The race to accumulate Bitcoin (BTC) is accelerating as corporations increasingly view the digital asset as a valuable addition to their balance sheets. Beyond publicly traded firms, private companies are joining the movement, including a Norwegian deep-sea mining company planning to acquire $1.2 billion worth of BTC.

This week also marked the official unveiling of a new venture by crypto entrepreneur Anthony Pompliano, aimed at building a billion-dollar Bitcoin treasury.

As Bitcoin accumulation intensifies, stablecoins are emerging as a key driver of crypto adoption. The United States is edging closer to passing landmark stablecoin legislation, South Korea is pushing banks to issue won-backed stablecoins and the rise of yield-bearing stablecoins — described by one venture executive as an “inevitability” — appears to be on the horizon.

This week’s Crypto Biz explores the growing momentum behind Bitcoin treasuries and the surging influence of stablecoins.

Norway deep-sea miner to buy Bitcoin

Norwegian deep-sea mining firm Green Minerals AS has announced plans to allocate up to $1.2 billion to its Bitcoin treasury, highlighting the growing institutional appetite for digital assets.

The Bitcoin treasury strategy is part of broader ambitions to incorporate blockchain technology into the company’s operations. The company said Bitcoin will help diversify its assets from fiat currencies.

Corporations are racing to buy Bitcoin, with new entity formations scooping up billions of dollars worth of the digital asset. Earlier this month, Tether and Bitfinex moved $3.9 billion worth of Bitcoin to Twenty One Capital, a new company backed by SoftBank and Cantor Fitzgerald.

Entrepreneur Anthony Pompliano has also launched a new Bitcoin financial services firm, called ProCap BTC, which announced plans to buy up to $1 billion worth of BTC.

Crypto execs plan BNB treasury

Bitcoin treasuries aren’t the only digital asset stockpiles making waves — crypto hedge fund executives from Coral Capital Holdings are reportedly raising $100 million to invest in Binance’s BNB (BNB) token.

Patrick Horsman, Joshua Kruger and Johnathan Pasch plan to complete the fundraising this month and begin accumulating BNB immediately, Bloomberg reported. The BNB treasury will be managed by a new entity called Build & Build Corporation, which will also file for a public listing on the Nasdaq stock exchange.

Horsman, Kruger and Pasch were part of Coral Capital, which was acquired by DNA Fund in 2024 for an undisclosed amount.

Stablecoin yields are an “inevitability,” says CoinFund exec

Crypto venture firm CoinFund has backed DeFi protocol Veda in an $18 million raise to support the expansion of its vault platform, which enables issuers to create crosschain yield products like yield-bearing stable assets.

“The natural next step for wealth onchain is to earn yield and to make your assets (fiat currency or digital assets) productive,” CoinFund managing partner David Pakman told Cointelegraph.

Although the US banking lobby is reportedly spooked about the impact of yield-bearing stablecoins, Pakman described them as an “inevitability,” since they are “a much more convenient way of earning low-risk yield on fiat than traditional bank savings and money market accounts.”

“I do agree that, once we have more and more yield-bearing stablecoins, traditional bank savings accounts will be endangered and need to evolve,” Pakman said.

South Korea eyes stablecoins

Stablecoins are coming to South Korea, with buy-in from the country’s central bank and broader financial sector.

Eight major South Korean banks are developing a won-backed stablecoin in an attempt to curb US dollar dominance in the country. The stablecoin rollout could begin later this year or early next year.

The Bank of Korea’s deputy governor, Ryoo Sangdai, wants regulated financial institutions to be the primary issuers of stablecoins in the country, according to local media reports.

“The aim is to establish a safety net, considering the potential for market disruption or consumer harm,” Sangdai said.

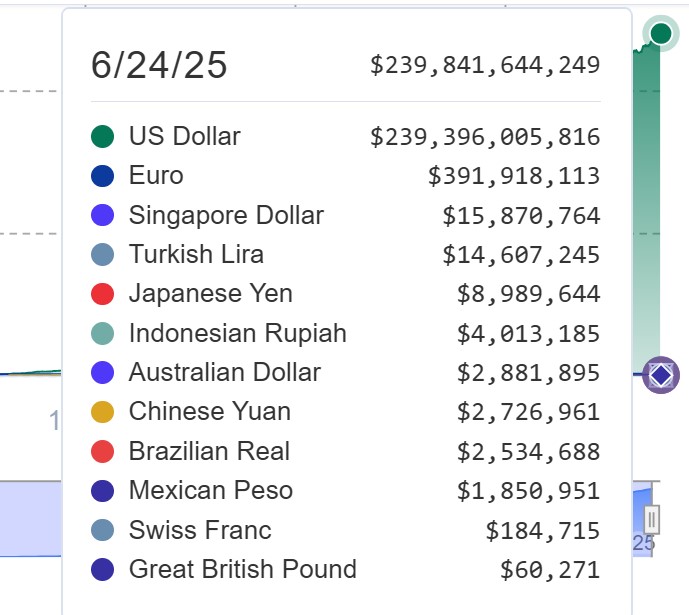

Stablecoins are a $239 billion market, according to industry data. However, 99% of that value is tied to the US dollar.

Crypto Biz is your weekly pulse on the business behind blockchain and crypto, delivered directly to your inbox every Thursday.