Cointelegraph Markets Pro is an all-in-one institutional-grade crypto market intelligence platform offering traders of all backgrounds real-time alerts for potential price movements before they occur.

The Cointelegraph Markets Pro platform was created with the aim to narrow the divide between institutional and retail investors. Its proprietary tools, like the Newsquakes™ indicator, the VORTECS™ Score and the Tweet Sentiment indicator, are the platform’s primary methods of achieving this goal.

Looking back at Cointelegraph Markets Pro alerts performance shows that the institutional-grade platform has been a resounding success. Since 2021, the platform has produced an average return of at least:

- 2,895% in gains from score-based trading strategies (potentially turning $10,000 into $289,549)

- 546% in gains from time-based trading strategies (potentially turning $10,000 into $54,635)

- 851% in gains from buy-and-hold breakout strategies (potentially turning $10,000 into $85,179)

After two years of delivering several winning trade opportunities every week and listening to direct feedback from thousands of users, the Cointelegraph Markets Pro team has taken the most requested feature updates, along with what they knew would improve the platform most, and came up with an even more powerful iteration.

Cointelegraph Markets Pro 2.0 — What’s new?

The new dashboard pairs new features with an organization revamp that makes it easier for traders to receive and interpret information.

The dashboard, for example, is now split into Short Term Trends and Long Term Trends, allowing traders to easily toggle between the sections depending on their trading preferences.

Here’s a summary of the most impactful new features:

1. An updated news section

The news section now features top trending news and latest news. Top trending news is calculated based on the number of times stories have been tweeted over a 24-hour period. Users can also find the news category in red letters below the title.

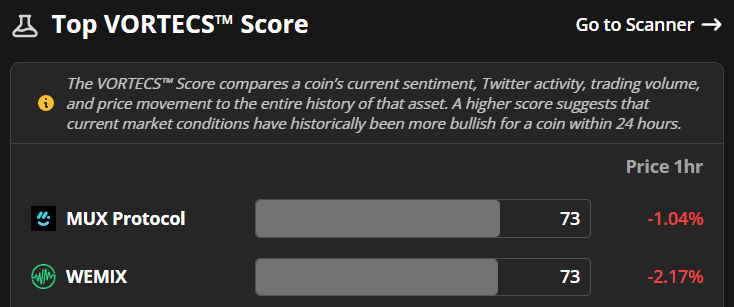

2. Top VORTECS™ Scores

The new dashboard provides more detailed information about the tokens with the top VORTECS™ Scores — a numerical value that accounts for an asset’s current sentiment, Twitter activity, trading volume and price movement compared to the entire history of that asset. A higher score suggests current market conditions have historically been more bullish for an asset in a 24-hour window.

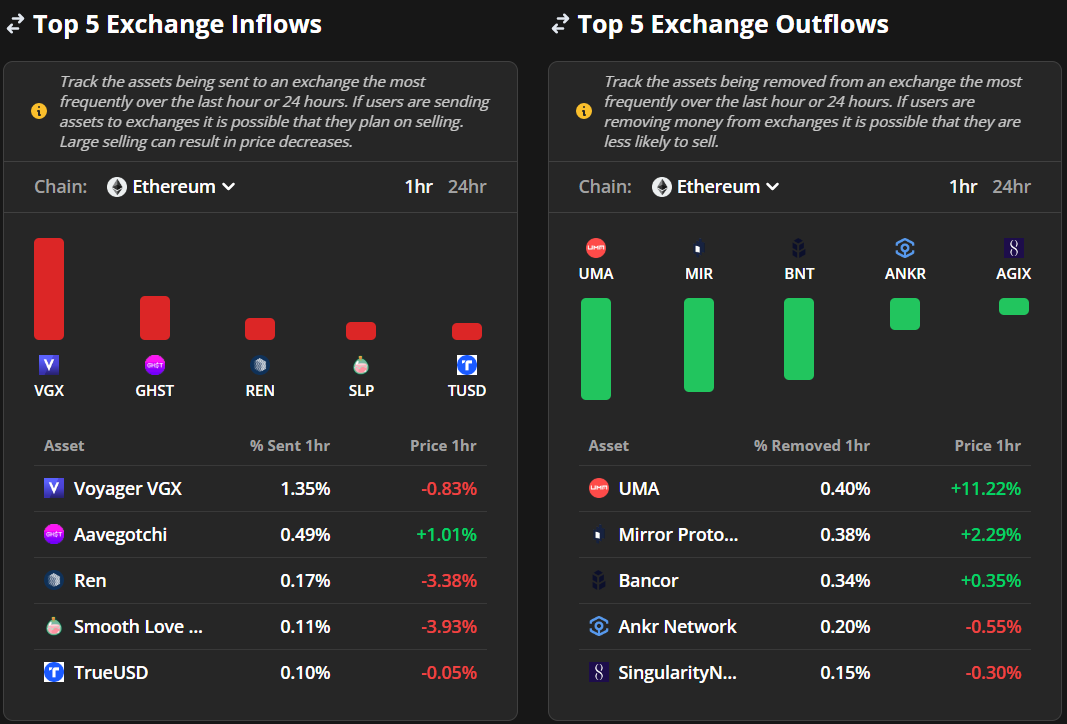

3. Top 5 Exchange Inflows and Outflows

The Top 5 Exchange Outflow section features the assets being removed from an exchange the most frequently over the last hour or 24 hours. If users are removing money from exchanges, it is possible that they are planning to HODL and are less likely to sell.

In contrast, the Top 5 Exchange Inflow section features the assets being sent to an exchange the most frequently over a period of one hour or 24 hours. If users are sending assets to exchanges, it is possible that they plan on selling; large selling can result in price decreases.

Additionally, users can also filter this information by blockchain and time frame.

4. Most Active On-Chain 24hr

The new Most Active On-Chain section shows users the five tokens with the largest increases in the number of active addresses on-chain in the last day versus a rolling average of the last 30 days.

Like the tweet and trade sections, these tokens are arranged from largest to smallest, left to right. Their price movement is also depicted at the bottom, below the number of addresses. On-chain activity is usually a bullish indication that a project is successfully being used, and users are being onboarded.

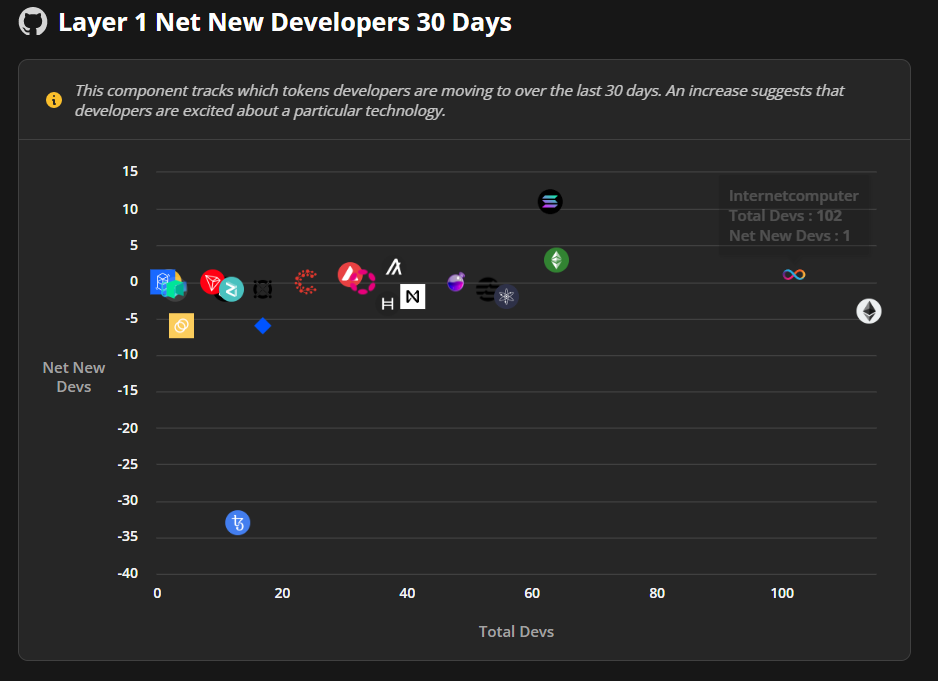

5. Net New Developers by Layer 1 Ecosystem in the last 30 days

This section shows which tokens developers are moving to over the last 30 days. An increase suggests that developers are excited about a particular technology. A layer 1 is only valuable due to the applications built on it, so more development on a layer 1 is a bullish sign long term.

The X-axis shows the total number of developers for the given chain whereas the Y-axis represents the net new developers in the last 30 days.

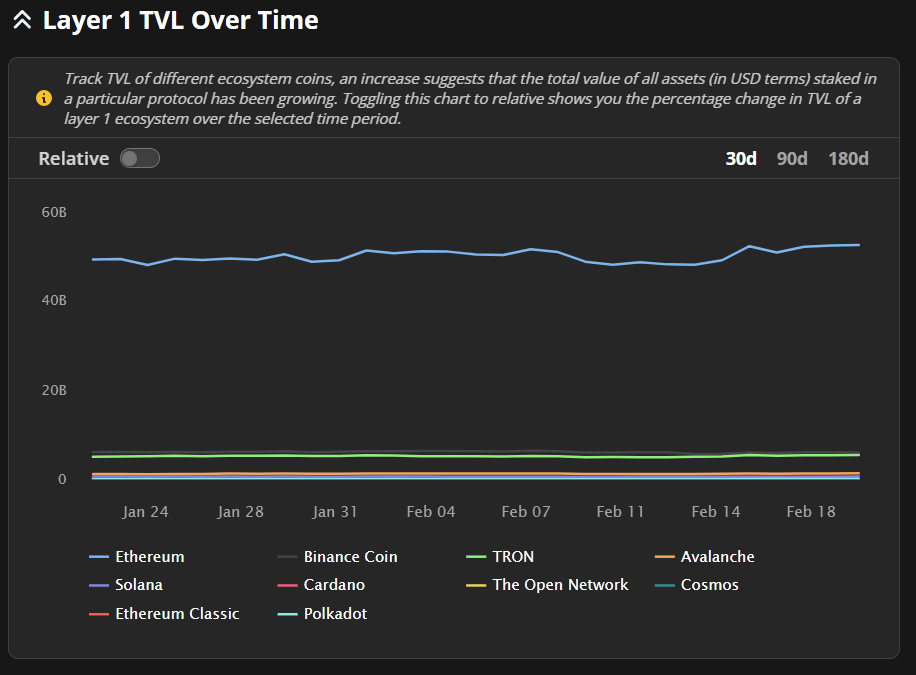

6. Total Value Locked (TVL) Gainers

This chart allows users to track the total value locked (TVL) of different ecosystem tokens. An increase can suggest that the value of all assets staked in a protocol is growing. This is typically bullish as it shows interest and commitment to a particular ecosystem.

Users can also click the “Relative” button to see the percent changes and filter by 30, 90 or 180 days. One can even hide a given blockchain by clicking its name in the drop-down below.

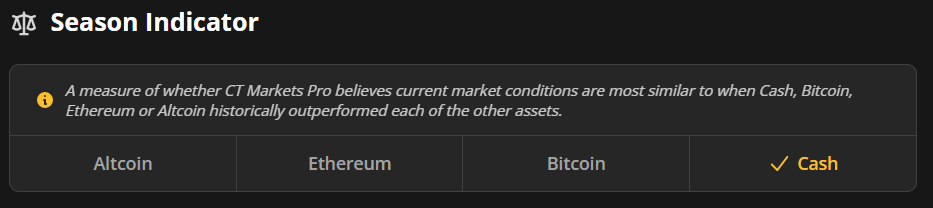

7. Season Indicator

A measure of Cointelegraph Markets Pro data that suggests which of the four asset classes — Cash, Bitcoin (BTC), Ether (ETH) or Altcoins — has historically outperformed each of the other assets in a given season. The season indicator is based on proven data and informs traders which season the market is in right now.

Join the Cointelegraph Markets Pro trading community

The latest update of Cointelegraph Markets Pro has paired institutional-grade tools with a library of information for independent analysis. Pairing individual analysis with the recommendation of institutional tools can help traders constantly locate high-probability winning trades.

The latest enhancements of the Cointelegraph Markets Pro platform are the most powerful yet. For anyone interested in confidently generating strong returns — even in a bear market — Cointelegraph Markets Pro is a platform worthy of consideration.

See how Cointelegraph Markets Pro delivers market-moving data before this information becomes public knowledge.

Cointelegraph is a publisher of financial information, not an investment adviser. We do not provide personalized or individualized investment advice. Cryptocurrencies are volatile investments and carry significant risk including the risk of permanent and total loss. Past performance is not indicative of future results. Figures and charts are correct at the time of writing or as otherwise specified. Live-tested strategies are not recommendations. Consult your financial adviser before making financial decisions.

All ROIs quoted are accurate as of February 23, 2023…