China’s national digital currency is close to launch, many say the first countries to adopt this tech will have the advantage over others as regular fiat faces collapse.

Ripple CEO Brad Garlinghouse threw the cat amoungst the pidgeons a few weeks ago on FOX news by stating the fact the US is stalling and could be left behind.

Part of the opportunity that they see is, how can the dislodge the US dollar. We do have some of the leading companies here based in the united states doing things around crypto. Ripple has been a leader in this space, I think there’s an opportunity to get behind some of these efforts

Brad Garlinghouse – FOX News

Respected ECB analyst Benoit Coeure also thinks the Chinese digital asset could oust the dollar as the global reserve currency and circumvent sanctions.

So what can be done, why are US financial policy makers lagging behind so badly when it comes to something so important, and what might it mean for XRP?

Pressure has been mounting on the US FED from congressmen, tech leaders like Garlinghouse as well as policy makers and think tanks in the FED itself.

Unless the FED wishes to intentionally destroy the dollars place as global reserve currency and reset the system, they must have their own dollar backed digital asset.

We are concerned that the primacy of the U.S. Dollar could be in long-term jeopardy from wide adoption of digital fiat currencies. Internationally, the Bank for International Settlements conducted a study that found that over 40 countries around the world have currently developed or are looking into developing a digital currency. The Federal Reserve, as the central bank of the United States, has the ability & the natural role to develop a national digital currency

Congressmen Bill Foster & French Hill

Experts say the Libra white paper has also supercharged nations to prevent social media platforms and digital assets to become more powerful than whole nations.

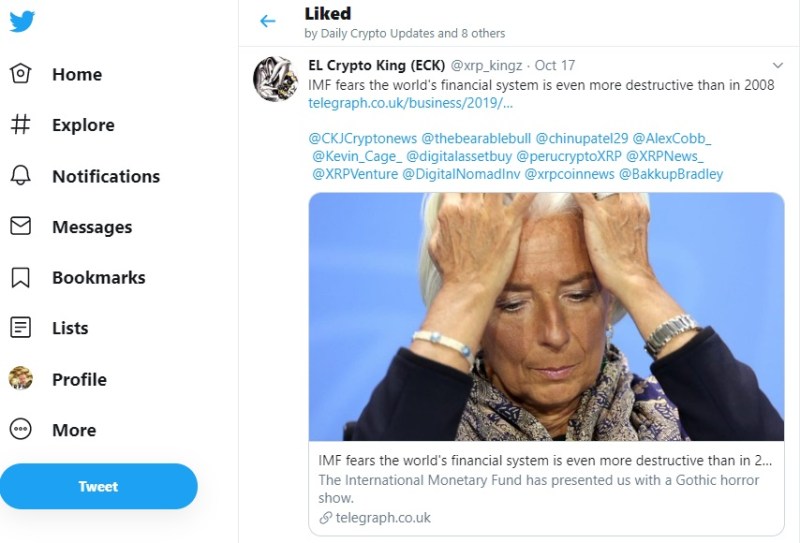

With the latest FED quantitative easing now said to be indefinite, clearly the dollar and the global markets are in serious crisis and something huge is brewing.

Out of the uncertainty one certainty arises, if the Dollar does not digitize fully like China and other countries the world famous dollar it will likely fail and collapse.

China been progressing for years with most using mobiles for payments, it’s ban on Yuan being used to buy crypto, many have found other ways to invest however.

To circumvent this people have been buying Tether which is legal in China and the buy into crypto to cirumvent the ban, perhaps China wishes to cash in on this.

Tether’s market cap has tripled since 2018, the digital asset also overtook Bitcoin as the worlds most used cryptocurrency so you can understand why…

So what about Ripple’s XRP what does all this mean for he worlds fastest and most reliable method of transferring value across the world for literally pennies?

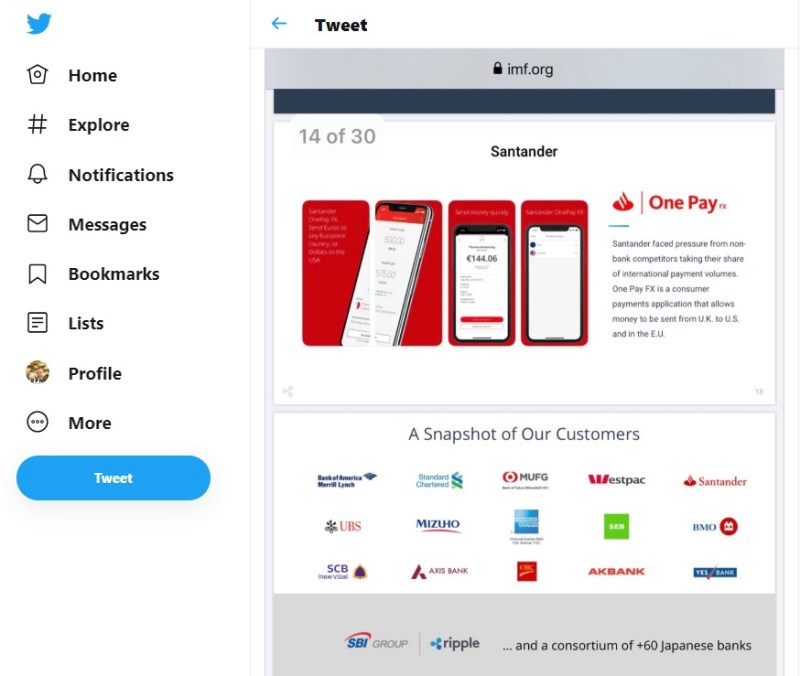

XRP was designed for this very function, whether it be fiat to currency backed digital asset payments, fiat to fiat, digital to digital, it was designed as the bridge for all.

Ripple operates on an open-source and peer-to-peer decentralized platform that allows for a seamless transfer of money in any form, whether USD, Yen, litecoin, or bitcoinThe digital currency, XRP, acts as a bridge currency to other currencies. It does not discriminate between one fiat/cryptocurrency and another, and thus, makes it easy for any currency to be exchanged for another

When people talk about XRP the standard they mean this very function, to be the standard asset token which bridges currencies globally instead of the dollar today.

When you realise the IMF has added Ripple to their list of working partnerships, one starts to wonder if XRP may be adopted as one globally recognized currency.

XRP allows payments across the world without trust but with certainty, fast and cheaper than ever imagined, when it begins this job en the world will change forever.

Read about the IMF’s thoughts on Digital tokens HERE & you can see Brad’s FOX News special below, make sure to skip right to 35 minutes to catch Brad.