On Wednesday, the price of Ethereum extended its previous session gains. ETH is still trading below the psychological $2,880 level. Still, once a decisive close above the bearish sloping line stretching from the highs of $4,759 is achieved, Ethereum’s price has room to rise.

Over the last four months, the king alt has been on a sharp fall from its ATH. At the $3,100-mark Point of Control, there was a battle between buyers and sellers.

Ethereum Below Psychological Barrier

ETH wants to test the $2,862-level before entering a likely low volatility phase on its Bollinger bands, assuming the altcoin follows its past trends (BB). Before the alt continues to notch higher bottoms, near-term retracements could find support at the $2,500 level.

The price of Ethereum is currently moving higher, with large gains, but there has been a slight retreat from higher levels. To close over the psychological $2,800 level, further buying pressure is essential.

Related Reading | Yearn Finance (YFI) Down 13% Following Andre Conje’s Exit

In the short term, the upward momentum is projected to continue as long as buying pressure is continuous. As a result, the $2,830 level could be the first upside obstacle from current levels. The price of ETH must close above this level on a daily basis, with above-average volumes.

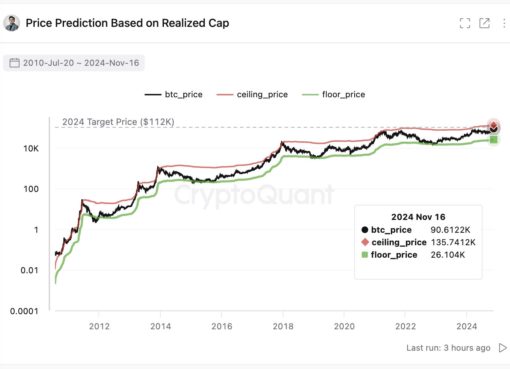

ETH/USD trades below $3k. Source: TradingView

The 50-day EMA (Exponential Moving Average) at $2,880 will provide resistance for ETH bulls next.

The RSI bullishly diverged with the price as it marked higher lows, confirming buying strength near its trendline support. A close above the midline would increase the odds of a further recovery towards the 54-point resistance in the future.

The MACD lines were also on the edge of crossing over to the bullish side. If they cross over, they must still cross the zero-line in order to claim unrestricted bullish momentum.

This, along with the impending RSI limit of 50.75, will most likely act as the key roadblock preventing bulls from hitting the $3,000 mark.

Bulls will have been boosted by the 10-day and 25-day moving averages, which are about to cross.

Related article | TA: Ethereum Breaks Barrier, A Strengthening Case for More Upsides

Featured image from Getty Images, chart from Tradingview.com

Source