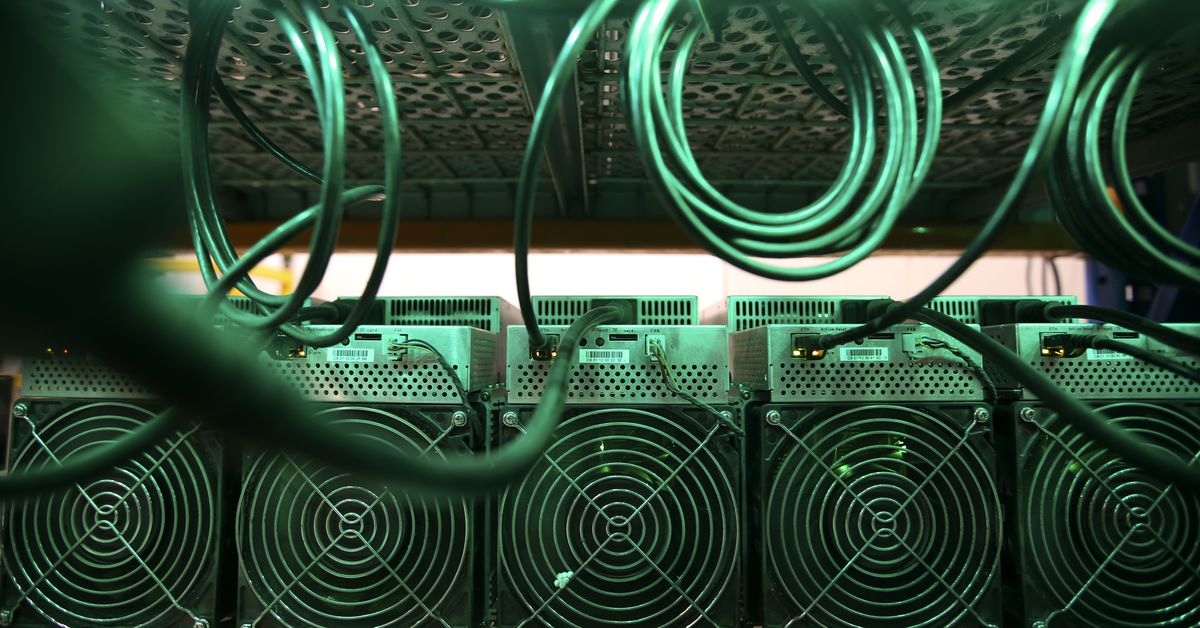

The recent selloff in the shares of cryptocurrency miners have created buying opportunities across the group, Christopher Brendler, an analyst at Wall Street investment banking firm DA Davidson, wrote in a research note dated Nov. 29.

Mining stocks have tumbled in recent weeks, after a rally in October and loggin a strong start to November. The recent drop corresponds with price declines in bitcoin and ether, suggesting that many investors still view mining firms as a public-market proxy for investing in leading cryptocurrencies.

“Although the slightly more risk-off market and BTC pullback may have contributed, we also think the group moved a little too much too fast,” Brendler said, adding that fundamentals for the miners “remain fantastic.”

Bitcoin’s price fell to near $53,000 last week, after reaching as high as $68,000 earlier this month. Marathon Digital, one of the largest bitcoin miners, also followed the same trend this month. Bitcoin has recovered since then and was trading near $57,000 as of press time.

Brendler highlighted Core Scientific, which is planning to go public via a special purpose acquisition company, as his favorite “buy-and-hold” miner and also sees potential upside in the shares of Hut 8 and Argo Blockchain.

Within the crypto miners, shares of Cipher Mining, BitFarms and BIT Digital were among the outperformers on Monday, while others including Marathon Digital, Hut 8, Hive Blockchain were also positive.