- U.S. stock futures traded mixed ahead of Monday’s open, leading to a volatile start to New York trading.

- Apple and Tesla are now trading at the stock split-adjusted price.

- The S&P 500 Index is wrapping up its best August since the 1980s.

The Dow and broader U.S. stock market were mixed during Monday’s open, as Apple (NASDAQ:AAPL) and Tesla (NASDAQ:TSLA) began trading at their new split-adjusted price. While not a component of the Dow or S&P 500, Tesla has become an important proxy for investor sentiment in the current market cycle.

Dow, S&P 500 Fall; Nasdaq Gains

Futures contracts for all three major U.S. stock indexes wavered ahead of Monday’s opening bell. By the open, the Dow Jones Industrial Average was down roughly 110 points.

The broad S&P 500 Index of large-cap stocks declined by 0.1%. The Nasdaq Composite Index rose 0.3%.

The S&P 500 and Nasdaq set multiple records last week, while the Dow closed at its highest level in six months.

Dow blue-chip Apple Inc. opened sharply higher after its four-to-one stock-split took effect. Apple is trading at a new split-adjusted price of $127.64, having gained 2.3%.

Tesla’s five-for-one stock split also took effect Monday. TSLA rose 0.6% to $4445.58.

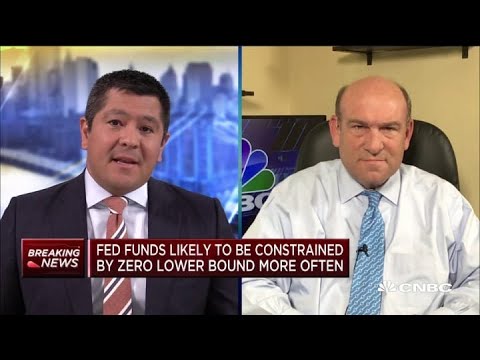

‘Fed Officials Continue to Drive Up Stock Prices’

The U.S. stock market has defied expectations recently, thanks in large part to an extremely dovish Federal Reserve.

Fed Chair Jerome Powell announced a historic policy shift last week that allows the central bank to create more inflation to drive economic expansion. Fed officials will allow inflation to rise above 2% so long as ‘average inflation’ evens out over time. Watch the video below.

Ed Yardeni, president and chief investment strategist at Yardeni Research, told investors that he was hoping to see more market consolidation before the next leg higher.

We “had hoped that the market would consolidate its gains since March 23, giving earnings a chance to rebound,” Yardeni said, according to CNBC. “However, Fed officials continue to drive up stock prices by committing to keeping interest rates close to zero for a very long time … Consequently, they are fueling the meltup in stock prices.”

Corporate earnings are coming off a dismal quarter, with the S&P 500 posting a blended earnings decline of 33.8%, according to FactSet. Big Tech managed to outperform the market as government lockdowns forced consumers and businesses to rely on technology.

Even with Monday’s pullback, the U.S. stock market is on track for its best August in more than 30 years.