Ethereum institutional adoption is moving from theory to reality, as the network proves its staying power in the evolving world of global finance. At the recent Ethereum Community Conference (EthCC) held in Cannes, France, industry leaders, developers, and institutional giants gathered to spotlight Ethereum’s growing role as the infrastructure layer of Wall Street and beyond.

The scene was more Cannes Film Festival than crypto conference — with the iconic red-carpeted Palais des Festivals hosting keynotes instead of movie premieres. But the real star of the show was Ethereum’s accelerating transformation from decentralized experiment to the foundation of institutional finance.

Robinhood’s Bold Crypto Pivot

One of the most striking moments of the week came when Robinhood (NASDAQ:HOOD) announced it would launch tokenized U.S. stocks and ETFs for European users via Arbitrum, a Layer 2 protocol built on Ethereum. This marks a historic milestone — making Robinhood the first publicly traded U.S. company to launch tokenized equities on a blockchain.

The move not only fueled a rally in Robinhood stock — pushing it over $100 for the first time — but also underlined the momentum of Ethereum institutional adoption. Rather than speculative hype, the conversation this year centered on Ethereum’s practical use as Wall Street’s new plumbing.

Ethereum as a Treasury Asset

Several public companies are already reshaping their financial strategies around Ethereum. BitMine Immersion Technologies (OTC:BMNR) saw a meteoric 1,200% gain after declaring ether as its primary treasury reserve. Similarly, Bit Digital (NASDAQ:BTBT), which shifted away from bitcoin mining to focus solely on Ethereum staking, climbed over 34% in a single week. SharpLink Gaming (NASDAQ:SBET) added more than $20 million worth of ether to its balance sheet, gaining over 28% in one day.

These bold moves signal a growing trend: Ethereum is not just a technology platform; it’s an emerging financial asset and strategic pillar for companies embracing the future of decentralized finance.

Institutions Bet on Ethereum’s Stability

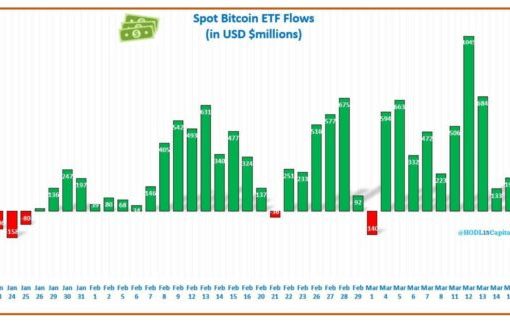

While Ethereum’s price remains down over 20% year-to-date and trails Bitcoin in market cap, its utility and reliability are winning over institutional players. Ether ETFs have seen two consecutive months of net inflows, signaling renewed investor confidence. According to CoinGlass, these funds now manage around $11 billion in assets — a modest sum compared to $138 billion for Bitcoin ETFs, but growing steadily.

Paul Brody, Global Blockchain Leader at EY, emphasized Ethereum’s long-term appeal: “Institutions are plugging Ethereum into core financial systems not just because it’s fast or cheap, but because it offers dependable, programmable functionality.”

Vitalik Buterin, Ethereum’s co-founder, echoed the sentiment. In his keynote at EthCC, he said institutions consistently praise Ethereum’s reliability: “They value that it doesn’t go down.”

The Tokenized Future Is Being Built on Ethereum

The momentum behind Ethereum institutional adoption is not just theoretical. Deutsche Bank is developing a tokenization platform on zkSync, a Layer 2 network on Ethereum, to help manage tokenized funds and stablecoins. Meanwhile, Coinbase (NASDAQ:COIN) has filed with the SEC to offer trading of tokenized public equities, and Kraken is preparing to launch 24/7 tokenized stock trading in select international markets.

Stablecoins continue to dominate Ethereum’s financial rails. Circle’s USDC — the second-largest stablecoin — still processes about 65% of its volume on Ethereum. And BlackRock (NYSE:BLK) is pioneering institutional finance on Ethereum with its BUIDL fund, offering real-time redemptions in USDC.

The Road Ahead: Scaling Without Compromise

Despite competition from faster blockchains like Solana, Ethereum’s core values — neutrality, censorship resistance, and security — remain its greatest strengths. Tomasz Stańczak of the Ethereum Foundation noted that institutions choose Ethereum because it guarantees fairness, reliability, and transparent execution.

The final takeaway from Cannes? Ethereum institutional adoption isn’t a trend — it’s a structural transformation. With developers, regulators, and corporations aligning behind Ethereum, the network is poised to power the financial systems of the future.

As Buterin put it: “We don’t just want to succeed. We want to be something that is worthy of succeeding.”

Featured Image: Freepik