While tradeoffs are unavoidable, experts interviewed by crypto.news believe that the blockchain trilemma sheds light on the challenges developers face and ways to navigate them.

The blockchain trilemma, coined by Ethereum co-founder Vitalik Buterin in 2017, highlights the challenges developers face in creating distributed ledger systems. According to Buterin, architects must make tradeoffs and prioritize two out of three key features.

In an interview with crypto.news, Luke Nolan, a research associate at CoinShares, concurred with this viewpoint. Nolan believes that, in a broad sense, the blockchain trilemma effectively illustrates the challenge of achieving all three features to their fullest extent. He emphasized that developers often sacrifice some aspects or both when optimizing one feature.

The blockchain trilemma

Alex Dulub, Founder of Web3 Antivirus, suggests that speeding up a blockchain can sometimes compromise its safety. He believes that solutions like Layer-2 (L2) networks and sidechains, handling transactions outside the main blockchain, can boost speed and scalability but may introduce new risks.

Dulub thinks that smart contract bugs, centralization risks, and potential attacks are the key vulnerabilities for blockchains aiming to improve all three aspects.

Neville Grech, the founder of Dedaub, a blockchain security firm, points out that increasing parameters such as block size and frequency to enhance speed may demand more computational power, bandwidth, and storage than average nodes can handle. This could lead to a more centralized network structure, with only a few nodes fully participating in the blockchain.

While adjusting the validation process might speed up a network, Grech warns that “it could expose the blockchain to vulnerabilities and validation disputes and create temporary forks.”

Moreover, according to him, reduced participation of nodes and validators in the verification process could compromise the network’s decentralization and the integrity of the blockchain.

To illustrate, the Bitcoin network, despite being decentralized and secure with over one million BTC miners worldwide, processes an average of 8.35 transactions per second (TPS). This figure is significantly lower than centralized money transmitters like Visa, which boasts a TPS range of 1,500 to 2,000.

In contrast, Zcash’s blockchain typically operates at an average speed of 26 transactions per second (TPS) for non-shielded transactions. However, a September 2023 report revealed that over 50% of Zcash’s hash rate was controlled by the ViaBTC mining pool, exposing the network to the risk of a 51% attack.

Take Solana (SOL) as another example, boasting a current real-time TPS of 772, according to Chainspect data. Despite facing its 10th major outage in February 2023, the network has demonstrated high stability since then.

In a July 21, 2023 report, the Solana Foundation declared a 100% uptime for the Solana blockchain. This achievement followed improvements in the ratio of voting-to-non-voting transactions.

In this case, Luke Nolan, a research associate at CoinShares, points out that the primary tradeoff made was with decentralization, and according to him, “security has come at a more minimal tradeoff.”

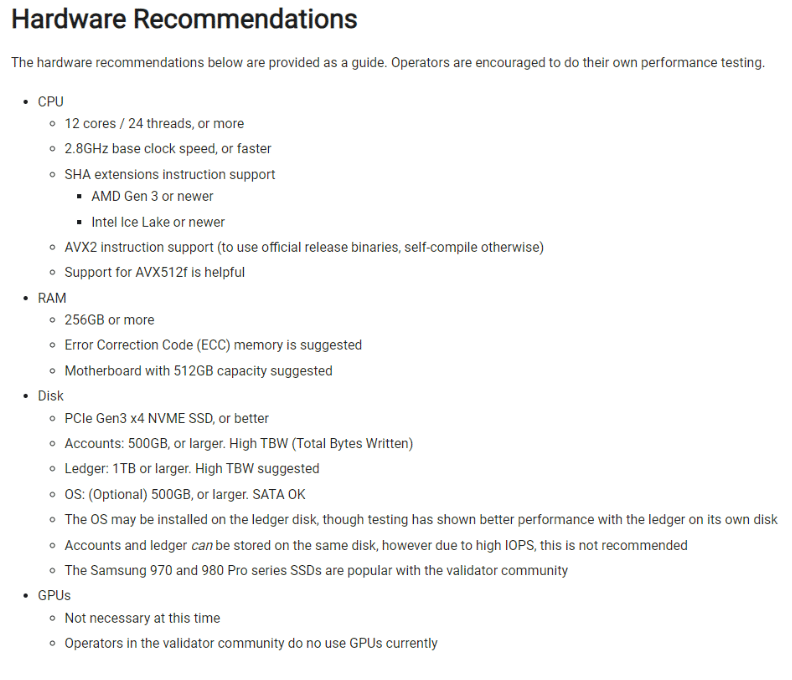

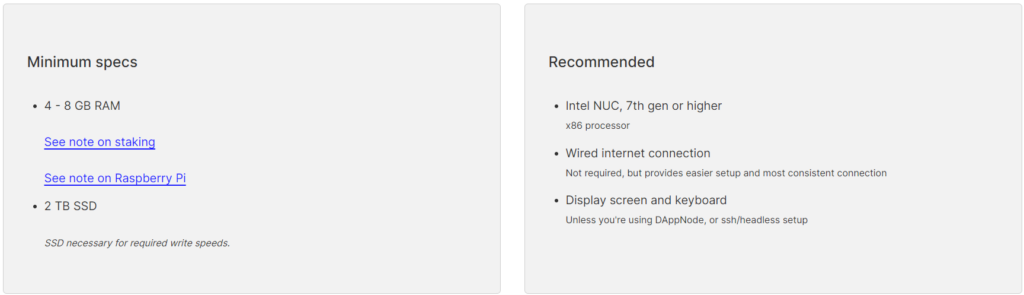

He highlights that the price of running a Solana validator can be quite high, ranging between $3,000 and $5,000. This high cost makes it expensive for the general public to operate a Solana validator, posing risks of centralization.

According to Solana Compass data, Solana currently has a total of 2,919 nodes with more than 433,000 stakers. The number of the network’s nodes has declined significantly since March 2023 after reaching an all-time high (ATH) of 2,564 operating nodes.

While the number of Ethereum nodes has been consistently declining since mid-January, currently hovering around 7,000, it’s still 2.4 times higher than Solana’s operating devices.

This number is reasonable given that Ethereum nodes require lower hardware requirements compared to Solana and cost between $500 and $1,000. In addition, the number of Ethereum stakers is also significantly higher than Solana’s — currently standing at over 921,000.

Nolan also mentioned that Ethereum has, for now, put aside the idea of Layer-1 (L1) scaling to avoid compromising decentralization or security. Currently, Ethereum handles an average of around 13 transactions per second (TPS), with its highest recorded TPS reaching 62.34.

“Overall, I wouldn’t say the number of validators is the number 1 metric of decentralization, but from a philosophical point of view, you could run an Ethereum node for very cheap, help progress the chain even without staking 32 ETH — although of course, you would not earn anything.”

Luke Nolan told crypto.news.

Solutions

To show that the blockchain trilemma isn’t an unbreakable rule, companies are introducing creative solutions that challenge the idea that speed and security are always at odds. Let’s explore some of the top solutions that aim to balance scalability, security, and decentralization.

- L2 networks: These solutions enhance Layer-1 blockchains by boosting transaction speed, cutting fees, and enhancing overall scalability. L2s let the main chain focus on security and decentralization, while Layer-2 networks handle scalability and efficiency. Technically, L2 blockchains inherit the security of L1 networks.

- Consensus mechanism changes: New consensus mechanisms, such as Proof of Stake (PoS) variants, aim to balance security and speed without major compromises. Transitioning from Proof of Work (PoW) to PoS could be a significant way to increase transaction throughput while reducing processing fees.

- Segregated Witness (SegWit): Implemented in Bitcoin in 2017, SegWit scales blockchain throughput by separating transaction signatures from transaction data and storing them differently. This separation improves space efficiency, streamlines verification, and reduces the overall size of transaction records.

- Sharding: Techniques like sharding distribute transaction processing across smaller groups of nodes, increasing speed while maintaining security. Harmony blockchain, for example, uses sharding and currently achieves a two-second finality time, whereas Solana’s Time to Finality (TTF) is around 12.8 seconds.

- Rollups:

- Zero-knowledge rollups (zk-rollups): These rollups bundle hundreds of transactions off-chain and generate a cryptographic proof, known as a zero-knowledge proof.

- Optimistic rollups: These operate on the assumption that transactions are valid by default. They carry out the computation on the Layer-1 (L1) blockchain only in case of a dispute. This introduces a finality delay in verifying the legitimacy of transactions before they reach the L1 network. If a transaction is found to be invalid, it can be rolled back to prevent any negative consequences.

Conclusion

Fast blockchains don’t directly sacrifice decentralization and security; instead, the blockchain trilemma sheds light on challenges developers confront and the occasional tradeoffs they must navigate.

“In a nutshell, while speed often poses tradeoff challenges with security, the blockchain community’s relentless innovation can provide some solutions. It’s not just about choosing between speed and security; it’s about smartly engineering the blockchain to balance both.”

Neville Grech told crypto.news.

Dulub emphasizes that “careful design, rigorous testing, and ongoing research are key to managing the challenges” associated with the blockchain trilemma.