards from the beacon chain, while retail investors have a plethora of high-yield DeFi staking protocol options.

With the recent spike in demand for liquidity staking derivatives, and the expected transactions throughput improvement from the Dencun upgrade slated for March 13, ETH market supply is likely to decline even further in the coming weeks.

If the macro market sentiment remains positive, this induced market scarcity could propel ETH price towards the $4,000 mark in March 2024.

Growing Demand: 1.84M new users joined Ethereum network in February

Ethereum’s dominant price performance in February has evidently enhanced its market position. In further affirmation of Ethereum’s bullish outlook for March 2024, the network has welcomed a significant number of new entrants in the past month.

Santiment’s amount of holders metric tracks the number of funded wallets currently registered on a cryptocurrency network. The chart below shows that ETH network welcomed 1.84 million new funded wallets as the total holders grew to 115.5 million addresses between Feb. 1 and Feb. 29.

An increase in funded wallets is a clear indication of deepening global retail adoption and fresh capital flowing into the underlying ecosystem. For context, the Bitcoin network saw a 70,000 wallet drop off in holder addresses in February, further emphasizing Ethereum’s pole position in the markets.

The growing demand from the 1.84 million newly-funded ETH addresses, combined with the $2.3 billion decline in exchange supply, suggests that the market forces are well-aligned for Ethereum price to advance towards $4,000 in March 2024.

However, in the short-term the bulls must first scale the major resistance sell-wall at the $3,550 territory.

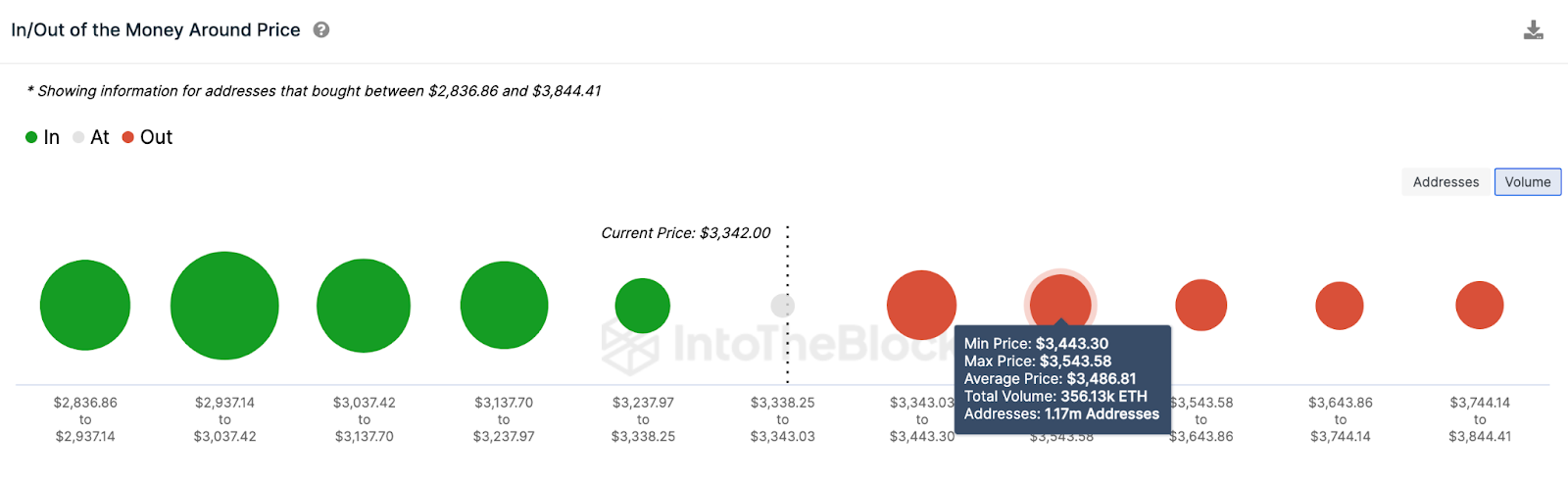

IntoTheBlock’s global in/out of money data which groups all existing ETH holders by their buy-in prices also affirms this outlook.

It shows that 1.2 million addresses that acquired 356,130 ETH at the maximum price range of $3,543 could mount a daunting resistance sell-wall as price approach their break-even point.

But if ETH price can scale that roadblock, the rally could pick up steam and head towards $4,000 as predicted.

Yet, the Ethereum bears could regain control if ETH loses the $3,000 support. However, this currently appears unlikely, considering the looming sell-wall at the $3,100 area.

At that range, 2.1 million investors that bought 1.1 million ETH at the average price of $3,090 could make frantic purchases to avoid falling into net-loss positions.