- As Tesla’s stock price soared, the EV maker has become more valuable than major traditional carmakers.

- Daimler was an early investor in Tesla but sold its nearly 10% stake six years ago.

- Toyota is another early Tesla backer that has seen its market cap dwarfed by the Elon Musk-led firm.

Tesla (NASDAQ:TSLA) becoming the world’s most valuable company is a tired line already. For some of the legacy carmakers that Tesla has passed on its way to the top, the most painful thing is not being outshone–it is missing out on the electric vehicle (EV) maker’s recent stock price rally.

Mercedes-maker Daimler, which was an early Tesla investor, is the most prominent example.

In April 2010, the German luxury carmaker acquired a 9.1% stake in Tesla at $50 million. The EV maker went public two months later.

Daimler sold the stake in 2014. Had Daimler not divested, a 9.1% stake in the EV maker would now be worth about $36.5 billion.

The Now-Sold Tesla Stake Is More Than Two-Thirds of Daimler’s Market Cap

The Mercedes maker’s market cap now stands at $54.4 billion. Had Daimler not sold the Tesla stake, it would constitute nearly 70% of the German auto giant’s market cap.

It is essential to point out, though, that after Tesla went public, Daimler’s stake in the EV maker was watered down. Additionally, Daimler transferred a part of its stake to the investing arm of Abu Dhabi’s government before Tesla going public.

Still, Daimler booked a $780 million windfall after selling the stake in 2014, a gain of over 1,500%. Had Daimler held on, the paper gains would currently be in the region of tens of billions of dollars.

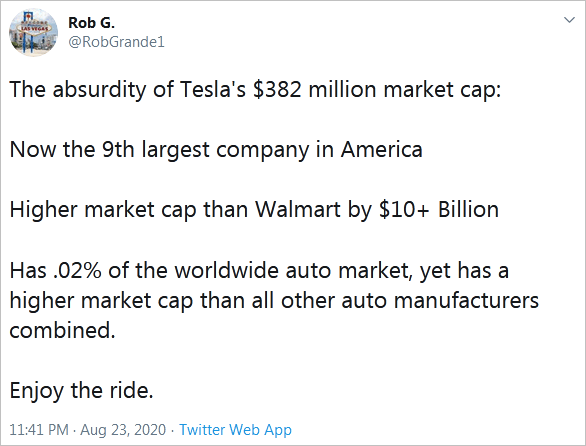

Year-to-date, the stock has gone up by over 400%. Tesla is now the ninth largest public company by market cap in the U.S.

Not Just Daimler’s Pain

As Tesla’s share price approaches $2,200 ahead of a stock split, Daimler is not the only traditional carmaker that probably regrets exiting their investment too early.

In this regard, Daimler is in the esteemed company of Japanese auto giant Toyota.

A decade ago, Toyota acquired a 3% stake in Tesla. Toyota completely divested from the company in 2017. The two carmakers ended their collaboration in making electric vehicles over culture clashes around the same time too.

The 20% Owner of Tesla

As Daimler and Toyota ponder over what might have been, the EV maker’s CEO Elon Musk has the last laugh. Musk owns 20.8% of Tesla.

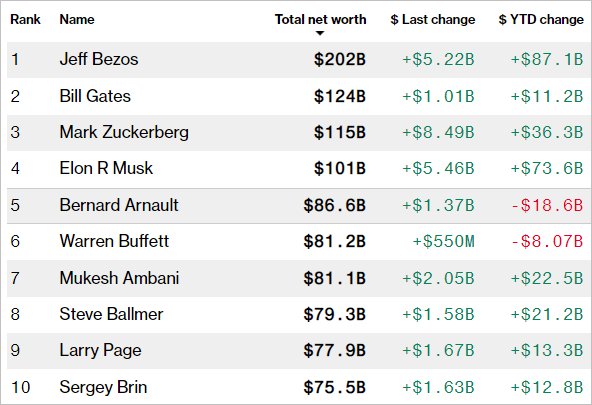

With the surge in Tesla’s stock price ahead of the split, as well as possible inclusion in the S&P 500 Index, Musk’s wealth has grown by triple digits. Year-to-date, his net worth has gone up by nearly 270%.

Musk is now the world’s fourth-richest person. At the beginning of the year, Musk was ranked no. 35. The Tesla CEO’s wealth gain year-to-date is the second-largest after Jeff Bezos.

Disclaimer: This article represents the author’s opinion and should not be considered investment or trading advice from CCN.com. The author holds no investment position in the above-mentioned securities.