“Money” is not only a viable instrument, it also turns out to be a trust symbol among two parties in the transactions. Since people hold their finances in both physical and digital forms, the financial industry is in need of secure terminologies that initiate more crypto startups recently.

These startups turn to financial services that are easily accessible globally. By adopting the blockchain technology in the financial sector, the shape of spreading the decentralized financial services into a new structure called “Decentralized Finance(DeFi)”.

This is a big shift in the FinTech domain and getting ready to meet this new shift is an essential one for beginners. While reading this blog, you will surely get the awareness on how DeFi helps to meet the grand shift with the adaptable elements and familiar cases. Let’s directly move on to the blog now.

Decentralized Governance: A Notable Shift in FinTech Domain

By leveraging the blockchain and its latest technologies, the DeFi introduces significant changes in the fintech industry. These changes are completely beyond the real-time expectations of the fin-tech community.

Towards a transparent financial economy, the DeFi is tailoring in a potential way. The major elements that govern this potential DeFi are:

- Interoperability

- Composing

- Programmability

With the arrival of DeFi, the Open Finance Movement (OFM) is emerging in the FinTech domain. With this domain, the parties involved in the transactions find many alternatives as follows:

- Savings

- Loan Processing

- Trading

- Insurance

Dependencies such as connectivity and the devices play a major role for the people to access the DeFi platform easily. An integration of cryptocurrency, financial system, and blockchain technology happens easily by leveraging Ethereum.

With the OFM and the dependencies, DeFi turns the existing financial market into a feasible and transparent one for any parties in any domain. Due to the removal of intermediaries, DeFi demands blockchain technology to do the following processes in a secure manner.

- Fund borrowing

- Crypto-currency Trading

- Insurance

- High interests

- Regulate the price moments on assets

Still, many more to go. This impact is evergreen in the market. Getting ready to meet this impact is pro-habit and everyone looks for the options to launch on their own.

Decentralized Finance (DeFi): Key to Meet

Blockchain technology facilitates the DeFi and hence it acts as the perfect key to meet all the shifts in the financial domain with the following aspects.

Data Unchangeable: By applying the tamperproof on the information, the financial operations are highly secure.

Transparent to All: Due to the integration of blockchain technology, the transparency level on data goes high and it is visible to all. This also ensures trust level, security, authenticity, and clear audits.

Interoperability: The built of DeFi application via the integration of various products like stable coins, marketplace, and decentralized exchanges. Due to this feature, DeFi developers customize or integrate third-party applications into the DeFi platform easily.

Absence of Failure: Since the information is distributed across multiple nodes, no single point failure occurs. This protects the transactions from the potential shutdown.

With all the above metrics, the DeFi platform acts as the major key to carry the big shift in fintech domains. The workflow of the DeFi comprises 3 major components like dApps, smart contacts, and blockchain technology.

dApps: Creation of dApps with the special characteristic of automating the interaction of money in different ways.

Smart Contracts: These remove the central authorities or any intermediaries, the transactions among the parties are direct and fast.

Blockchain Technology: With the factors like reliability, tamper-proof, automation, and programmability, the built of DeFi platform ensures secure transactions.

Elements Make Up DeFi

The elements that make up DeFi as prominent are categorized into 3 major forms as follows:

Decentralized Exchanges(DEXs):

Without any need for a third-party service provider or intermediary, these platforms allow users to trade their digital assets. No need for an account if DEX is preferred by the users to buy/sell digital currency. Built-up of distinct blockchains, compatible wallets liquidity, and the regular user base are the special benefits of implementing DEX platforms.

Decentralized Marketplaces

They commonly act as they peer in peer-to-peer networks and allow the users to do transactions with one another without any intermediary. Smart contract Ethereum is one of the top blockchains that facilitates decentralized marketplaces efficiently.

Aggregators/Wallets

These are the special interfaces that are used by the users to do interactions in the DeFi market in a basic way. This facilitates the automatic movement of users’ crypto assets among various yield-farming platforms for high returns.

Cases Specially Used for DeFi

Upon getting the awareness of DeFi, various industries show their interest in DeFi platform development. They acquired DeFi in various cases as follows:

Lending/Borrowing Platforms

Due to the enabling of security and direct exchange aspects, the DeFi turned out to be the primary use case for monetary services like banking or payments. The payments are in the ranges of open, easy-to-use and accessible.

Stable Coins

With the main focus on stabilizing the changing prices of cryptocurrencies, stable coins collectively stable assets, and gold coins are implemented especially for DeFi to perform the following actions; lending, borrowing, remittances

Insurance

Due to the transparency and the numerous alternatives, the DeFi element called smart contracts largely applied to sensitive areas like insurance. Insurance claiming and protection of the assets is also based on smart contracts.

Identity

DEXs highly involve peer-to-peer transactions among the stakeholders. These support different online marketplaces to enable the users to exchange the products/services globally. Due to its decentralized nature, DeFi’s common advantages are the absence of signup, identity verification, and withdrawal fees.

DeFi Leading Platforms

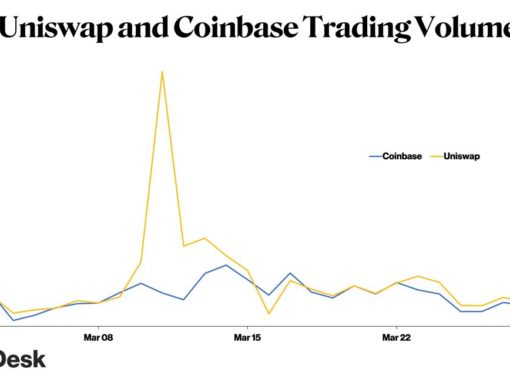

With all the essential use cases and the elements, the leading DeFi platforms are Uniswap, maker. Compound and Aave. Each of them has unique operations and pricing mechanisms.

Uniswap: Built by using the liquidity pools for the token swaps with unlimited orders.

Maker: Stable coin usage in most of DeFi projects

Compound: Algorithmic money market protocol on the basis of Ethereum to lend the assets and take loans easily.

Aave: A open-source and non-custodial protocol specially designed for borrowing/lending activities.

Way to Be One Among DeFi Leaders

Crypto startups are the most essential platforms that offer a wide range of support to FinTech domains. Future of financial services in the hands of DeFi platforms. To meet the big revolution in insurance as well as decentralized governance, focusing on the development of DeFi platforms is observed in the market.

When you are interested in the idea of the DeFi platform, the cases, elements listed in this blog add value to your ideas. Be a prominent player in this field by hiring the right DeFi Development Service providers in the market.