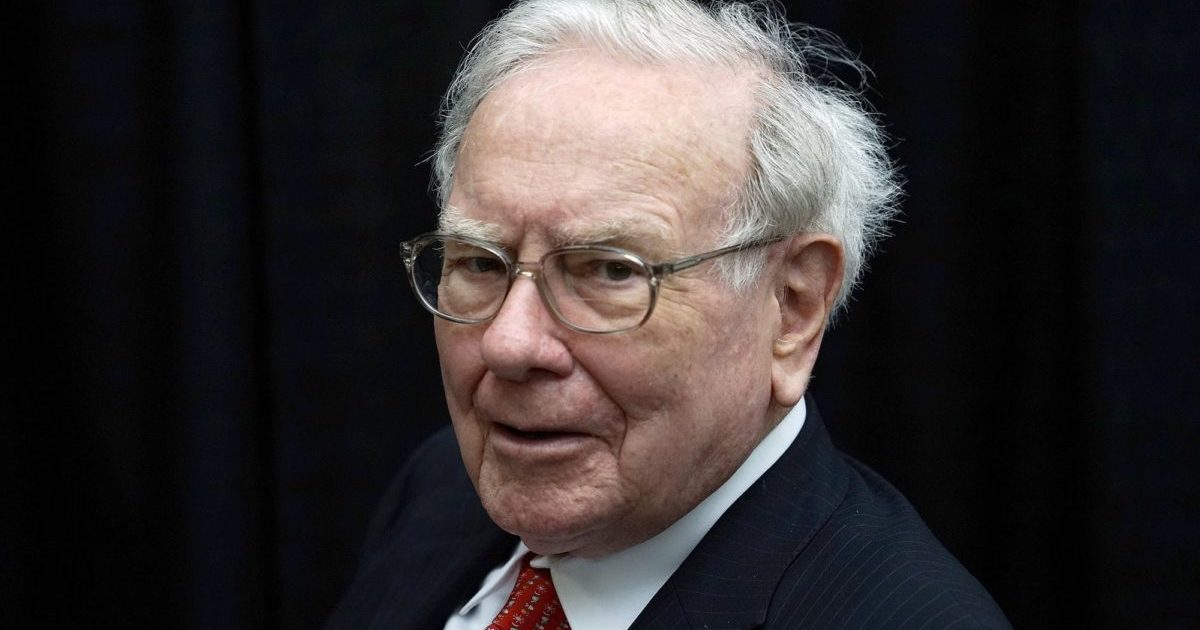

- Major Berkshire Hathaway holdings including Apple and Delta Airlines are massively exposed to the coronavirus outbreak.

- Warren Buffett’s company is also heavily exposed to banks and financials, which will be squeezed if Fed cuts interest rates this month.

- Buffett has little hedge protection against effects of the coronavirus on the stock market.

Warren Buffett may be telling investors all is well in the stock market, but a quick glance at the portfolio of Berkshire Hathaway (NYSE: BRK.A) tells us another story.

Buffett is famous for being a “contrarian investor” – pithily summing up his strategy with his famous quote:

Be greedy when others are fearful, and fearful when others are greedy.

So it would be against the Warren Buffett brand to be telling investors they might indeed need to be fearful when the world is in the grips of a global pandemic disease and a worldwide stock market sell-off to match.

But maybe Buffett is more fearful himself than he would ever let on.

Berkshire’s coronavirus exposure

Berkshire’s largest position – Apple (NASDAQ: AAPL) – is heavily exposed to the Chinese economy.

Apart from Chinese consumers’ love of Apple products, the company will be grappling with Chinese supply-chain disruptions for months.

Apple has already told the markets that it has yet to reopen the majority of its retail stores in China:

All of our stores in China and many of our partner stores have been closed. Additionally, stores that are open have been operating at reduced hours and with very low customer traffic. We are gradually reopening our retail stores and will continue to do so as steadily and safely as we can.

Apple stock has responded negatively over the past month – but in light of these issues, it is very conceivable that the worst is still to come.

In addition to Apple, Berkshire also holds large stakes in three airline companies: Delta, Southwest, and American.

I don’t think it’s necessary to spell out why the coronavirus might not be good news for airline companies. All three stocks are down over 20% year-to-date.

Berkshire’s interest rate problem

Another less-appreciated thorn in Berkshire’s side is how the Fed is likely to respond to the coronavirus threat. Further interest rate cuts are likely to be the first weapon deployed from the Fed – and the stock market knows it.

Investment bank Goldman Sachs is reportedly expecting three rate cuts by June.

Interest rate cuts would be detrimental to another major holding of Berkshire Hathaway – banks. Bank of America, Wells Fargo, and JPMorgan Chase are the second, fifth, and seventh-largest holdings of Berkshire respectively.

Banks earn profits on the spread between the money they lend and money deposited to them. Lower rates typically reduce this spread and hurt earnings – especially if rates stay low for an extended period. So if the Fed does cut rates three times in 2020, it would represent another major headache for Berkshire’s portfolio.

Buffett has less protection from a plunging stock market than you think

To the relief of Berkshire’s shareholders, Buffett does have an extremely large $128 billion cash buffer in place. He hopes to use this to both weather and prosper from the economic storm.

But apart from this pile of potential, Berkshire has very little in terms of a hedge or protection against the coronavirus situation. His famous position (and fourth-largest holding) in American Express is down over 20% in the last two weeks, and we won’t even mention Kraft Heinz.

Perhaps Coca-Cola is Berkshire’s saving grace in this difficult time. Buffett has said he never plans on selling his shares. Times like these prove why.

Disclaimer: This article represents the author’s opinion and should not be considered investment or trading advice from CCN.com.

This article was edited by Josiah Wilmoth.