- Warren Buffett’s value-investing philosophy has received a lot of flak recently.

- Year-to-date Berkshire Hathaway is down by double-digits.

- Meanwhile, Dave Portnoy has become the latest internet sensation with his “outlaw” style.

The self-declared captain of day traders, Barstool Sports founder Dave Portnoy, has called Warren Buffett “washed up.” He has also claimed to be smarter than the Berkshire Hathaway (NYSE:BRK.A) chairman and CEO.

Buffett should hire Portnoy ASAP. Hear me out, please.

All aging corporations need an injection of new blood, new perspectives, and new thinking. Berkshire Hathaway certainly is no exception.

And in a workplace setting that is no doubt used to formal attire, there is no harm in a hire who comes to work in beach shorts and sandals whenever the weather allows it!

Here are three reasons why Portnoy would be a good fit for Buffett’s firm.

1. Berkshire Hathaway needs generational diversity

Berkshire Hathaway desperately needs some younger people at the helm. Warren Buffett is approaching 90 while his sidekick, Charlie Munger, is 96.

Their presumed successors are not young either.

Ajit Jain, a Berkshire Hathaway vice chairman, is 68. Another of the investing conglomerate’s vice chairman, Greg Abel, is 57. Abel was the only Berkshire executive to take questions alongside Buffett at this year’s annual meeting, prompting speculation that he is the preferred successor.

Portnoy, who is 43, would bring a new younger worldview to the company. Who knows, he might even get Berkshire Hathaway to open a Robinhood account!

2. Value investing is dead

The S&P 500 Index returned 31% in 2019 while Berkshire only gained 11%. If things go unchanged, Berkshire will fare even worse this year, providing further proof that Buffett’s value-investing philosophy has lost its magic.

But Buffett’s style is not the only game in town, as Portnoy has demonstrated. Since May 14, the Barstool Sports founder has generated 73% returns through his Davey Day Trader Global outfit.

Even other billionaires think Warren Buffett could do better. Take hedge fund billionaire Bill Ackman, for example. Last month, Ackman revealed that he had dumped his Berkshire Hathaway shares worth close to $1 billion. Clearly, he has lost all confidence in the Oracle of Omaha.

Last year, Ackman’s hedge fund Pershing Square Holdings, returned 58%. As of late May, the hedge fund had generated returns of 27% for 2020. This contrasts sharply with Berkshire, which is down 21% since the year started.

With everyone making money except Buffett, Portnoy is the guy to turn the ship around. Trust me–if Buffett hires a guy who picks stocks randomly with the help of Scrabble tiles, he will win back fans who have increasingly been losing faith in him!

3. Both Dave Portnoy and Warren Buffett have a common “enemy”

Opposites attract. But it doesn’t hurt to have something in common to solidify the relationship. And believe it or not, Portnoy and Buffett have something they both agree on. This can form the basis of a long and fulfilling co-working relationship on their way to bringing Berkshire Hathaway back to its glory days.

At every opportunity presented to him, Buffett has bashed bitcoin. He has called the cryptocurrency “gambling device” and even “rat poison.” His sidekick Munger feels the same.

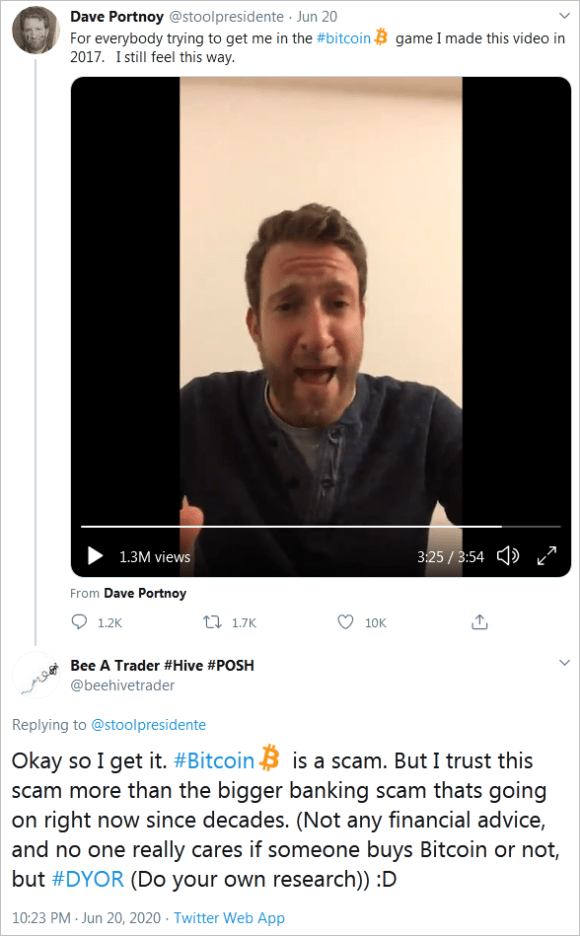

While Portnoy has not used such colorful language, he believes bitcoin is a scam. Aren’t they a match made in heaven?

Time to give Portnoy a call, Mr. Buffett. Or Portnoy will end up hiring your people in a few years, or even months. After all, he has said stocks always go up in price. He is set to make Dave Day Trader Global bigger than Berkshire Hathaway!

Disclaimer: This article represents the author’s opinion and should not be considered investment or trading advice from CCN.com. The author holds no investment position in the above-mentioned companies.