Data appears to contradict Bitfinex’s claim that the reason for its users withdrawing 135,000 Bitcoin (BTC) from the exchange was an arbitrage opportunity that ensued following Black Thursday.

135,000 BTC later

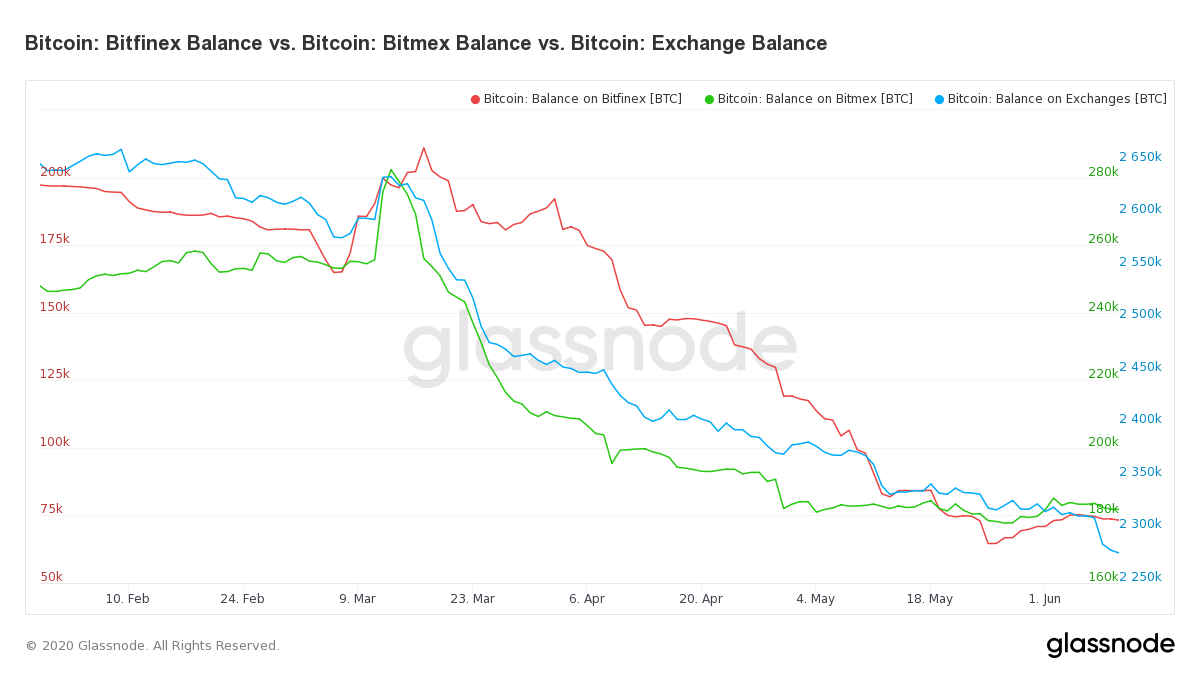

On Thursday, March 12, Bitfinex was holding 200,000 BTC. By May 25, this number dwindled to just 65,000 BTC. This is a 67% decrease over the span of two and a half months.

Bitfinex Bitcoin Balance. Source: Glassnode

Data contradicts Bitfinex’s explanation

In a Cryptox interview, Bitfinex CTO Paolo Ardoino stated the driving factor behind this trend was the fact that following March 12, BTC price on the exchange was lower than on other exchanges, thus presenting an arbitrage opportunity for the traders:

“For a period following March 12th, the price of BTC on Bitfinex was lower than other exchanges, so traders were buying BTC on Bitfinex and selling somewhere else. (We have seen the opposite trend for ETH, where Bitfinex has seen an inflow of 1 million.”

Bitcoin Price On Major Exchanges (GDAX denotes Coinbase). Source: Nomics

However, hourly price data obtained by Cryptox appears to contradict Ardoino’s thesis. The price across most exchanges appears to be synced with nearly zero gaps. Meanwhile, Bitfinex’s balance fell by over $1 billion.

Bitcoin Balances Bitfinex, BitMex & Other Exchanges. Source: Glassnode

During the same time period, Bitcoin balances across other exchanges shrank by 315,000 BTC. Bitfinex’s share represents 43 percent of this decrease, and BitMex represents a further 31%. These two exchanges were responsible for nearly 75% of the trend.

Consistent arbitrage opportunity makes no sense

Although this coincides with the overall trend of investors withdrawing their digital assets from exchanges, the fall in Bitfinex’s balance is by far the worst.

The point of arbitrage is that price gaps are traded away. This leads to uniformity across trading platforms. Such consistent arbitrage opportunities would be contrary to the way markets operate under normal conditions.

Cryptox reached out to Bitfinex for comment, but has not received a response in time for publication.