On December 29, two addresses from 2011 containing 500 bitcoin each transferred 1,000 coins for the first time in 10.5 years. Furthermore, another wallet from 2011 woke up on Wednesday, moving 40 bitcoin for the first time in over a decade.

1,040 Bitcoin from 2011 Move for the First Time in 10.5 Years

On Wednesday, an address created on July 10, 2011, at 11:22 p.m. (UTC) with 500 bitcoin (BTC) transferred the BTC for the first time in 10.5 years. Another wallet, created on the same day in 2011, dispersed another 500 BTC worth more than $23 million at the time of transfer.

Furthermore, a wallet from August 12, 2011, containing 40 BTC worth $1.8 million transferred coins for the first time in over a decade. At the time of transfer, BTC was trading for $47,500 per unit, and the aggregate 1,040 BTC from 2011 spent on Wednesday was worth over $49 million.

One can assume the 1,000 BTC stemmed from the same owner as the bitcoin wallets were both created on July 10, 2011. It’s possible the 40 BTC could have been the owner as the 40 BTC wallet was created about a month later.

There haven’t been that many 2011 bitcoin spends in December besides four previous 2011 transactions this month. Two coinbase rewards were spent on December 1 and December 14. Ten bitcoin (BTC) from a wallet created in 2011 was transferred on December 11 and 20 BTC from another wallet created in 2011, moved on the same day.

Researchers Believe Exchanges May Desire Old Bitcoin

The bitcoin wallet that sent 500 BTC sent the funds with a “moderate” level of privacy or a score of 65 according to blockchair.com’s privacy tool. Four issues were found during the send as “several indicators we were able to link the similar types of addresses involved in this transaction” including “matched addresses identified.”

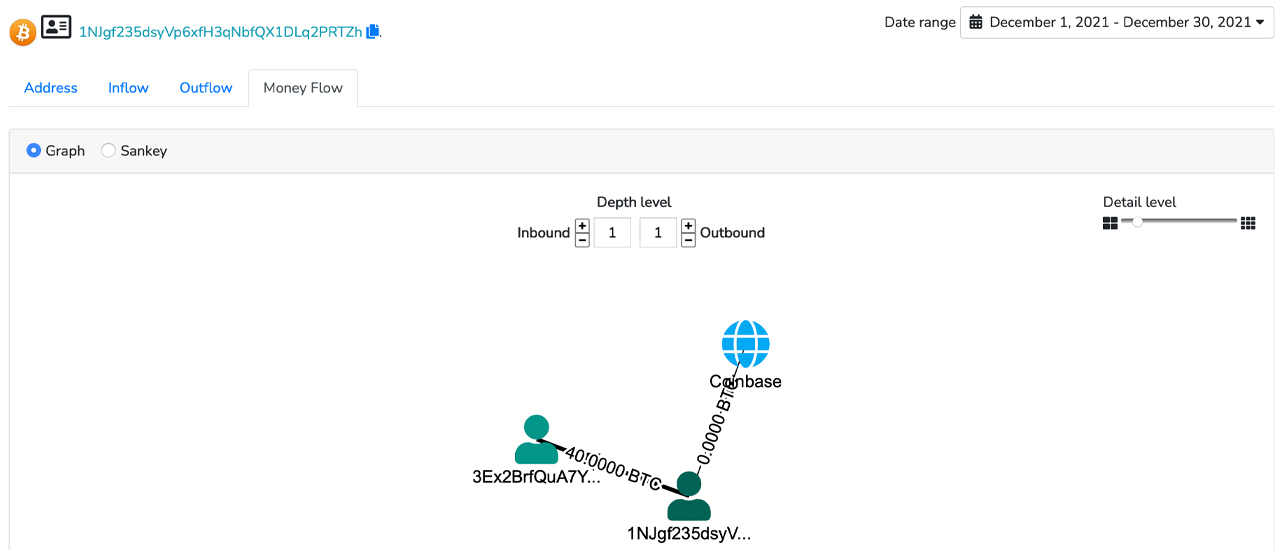

Bitquery.io data shows that one of the transfers may have been tethered to a known Coinbase address. Similarly, blockchair.com’s privacy tool gives the other 500 BTC transaction the same rating, and Bitquery.io data from that address shows money flow tied to a known Coinbase address.

When the 40 BTC was transferred the privacy was lower and had a ranking of 45 according to blockchair.com’s metrics. Just like the previous two BTC transfers from 2011, the outgoing send was tethered to matched addresses.

Bitquery.io statistics indicate that another known Coinbase address is tied to the wallet’s money flow. The 1,040 BTC sent on Wednesday follows similar patterns as many of the old coins transferred in 2021. Researchers from the Telegram channel “gfoundinsh*t” and the creator of Btcparser.com told Cryptox.trade News that the old coins may be desired by exchanges.

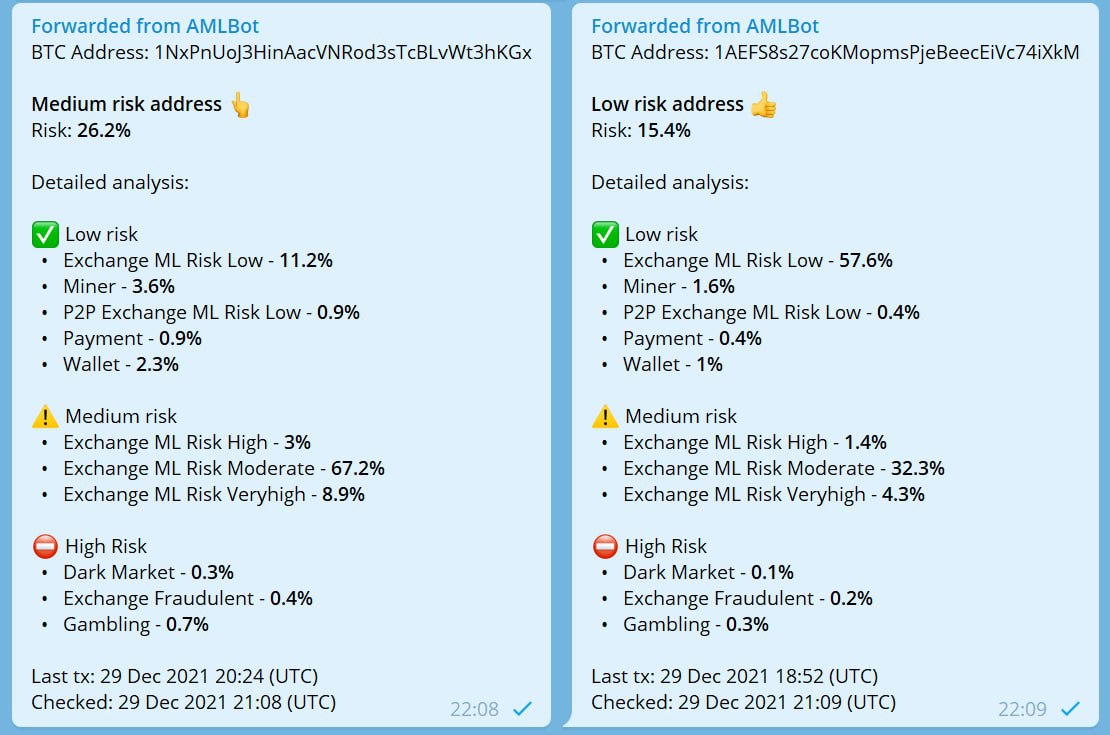

“We at (GFiS) have a theory on why some major exchanges may desire having old bitcoins,” the researchers said. “The presence of these old bitcoins may help to purify a whole pool of bitcoins that might already hold dark tones. And now if they mix it up with the white and shiny ones from 2010-2011, it will help all of them to pass through various AML and risk analysis bots.”

Statistics from amlbot.com indicate that the addresses that sent the 500 BTC had low-risk assessments. The funds from the address that sent the 40 BTC derived from an address that once contained 31,723 BTC and emptied the last of its coin on May 11, 2012, when it sent 101 BTC.

The transaction hash data that shows the 1,000 BTC sent, makes it look as though the funds derived from a miner as ten addresses sent 50 BTC to the wallet and 0.05437193 BTC was paid in fees. It’s not certain if these coins were sold on the open market or even over-the-counter (OTC), as the owner of these old school coins could have moved them to disperse them into addresses with smaller amounts of funds.

What do you think about the 1,040 bitcoin from 2011 that moved for the first time in 10.5 years on Wednesday? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Cryptox.trade does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.