On September 2, the revenue of Ethereum (ETH) miners reached an all-time high of 51,541 ETH. While this may be good for the miners, it could turn popular DeFi projects into a mousetrap.

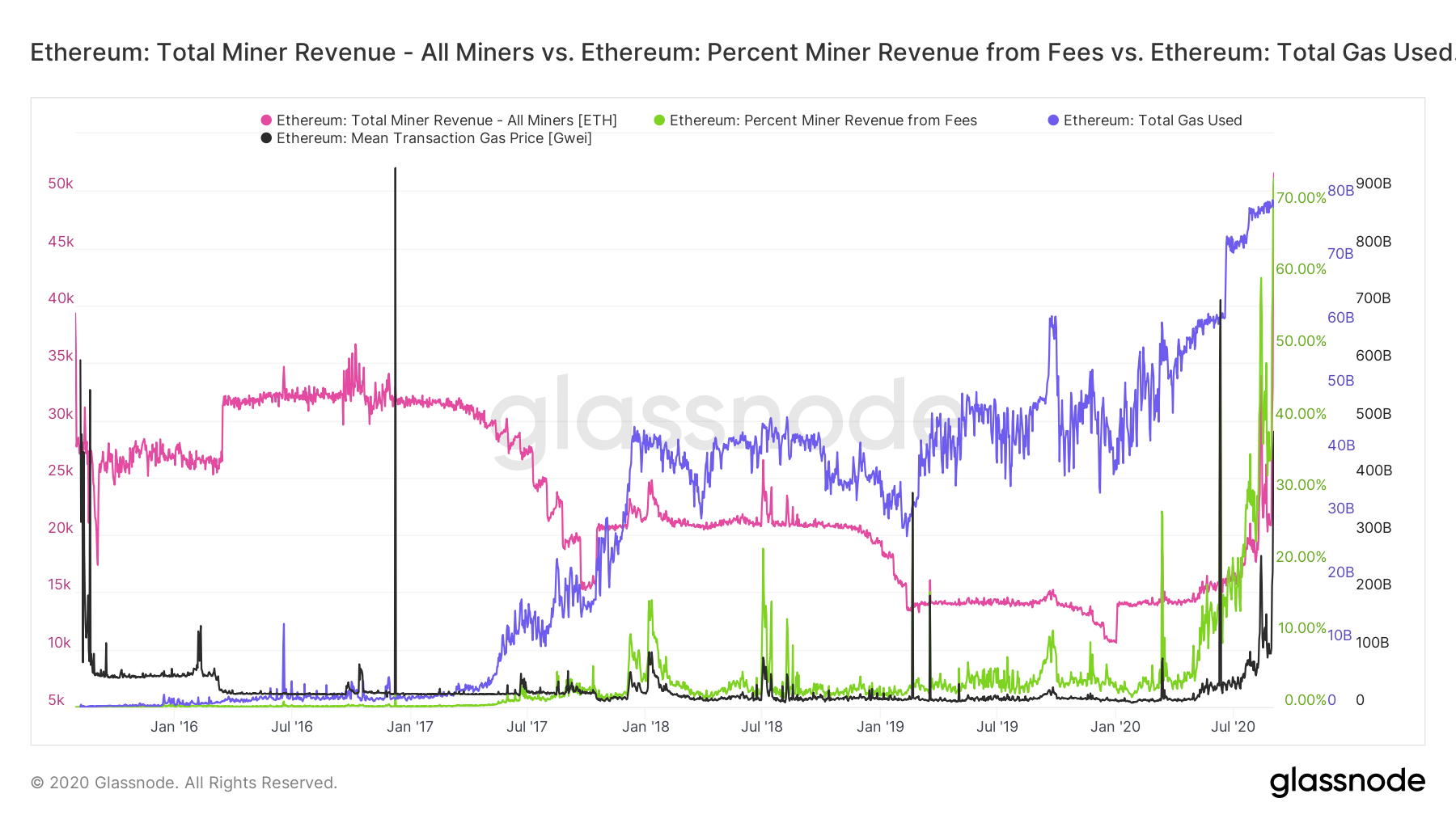

Ethereum miner revenue, percent from fees and total gas used. Source: Glassnode.

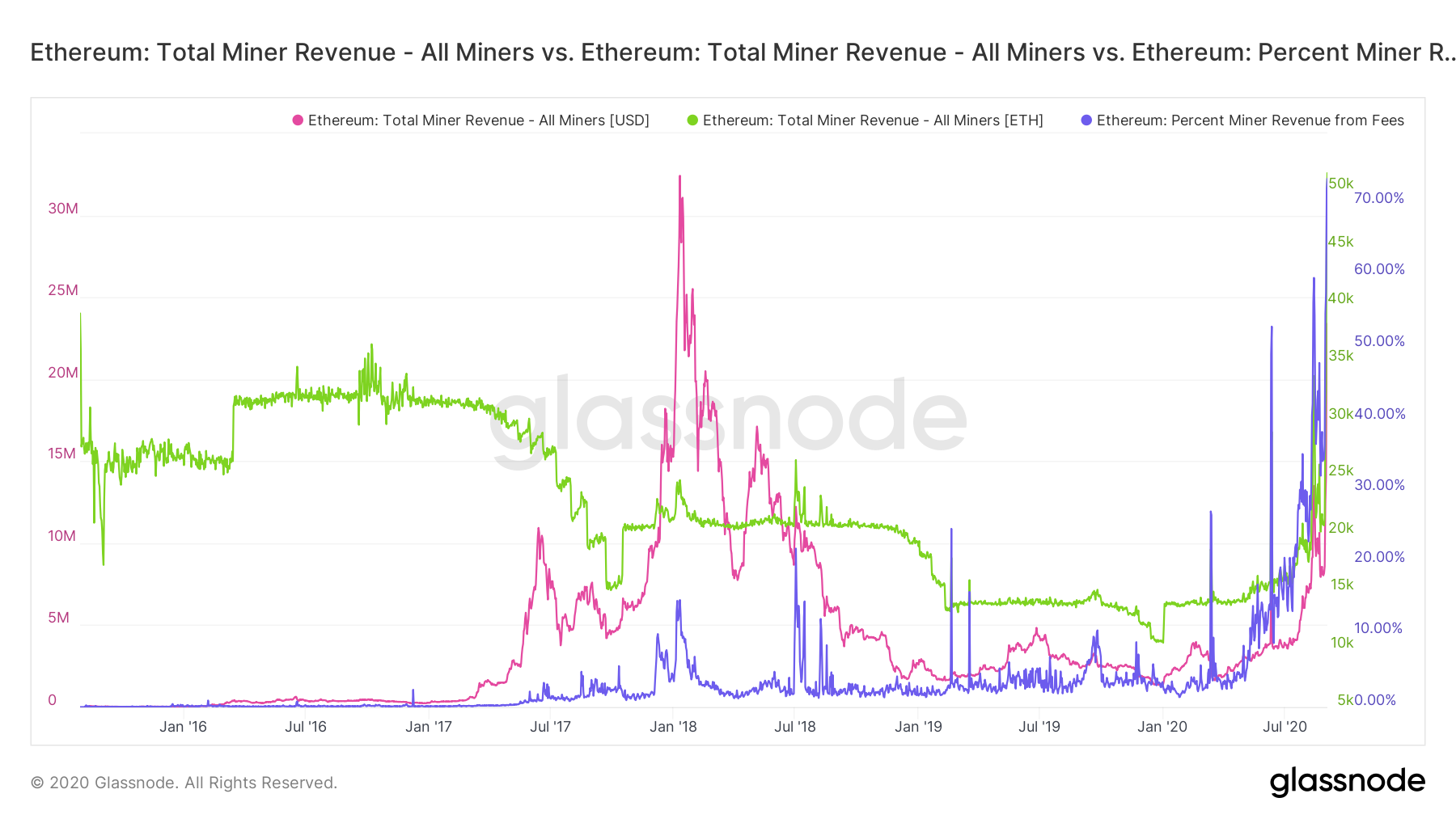

When denominated in USD, these numbers are still below the record set on January 10, 2018 — when miners earned $32 million versus $23 million on September 2. The price of ETH at the time was approximately three times the current rate. However, what is more significant is that in 2018, only 12% of the revenue came from transaction fees — yesterday this metric stood at 74%.

Ethereum miner revenue in ETH, USD and percent from fees. Source: Glassnode.

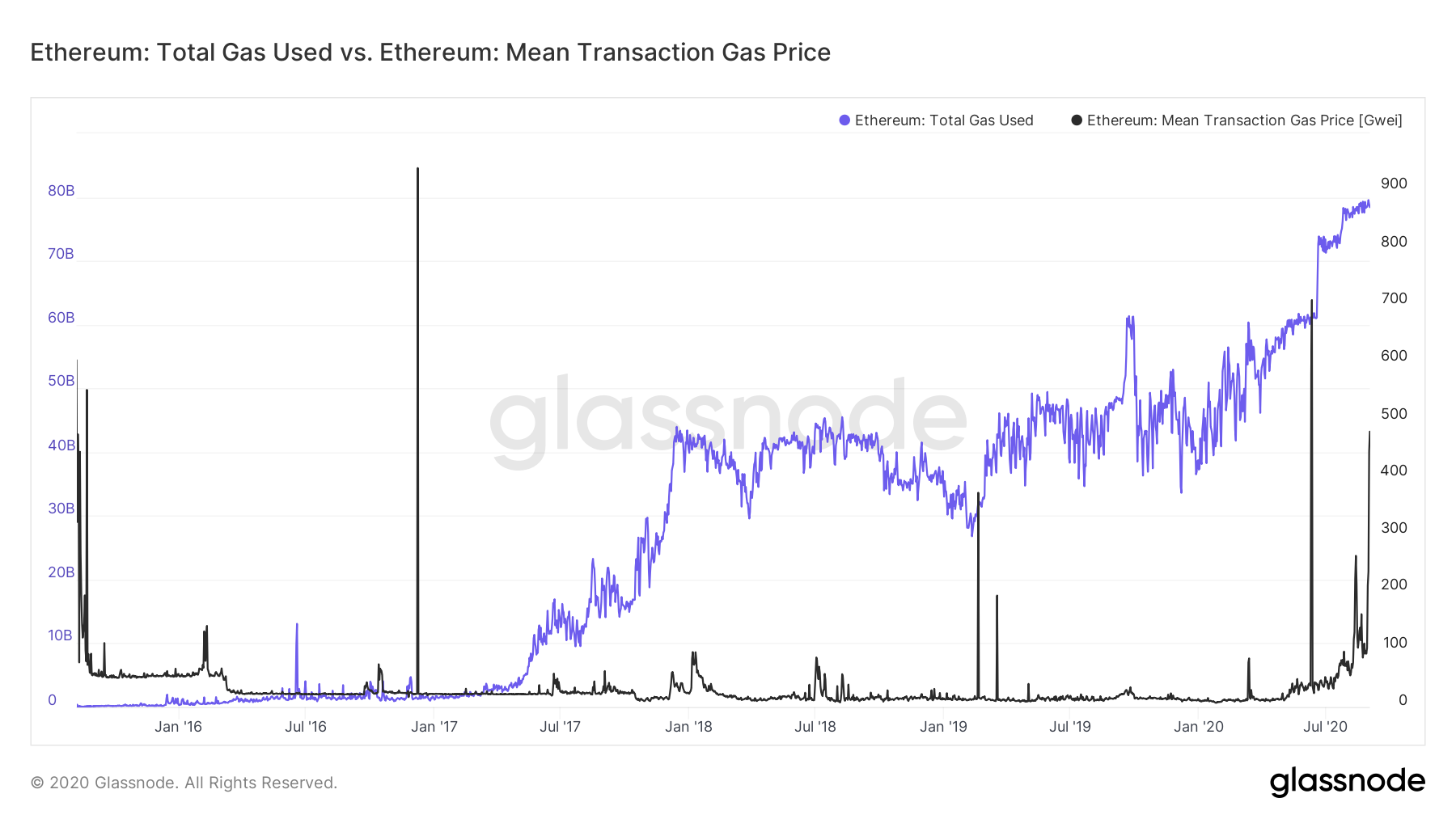

The demand for the network is at its highest level since creation in 2015. The amount of gas used is two times higher and the price of gas is five times higher than what it was during the 2018 peak. This fresh application of stress on the network is generated by the DeFi boom; the biggest crypto trend of 2020.

Ethereum total gas used and gas price. Source: Glassnode.

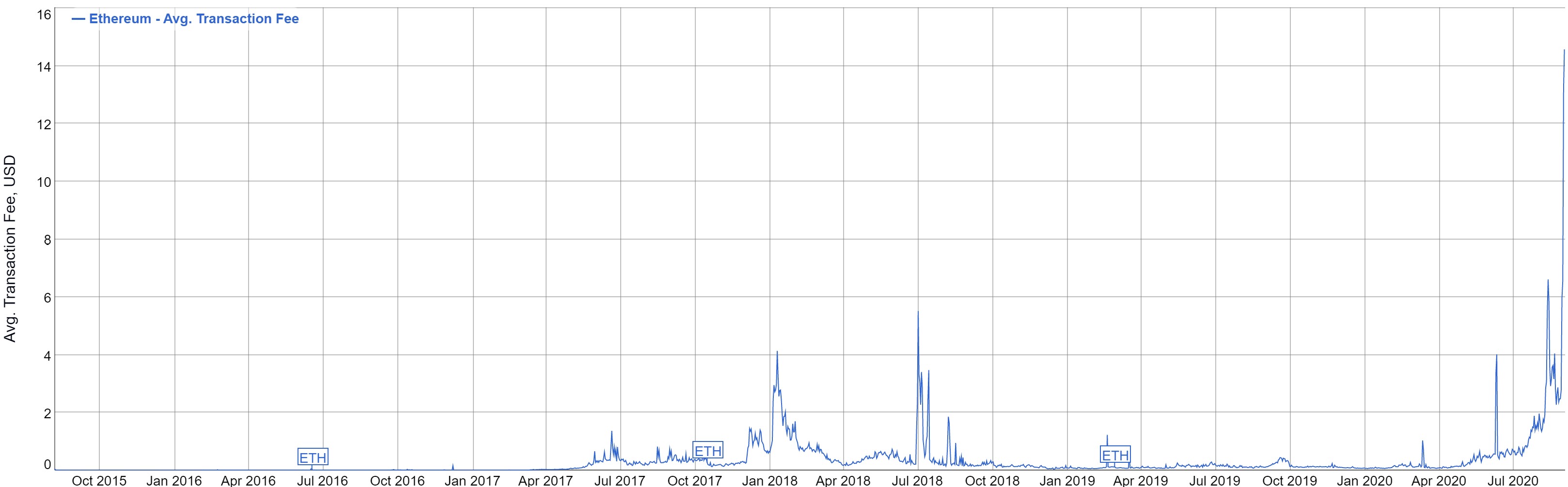

The total value locked in DeFi has grown from under $1 billion at the beginning of the year to almost $10 billion, currently. This has translated into the highest ever average transaction fee cost — currently, above $14.

Ethereum average transaction fee. Source: BitcoinCharts.

Though a $15 transaction fee may sound like a lot, it does not paint the entire picture. The key here is that this is an average price. There is a disparity in transaction fees on the Ethereum network as the price one ends up paying depends on the type of transaction, with some transactions requiring much more gas than others. For instance while, at the time of this writing, a simple ETH transfer may incur a fee of just above $4, a token swap via a DEX aggregator requires a fee of $180. Many DeFi-related transactions tend to be on the higher side.

This creates a situation where DeFi becomes inaccessible to retail investors as transaction fees may far outweigh potential profits. This may also present an even bigger issue — those retail investors who have already staked their assets in DeFi applications may not be able to withdraw their funds without suffering a significant loss. The higher the fees, the bigger the DeFi mousetrap gets.

This also places limitations on the potential growth of DeFi on Ethereum. The higher these fees get, the bigger the entrance ticket to DeFi will become. This could eventually turn turn the DeFi ecosystem into a playground exclusive to funds and whales.

The cost of transaction fees on the Ethereum network is governed by the market or supply and demand. The only caveat is that unlike most market-driven economies, the network’s throughput is fixed and thus cannot adjust to the increasing demand, resulting in ever-increasing gas prices. Nonetheless, this trend cannot continue indefinitely and will likely revert at some point.