Trading volumes are surging on Uniswap and other so-called decentralized cryptocurrency exchanges, challenging established venues like Coinbase while driving up fees and congestion on the Ethereum blockchain.

Uniswap, a semi-automated platform for matching buyers and sellers of cryptocurrencies and other digital assets, saw its trading volume climb to $953.59 million on Tuesday, a more than ten-fold gain over the past month, according to the website uniswap.info. The 24-hour trading volume has crossed above $1 billion – at least 50% higher than daily trading volumes observed on Coinbase Pro, the largest U.S.-based centralized cryptocurrency exchange.

The rise of decentralized exchanges, or DEXes, represents a new chapter of this year’s boom in decentralized finance. The fast-growing ecosystem, known as DeFi, consists of automatic lending and trading platforms, built atop distributed computing networks like Ethereum and constructed from open-source software and programmable cryptocurrencies. They aim to provide more efficient and less costly ways of conducting transactions currently handled by banks and traditional exchanges.

“It indicates that the DeFi flippening is real and already here,” Denis Vinokourov, head of research at the London-based prime brokerage Bequant, told CryptoX in a Telegram chat. “Flippening” is crypto jargon, used loosely to indicate the hypothetical moment when one blockchain or digital-asset trend overtakes another.

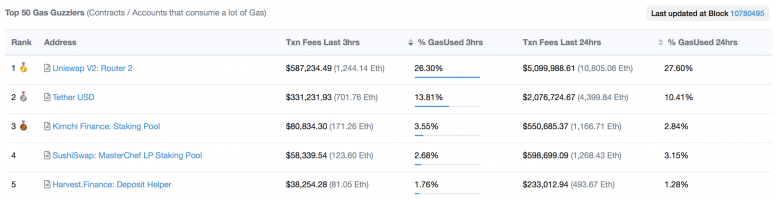

Uniswap’s usage has grown so rapidly that it’s taken over the top spot among fee payers on the Ethereum network, where most of the DeFi development is taking place. The total value locked in the DeFi applications, the most common metric for measuring the activity, has increased 13-fold this year to about $9.2 billion, according to the data-tracking website Defi Pulse.

Uniswap has now moved into the top spot in total value locked, at $1.7 billion, CryptoX reported Tuesday, while overall decentralized exchange volumes nearly tripled in August to $11.6 billion from July levels.

“As DeFi assets approach $10 billion, one narrative we may see is that crypto is a completely separate, new sphere of economics and finance,” according to a blog post Tuesday by Fintech Blueprint, curated by Lex Sokolin of the Ethereum-focused developer ConsenSys. “It does not need to connect to the old world. It simply needs to be left alone to perform.”

Traders on Uniswap have paid $5 million (10,805 ETH) in transaction fees in the past 24 hours, according to data source etherscan.io. That’s more than double the amount paid for transfers of the dollar-linked stablecoin tether (USDT), which had been the top contributor, according to ethgasstation.info.

Uniswap is designed to be more customizable than centralized exchanges like Coinbase. Instead of listing specific assets available for trading on the platform, traders can choose and list the tokens they want to transact in; currently the platform boasts more than 6,020.

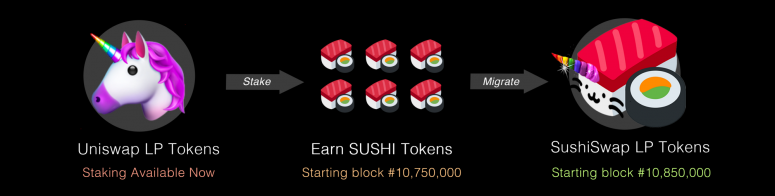

And SushiSwap, a five-day-old unaudited project that’s an adaptation of Uniswap, has already moved into to the No. 3 spot of payers of Ethereum “gas,” which is the unit used to calculate fees for token transfers on the Ethereum blockchain.

Sushiswap, which went live on Aug. 28, pays out rewards to liquidity providers in its tokens — ticker SUSHI — in addition to a share of trading fees.

There’s already $81 million of liquidity for Sushi on Uniswap, and the 24-hour trading volume of $151.42 million exceeds that of spot-market cryptocurrency trading volumes on mid-tier exchanges like Binance US, Gemini and Poloniex.

The “fear of missing out” on SUSHI reveals the “the DeFi craze,” according to a report Tuesday from the Norwegian cryptocurrency-analysis firm Arcane Research.

Press officials for Coinbase, which is reportedly considering an initial public stock offering, didn’t respond to a request for comment.

DeFi has grown so quickly that centralized exchanges from Binance to FTX have rushed to roll out indexes — and new trading contracts like futures and perpetual swaps linked to those indexes — to give investors a way to bet on the industry segment’s growth.

But according to Vinokourov, DEXes might represent a more existential threat to the centralized exchanges.

“Those already trading on DEXes fully realize that growth will only accelerate,” Vinokourov told CryptoX.