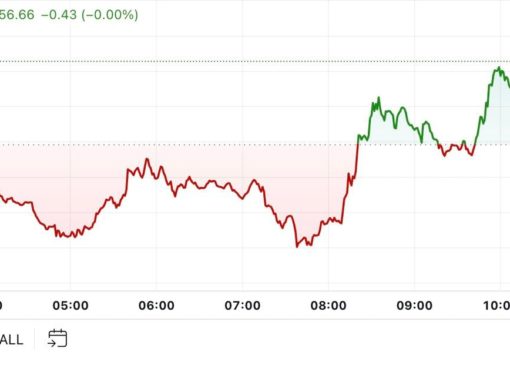

DeFi tokens have experienced a significant plunge, dropping between 10-20% amid weak crypto price action this week. This downturn in decentralized finance (DeFi) tokens highlights the volatility and challenges within the broader cryptocurrency market.

DeFi Tokens Face Steep Declines

The DeFi sector, known for its decentralized financial products and services, has seen some of its prominent tokens suffer substantial losses. Leading the decline is Pendle (PENDLE), which has experienced a sharp drop. The overall sentiment in the cryptocurrency market remains bearish, contributing to the steep declines in DeFi tokens.

New data from CryptoX shows that DeFi tokens, including those of popular projects, are facing intense selling pressure. Pendle (PENDLE), for example, has seen its value decrease significantly, mirroring the broader downturn in the crypto market. This decline has raised concerns among investors about the future stability and growth potential of DeFi projects.

Market Sentiment and Investor Concerns

Market sentiment has played a crucial role in the recent price action. The bearish trend across the cryptocurrency market has not spared DeFi tokens, which are often more volatile due to their relatively smaller market capitalizations and higher risk profiles. Investors are becoming increasingly cautious, leading to a sell-off in these tokens.

LPL Financial chief economist Jeffrey Roach noted that the recent data is “sending a warning sign” about the potential softening of the market. This sentiment is echoed by other analysts who believe that the current market conditions could lead to further declines if negative sentiment persists.

Pendle Leads the Decline

Pendle (PENDLE) has been at the forefront of this decline. The token has faced significant selling pressure, resulting in a substantial drop in its value. The broader market’s weakness has exacerbated Pendle’s struggles, reflecting the interconnectedness of the cryptocurrency ecosystem.

The price action in Pendle (PENDLE) serves as a stark reminder of the volatility inherent in the cryptocurrency market. As investors react to broader market signals, tokens like Pendle are often subject to exaggerated moves, both upwards and downwards.

Broader Impact on DeFi Sector

The decline in DeFi tokens is not limited to Pendle. Other significant tokens within the DeFi ecosystem have also faced considerable losses. This includes well-known tokens such as Uniswap (UNI) and Aave (AAVE), which have both seen their prices drop amid the broader market weakness.

The drop in DeFi tokens has broader implications for the DeFi sector. As these tokens lose value, it can impact the overall liquidity and functionality of DeFi platforms. Lower token prices can lead to reduced collateral values, affecting lending and borrowing activities within the DeFi space.

Future Outlook for DeFi Tokens

The future outlook for DeFi tokens remains uncertain. While the current market conditions are challenging, some analysts believe that the long-term prospects for DeFi remain strong. The potential for decentralized financial services to disrupt traditional finance is significant, and many believe that DeFi will continue to grow despite the current setbacks.

Nancy Vanden Houten of Oxford Economics highlighted that while the current data is concerning, it is essential not to overreact to short-term volatility. “A persistent rise in initial claims would signal more weakness in the labor market and a larger rise in the unemployment rate than we currently expect,” she noted. This cautious approach is shared by other analysts who urge investors to consider the long-term potential of DeFi projects.

Conclusion

The recent plunge in DeFi tokens, led by Pendle (PENDLE), underscores the volatility and risks associated with the cryptocurrency market. While the short-term outlook is challenging, the long-term potential for DeFi remains promising. Investors should remain cautious and consider both the risks and opportunities within this dynamic sector.

Featured Image: Freepik © freepik