The price of Bitcoin (BTC) has been ranging between $9,800 and $10,500 for nearly a week after a short fall from almost $12,100 seen on Sept. 1. As BTC struggles to show any distinctive price movement, traders are generally cautious.

Over the medium to long term, traders expect Bitcoin to recover and perceive the ongoing consolidation phase as a healthy pullback. From July 16 to Aug. 17, Bitcoin rose from $9,005 to $12,486 on Coinbase, with a pullback arguably necessary to neutralize the futures market.

A large portion of Bitcoin’s daily volume comes from the futures market. Cryptocurrency futures exchanges use a mechanism called “funding” to achieve a balance in the Bitcoin market. The mechanism forces long contract holders to compensate short-sellers for a portion of their positions if the market is majority long, and vice versa.

Typically, when the rally of Bitcoin becomes overextended, it causes the futures market to get overcrowded and funding rates to soar. In the event of a pullback, it allows funding rates to stabilize, reducing the probability of a long or short squeeze.

Explaining short-term BTC bearishness

Speaking to Cryptox, Dennis Vinokourov, the head of research at crypto exchange and institutional brokerage provider BeQuant, and Guy Hirsch, managing director of eToro trading and brokerage platform, revealed that Bitcoin’s medium-term outlook is positive due to various fundamental and technical factors.

Following the rejection of Bitcoin at $12,000, analysts attributed many factors to the decline of BTC. As Vinokourov pointed out: “The aggressive unwind of crowded positioning related to DeFi assets” could have contributed to the decline. However, other factors like whales taking profit, miners selling off their stashes, and a major South Korean exchange Bithumb reportedly being raided by police all might have applied selling pressure on Bitcoin. Hirsch emphasized that in periods of low volatility, price drops can be intensified when fewer traders are in the market:

“Mining pools are moving higher than usual volumes of Bitcoin onto exchanges while looking to cover their overheads, and investors have recently been more reserved (even for the usual summer lull). Lower volumes mean volatility, and price drops can be more drastic than they normally would be during heavier trading sessions.”

Vinokuorov stated that the pullback could benefit Bitcoin in the months ahead, as price rejection is not a negative occurrence if the market were to calm down as a result. He also noted that the leveraged and speculative flow of traders would align after a consolidation period:

“Price discovery and consolidation following a strong run up is an indication of a healthy two way market flow. Price rejection is not necessarily a bad development, as it gives market participants an opportunity to take stock of the situation and look to align the interest of both leveraged/speculative flow and those of long-term holders.”

Bitcoin’s longer term outlook

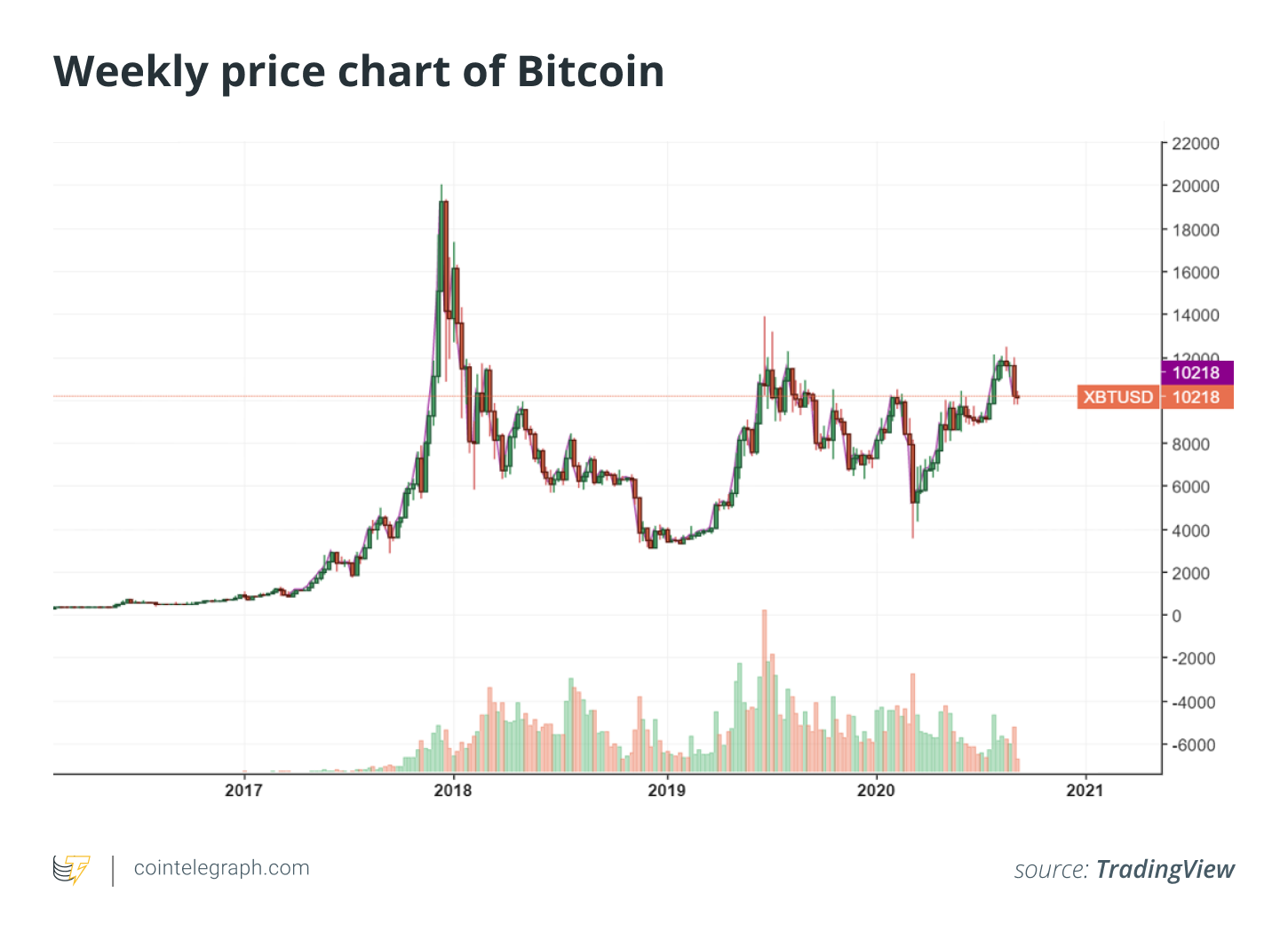

Heading into the fourth quarter of 2020, analysts remain neutral or bullish on the price trend of Bitcoin, and an abundance of technical and fundamental factors could buoy the sentiment around BTC from November to December. Historically, BTC performed strongly in the last two months of the year. Most notably, BTC surged to a new all-time high in December 2017.

Potential technical catalysts include the closure of Bitcoin’s monthly candle above $11,600 for the first time since 2017, and reaching the $12,000 resistance level. Albeit briefly, it marked an important breakout after dropping to as low as $3,596 on BitMEX in March 2020.

Fundamental factors that could contribute to the uptrend of Bitcoin are strengthening infrastructure, rising inflation and the near-zero interest rates. A low-interest rate environment boosts the bull case of gold and potentially Bitcoin because it could lower the value of the U.S. dollar. Hirsch said:

“I do believe that this bearish sentiment is short-term, and there are some positive developments that support BTC’s continued growth, such as the Fed’s policy of near-zero interest rates for the considerable future.”

He also added that a Bitcoin breakout is possible in the near term if the perception of Bitcoin as a hedge against inflation improves. Throughout the past month, public companies and institutional investors have purchased billions of dollars in Bitcoin. MicroStrategy, a company listed in the U.S. stock market, invested $250 million in BTC as the firm’s primary treasury asset.

Based on the increasing demand for Bitcoin as a potential hedge against inflation as well as the tone around BTC set by Wall Street giants like Paul Tudor Jones, Hirsch believes another major upsurge is a possibility: “Federal Reserve’s attempt to prop up the economy might fuel investors to look more closely at Bitcoin for a number of reasons, resulting in a positive uptick for the largest digital asset.”

BTC enters uncertainty

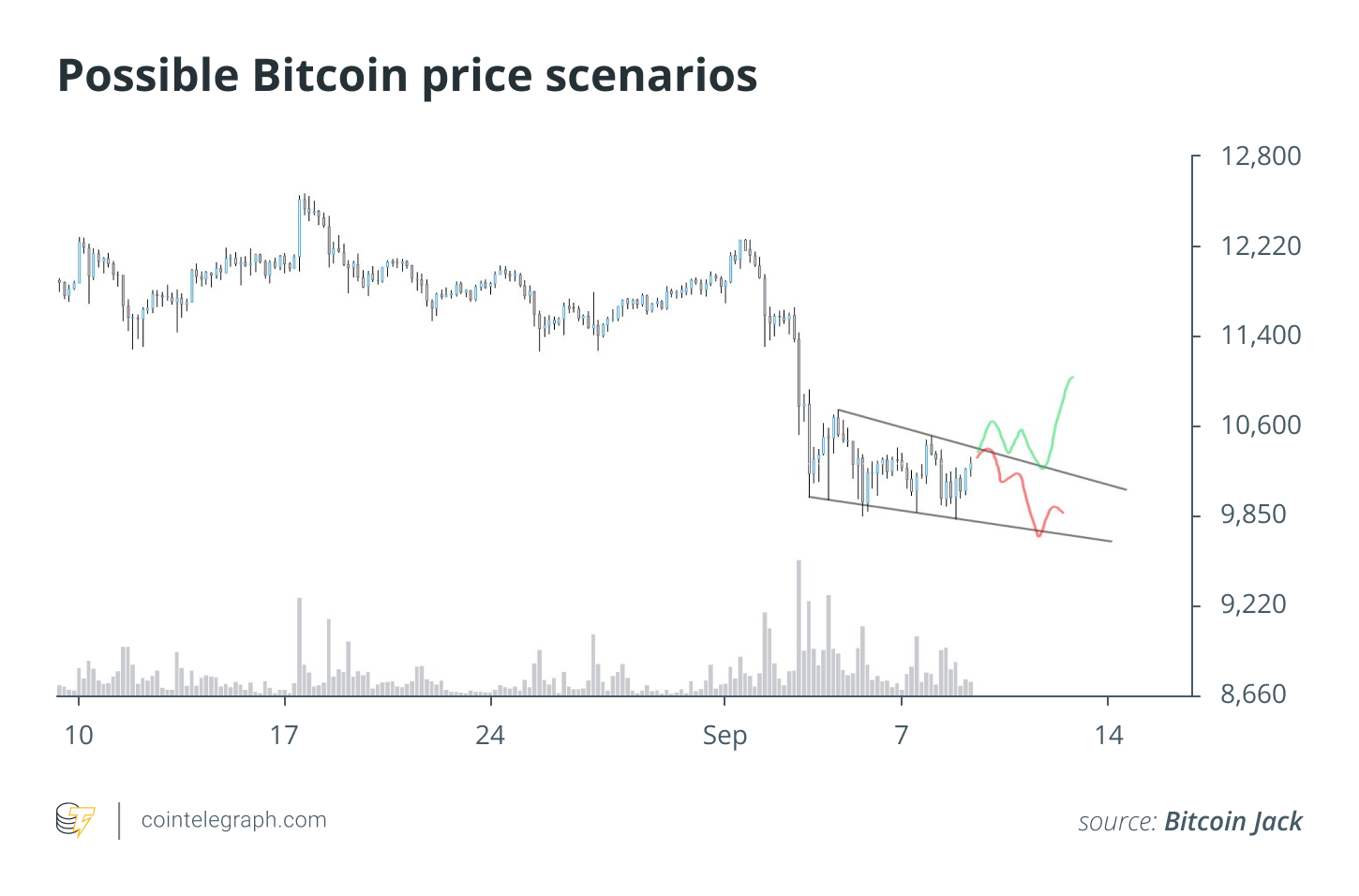

But in the short term, technical analysts remain divided on the Bitcoin price trend, although agreeing that Bitcoin price action will slow down. A pseudonymous trader known as “Bitcoin Jack” said Bitcoin could be in a descending wedge that has a 50% chance of breaking out or down: “BTC testing the 128 DMA — historically often a level of support/resistance on trending price. Also testing HTF support — the LTF doesn’t have me convinced yet. If LTF can show strength I want more longs.”

The bullish scenario for Bitcoin in the short-term would lead to a retest of the $11,000 resistance level, based on the chart above. A bearish scenario would cause another drop to the $9,000s, potentially leading BTC to the $9,650 CME gap that has not filled yet.

Since Bitcoin whales often mark tops and bottoms for BTC, there is a strong possibility that BTC may drop to as low as $8,800, which was identified as a buy area by them. A pseudonymous trader recognized as “Salsa Tekila” said: “If BTC does retrace 30–45% from top like 2017 (past performance doesn’t predict future), it would take us somewhere between $6,850–$8,650.”

But Hirsch said that in previous market cycles, Bitcoin rallied in early November, ahead of key holidays in Asia: “We’ve seen these rallies happen a number of times, and so I wouldn’t be surprised if a Bitcoin rally would happen this year too.” Furthermore, Vinokourov believes that Bitcoin may retest the $12,000 mark soon, since “the number of Bitcoins locked on Ethereum continued to rise even as the total amount locked across the ecosystem declined.”