Crypto social media platform Friend.tech faced backlash after a controversial decision by its team. The platform’s native token, FRIEND, plummeted over 42%, reaching its all-time low (ATL) price amid the controversy. As a result, an Ethereum (ETH) whale saw its investment in the token drop by over 95%.

Related Reading

Friend.tech Loses Investors’ Trust

Over the weekend, crypto platform Friend.tech announced its decision to resign control over its smart contracts to avoid future changes. Friends.tech is a Social Finance (SocialFi) platform launched in 2023 that combines the principles of social media and Decentralized Finance (DeFi).

The project is a blockchain-based social platform built on Ethereum’s Layer-2 Base, offering users the potential to profit from content creation. The crypto platform allows creators to monetize their content by using tradeable tokenized shares, known as “Keys,” to access their exclusive publications and private chats.

On September 7, Friend.tech’s team revealed it had sent the admin and ownership of its smart contracts to Ethereum’s null address “to prevent any changes to their fees or functionality in the future.”

Per the post, the change won’t affect the “separate web client operated at friend.tech which will continue as is.” Additionally, fees from the smart contracts or the platform are not going to the developer team’s multisig.

Following the news, the project’s community shared their discontent, expressing their disbelief about the decision. A community member called the team’s recent actions “The best display of WORST LEADERSHIP ever in crypto history.”

Meanwhile, others questioned whether the decision was “the final nails in the coffin, or ribbons on a present?” Investor’s doubt was founded in May when the project’s airdrop presented several issues.

However, distrust was cemented when the platform announced it would build its blockchain, “Friendchain,” in June. After the backlash, Friend.tech announced it had abandoned the project in a now-deleted post. This decision dragged its token’s price down by over 35% in July.

Crypto Whale Investment Drops 94%

Since the news dropped, FRIEND’s price decreased by 42%. The cryptocurrency plummeted from the $0.102 mark to the $0.0593 level over the weekend. On Monday morning, the crash drove the token’s price to its ATL of $0.0574, nearly a 98% drop from its all-time high (ATH) of $3.26.

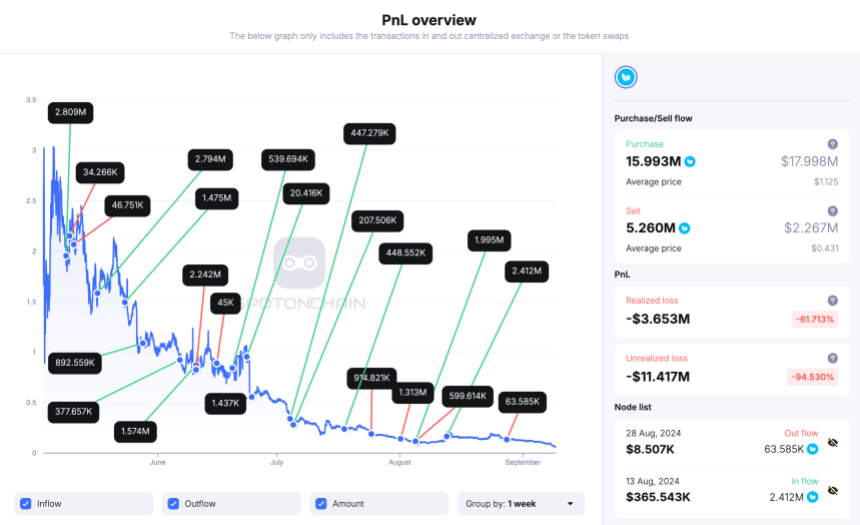

As the token hit its lowest price, a crypto investor saw its investment nosedive over 95%. Blockchain research platform Spotonchain revealed that a whale had lost over $15 million on its FRIEND holdings.

Per the report, Taiwanese personality Machi Big Brother was a “hard-core bull” on the platform’s token. The whale was at nearly $16 million in realized and unrealized losses after spending around $18 million worth of ETH to acquire FRIEND tokens.

Machi bought 15.99 million FRIEND tokens between May 9 and August 13 at an average price of $1.125. The trader also accumulated FRIEND by providing liquidity on BunnySwap during this period.

As the token’s value declined over the months, the investor sold around 5.26 million tokens to cut loss. At the time, the sale was worth $2.27 million at an average token price of $0.431, representing a 61.7% realized loss.

Related Reading

Machi’s remaining 11.1 million FRIEND tokens had a 94.5% unrealized loss, worth $11.4 million. At the time of the report, the whale’s holdings were worth around $689,000.

The cryptocurrency has recovered 32% from its ATL, briefly hitting the $0.09 mark earlier today, according to Coingecko data. As of this writing, FRIEND is trading at $0.0761, a 2.1% surge in the last 24 hours.

Featured Image from Unsplash.com, Chart from TradingView.com