What’s an effective way to diversify a crypto portfolio? Are crypto assets able to be diversified at all? These are the questions that many “Hodlers” have been asking. The slow bleed of Bitcoin (BTC) and other major cryptocurrencies prices has been challenging investors and their holding powers. Despite BTC still able to maintain its 112% year-to-date gains so far — thanks to the massive bull run in the second quarter and the recent China-inspired rally — the recent price correction could pressure some of the latecomers. In this article, we will study some possible diversification options for crypto portfolios from a Hodler’s perspective — i.e., diversifying investment by allocating capital into various crypto assets using long-only strategies. We will also explore how altcoins and stablecoins could balance a portfolio.

Why diversify?

In the traditional world of finance, the performance of different assets could vary under different market conditions. For example, real estate investment trusts could outperform general equities in a turbulence market, and defensive stocks could disappoint investors when the appetite for risk is heightened. That’s when diversification comes in. The main purpose of exposure to different asset classes is to balance risk and return in a portfolio.

In the cryptocurrency space, diversification could also be one of the ways to manage risk exposure. However, some would argue that it is impossible to diversify a crypto portfolio due to the fact that major altcoins are highly correlated with Bitcoin. However, with a carefully selected basket of altcoins — in conjunction with stablecoins — investors could able to navigate the market more effectively with manageable risk.

Concentration vs. diversification

There has always been a debate about putting all your eggs in one basket. While in some cases concentrating on only one asset could maximize profitability, this also maximizes the risk exposure. On top of that, a heavy-concentration strategy gives investors no room for any errors in analysis, and it overexposes the investor to unnecessary risks.

However, over-diversification could also hurt investment returns. Some investors believe that the more assets they own, the better return they can have — and that’s not the right concept. It could increase investment cost, add unnecessary due-diligence efforts and lead to below-average risk-adjusted returns.

Market performance overview

Before getting into portfolio diversification, let’s have a quick recap on the performance of major cryptocurrencies. The figure below shows that OKB and BTC were among some of the YTD gainers, while XMR and XRP have been underperforming compared to their peers. Once again, this shows various crypto assets could perform very differently, highlighting the importance of balancing risk and return.

Asset allocation

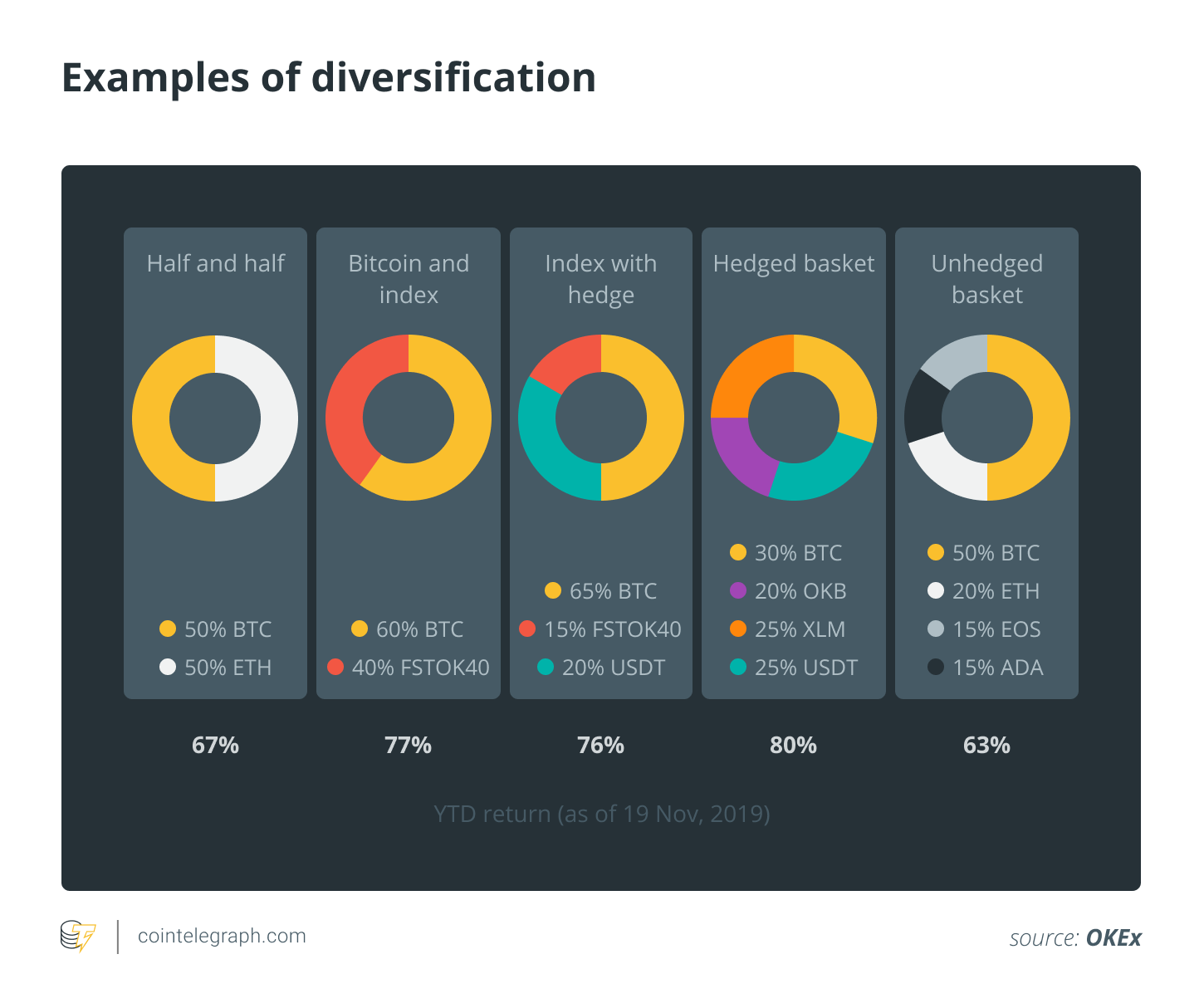

A portfolio with a balanced selection of coins and tokens could help Hodlers balance risk and returns. Here are some sample portfolios using BTC alongside other leading altcoins as well as the Fundstrat Crypto 40 Index — a weighted index tracks the top 11 to 50 cryptocurrencies by market value and liquidity. The results could make Hodlers think again about putting all their eggs in one basket.

Many BTC-based portfolios have remained solidly in the green, due in part to Bitcoin holding on to its 112% gain so far this year. As shown above, however, the portfolio containing only BTC and Ether (ETH) has been underperformed compared to portfolios that have both BTC and exposure to mid-cap altcoins. To see this, compare the 50/50 portfolio (with a yearly gain of 67%) to the one consisting of Bitcoin and the top-40 index (gaining 77% on the year).

Meanwhile, the hedging nature of stablecoins like Tether (USDT) has been reflected in the sample portfolio based on BTC and the index with a hedge (76%). In this diversification example, the exposure to altcoins is reduced, the BTC holdings are slightly increased and USDT was added. Still, the gain of this portfolio was very close to the one without USDT. In general, a portfolio that includes stablecoins can reduce the risk ratio more than one that is unhedged, but as the examples above show, it is still possible to achieve similar results.

Stablecoins are especially important in portfolios that include highly volatile coins and tokens, as can be seen in the example of the hedged basket. The group comprises XLM and OKB, which have plummeted over 46% and surged over 290% respectively. Still, this combination was able to achieve almost 80% YTD gains, and the USDT holdings were part of the reason behind that performance. In contrast, the mixture of BTC and certain altcoins without a stablecoin in the basket could underperform the other sample portfolios provided.

Advanced setup

Additionally, experienced traders and Hodlers are able to fine-tune their portfolios by adding derivatives on top of a long-only portfolio. For example, if a Hodler is being short-term bullish on an individual coin, he can increase his leverage on that specific coin by adding futures or perpetual swap positions on top of the holdings. Structured products can also be used as a hedge in a downturning market.

Related: How to Trade Big Crypto Volumes, Explained

Crypto asset diversification has been one of the most debated topics in the industry. Some would argue that a 100% Bitcoin allocation setup could probably still able to generate a decent return this year. However, a BTC-only portfolio will never able to capture the distinctive opportunities in the altcoin world, which could potentially generate higher returns — and, of course, putting all your eggs in one basket comes with higher risk. A carefully designed portfolio with balanced asset allocation could maximize the risk-adjusted return. As the year-end approaches, investors and Hodlers can review their risk profiles and adjust their strategies for next year.

The views, thoughts and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of CryptoX.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Cyrus Ip works at OKEx as a research analyst. He provides value-added Bitcoin and altcoin analysis, and has produced macro-thematic research that bridges the gap between the crypto world and traditional financial markets. Previously, Cyrus worked with Citigroup, where he served as a forex market analyst with a focus on G10 and EMFX. He was also a long-time financial journalist with solid experience in Hong Kong, China and Canada.