Just four years ago, two lifelong friends from New Orleans turned a small initial investment into the largest crypto miner in North America.

When their company, Coinmint, bought a former Alcoa plant in upstate New York, they brought hope the new economics of cryptocurrencies would revive a region that suffered with the decline of American manufacturing.

But just as they should be preparing for the impending “halving” of bitcoin in May – an era-defining moment for the industry – the four-year-old company is now grappling with an existential threat: a lawsuit filed in a Delaware court by one of its two co-founders, who is seeking nothing less than the dissolution of the company and liquidation of its assets.

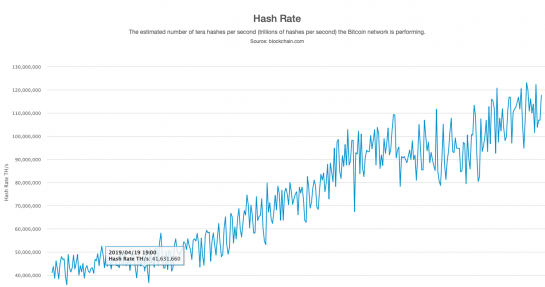

The business of mining bitcoin and other cryptocurrencies using high-speed computers is humming: Bitcoin prices are up 36 percent this year alone after nearly doubling in 2019. Mining firms are scrambling to raise capital from investors to set up large-scale data centers, upgrade equipment and expand processing power. The bitcoin network is months away from its next “halving” – a once-every-four-years occurrence that some analysts say could drive prices even higher. Before that happens, the partnership that owns Coinmint may itself be halved, along with the lifelong friendship of its co-founders.

Coinmint was started in 2016 when childhood friends Ashton Soniat and Prieur Leary each put $25,000 into the cryptocurrency prospecting firm. They would go on to develop a bitcoin mine in Massena, N.Y., that is now believed to be the largest such facility in North America; it draws some 80 megawatts of power, or the same amount used by roughly 60,000 average U.S. households.

Executives with the project have been lining up financing to install another 40 megawatts worth of capacity by May. The new production would come on line just in time for the halving, which under the terms of the bitcoin network’s original protocol will cut in half the number of bitcoins awarded to miners for helping to confirm data transactions on the blockchain. If bitcoin’s price surges, mining firms could win big. If it doesn’t, they would likely see a steep drop-off in profits.

Leary, a co-founder who until recently was Coinmint’s president, filed the dissolution suit in Delaware Chancery Court in December, claiming Soniat, who serves as CEO, unilaterally moved Coinmint’s headquarters to Puerto Rico and then shut him out of day-to-day management.

In phone interviews from his home in Miami Beach, Fla., Leary, 51, said he has put a lot of time, effort and money into Coinmint and he doesn’t want his investment at risk. He said Coinmint has received purchase offers from private equity firms at valuations above $80 million, but Soniat has thus far spurned any deal.

“I believe that it’s imprudent to risk your entire business on whether the halving is priced in or not,” Leary said.

In an email, Soniat, 50, said he is prepared to defend himself against the “spurious allegations” and that Leary’s claims are baseless. Soniat said he’s poured in almost all of the additional capital needed to fund Coinmint’s development and operations, and that Leary’s stake now amounts to just 18 percent. He contends Leary was fully aware of Coinmint’s conversion to a Puerto Rican limited liability company in 2018.

Leary’s actions are “simply another misguided attempt” to “bolster his financial standing at the expense of a company in which he owns an interest,” the statement read. “Despite the distraction of the lawsuit, Coinmint has continued to focus on, and is committed to, building a world-class cryptocurrency-mining enterprise.”

The dispute comes at a critical time for the crypto-mining industry, which has evolved in recent years from being dominated by hobbyists or small operators running one or a handful of computers in their kitchens or basements. With bitcoin and cryptocurrencies now gaining momentum, the business has become the province of big-money, institutional-scale developers, requiring wholesale electricity procurement contracts, large-scale site management and heavy capital investments in state-of-the-art data centers.

In an example of the rising costs of crypto mining, Coinmint went so far as to pay $15,000 a month last year to retain a New York-based public affairs adviser, Michael McKeon of the consulting firm Mercury. McKeon was a top communications aide and campaign adviser to former New York Governor George Pataki and also worked on former New York City Mayor Rudy Giuliani’s presidential campaign in 2008.

New bitcoin mining facilities sprouting up in Texas, Washington State, New York and some Canadian provinces are becoming so large they’ve been pitched as economic development projects to create jobs for remote communities with otherwise few opportunities. Indeed, Coinmint Chief Financial Officer Michael Maloney said in an interview the planned expansion at Massena will add about 50 jobs, in addition to the roughly 100 employees who work there now.

Yet, as with many of the projects across the nation, there’s been an accompanying backlash. Nearby residents complain of elevated electricity bills. Environmentalists warn the extra draw on power from crypto mines could lead to more emissions from fossil fuel-burning generating plants, contributing to climate change.

From Big Easy to Big Difficulty

Coinmint’s story dates back decades before bitcoin was even invented. Leary and Soniat became acquainted as teenagers living in New Orleans in the 1980s.

“We went to different schools but we were in the same circles,” Leary recalled. “We were mostly party friends. We had a group of guys that all hung around together, and he was in our group.”

Soniat pursued a career in energy trading, working for the likes of Enron, TXU Energy and Deutsche Bank before starting his own firm in 2009. Leary went into the data-center business.

When Leary called Soniat in 2016 to pitch the idea of forming a partnership to start a bitcoin mine, it seemed like a natural fit. Both men had endured acrimonious breakups in prior business ventures that ended in courtroom disputes, but the cryptocurrency venture provided new grounds for optimism.

“It made sense,” Soniat said in a phone interview from Puerto Rico. “I looked at bitcoin mining as a play on electricity.”

Following the initial $25,000 capital contribution from each of the partners, Soniat provided nearly all of the capital needed for the buildout.

“Ashton was more on the financial side,” Leary said. “I’m the guy who found the sites and made it happen.”

The first two years were good for the business, Leary said, with bitcoin prices rallying 30-fold over the course of 2016 and 2017. Soniat, who lives in Puerto Rico, donated $150,000 to the island territory’s Sacred Heart University to strengthen a scholarship program, according to a February 2017 report from the Puerto Rican business-news website News Is My Business.

That same year, the pal-partners secured a lease on 1,300 acres at a former Alcoa aluminum-smelting plant in the town of Massena in upstate New York, not far from the St. Lawrence River, opposite the eastern end of Ontario, Canada. The town has been hit hard in recent decades by factory closures. As of the most recent census estimates, Massena had an unemployment rate of some 21 percent, more than five times the current U.S. average.

But Massena boasts natural resources that are attractive to bitcoin miners like Coinmint. The regional electricity grid draws supply from nearby hydropower plants, once prized by the smelters. Another key feature is that it’s usually cold, with an average temperature of 44 degrees Fahrenheit (6.7 Celsius). The chilly clime increases the efficiency and reliability of the bitcoin-mining computers, typically running 24 hours a day, 7 days a week.

In mid-2018, Coinmint said it would invest as much as $700 million in the Massena facility, creating an estimated 150 jobs over the ensuing 18 months, CNBC reported at the time. The plant has the potential for upgrades up to 435 megawatts of crypto-mining capacity.

“That was the original plan,” Leary said, “but the plan didn’t go the way we thought it was going to go.”

Bitcoin’s price tumbled 73 percent in 2018, raising questions not just about Coinmint’s prospects but about the very future of cryptocurrencies. As the partners deliberated over next steps, the friendship became strained. Coinmint got hit with a lawsuit from a landlord in Plattsburgh, N.Y., where it was operating a separate, smaller bitcoin mine from space in a strip mall. Local residents complained their monthly utility bills were soaring because the operations were sucking up so much electricity. (Coinmint recently suspended operations in Plattsburgh, at least until March.)

In August 2018, Coinmint considered launching its own digital token to pre-sell batches of bitcoin mining processing power known as “hashrate” to buyers. Each token would be equivalent to one terahash, or a trillion computations, of bitcoin mining, according to a press release at the time. The token represented a potential new source of financing, but it has never been listed on a cryptocurrency exchange. A person close to Coinmint said none of the tokens were ever actually sold.

From Leary’s perspective, the Massena project has come to a crossroads where deeper pockets are needed to fund the next phase. He said the company is low on cash reserves, even as it needs a significant jolt of new capital to fund needed expansions and upgrades. He said many of the computers at the Massena facility are older-vintage machines that could become unprofitable following the halving.

“Bitcoin mining has become a big-money business,” Leary said. “Coinmint still has a great advantage, but if you want to compete with the Chinese, you have to partner with deep pockets or you have to have deep pockets yourself.”

Soniat loaned Coinmint more than $20 million, an obligation that until recently remained on the company’s books.

“Ashton is a trader,” Leary said. “He is more aggressive and a risk taker than me. To his credit, the company wouldn’t be where it is today without taking some risks. But we’ve reached a point where it’s too big and there’s too much risk. It’s not a fun situation for me.”

Last year, a private equity firm offered to buy a stake in Coinmint at a valuation of over $80 million; a few months later, a reduced offer valued the company closer to $60 million. In addition to the bids from private equity firms, Coinmint attracted interest from Chinese investors but Soniat didn’t want to engage.

“I kept pushing to do a deal,” Leary said. “He thought they were low-ball offers.”

By November of last year, relations between the childhood friends grew so strained that Soniat sent Leary an email saying he wasn’t sure he wanted to work with him anymore.

Leary traveled to Puerto Rico for two days to meet with Soniat, but his old buddy refused to talk with him.

Eventually, Leary’s lawyer, Ben Wolkov of the Miami-based firm AXS Law Group, recommended the dissolution petition.

“It’s a case of one partner just shutting another one out unlawfully, in our view,” Wolkov said in a phone interview. “This company’s going to have to deal with the industry waters, and the halving’s a concern, having to upgrade the equipment and the capital intensive nature of that endeavor. My client’s been left out in the dark.”

Soniat “went through the roof” when he found out the suit had been filed, and he sent out emails to Coinmint employees telling them not to talk to his partner, Leary said.

Soniat said in the phone interview he’s the majority owner of Coinmint, so decisions over a sale or new financing are his to make. He added that Leary’s description of the private equity offers is “categorically false.”

Coinmint is a private company and Soniat declined to disclose financial details, but noted: “I’ve provided the vast majority of money for the growth of the company through equity injections.”

Hashing it out – or not?

In the meantime, Coinmint is moving ahead with an expansion of the Massena plant. Maloney, the CFO, who previously worked for the crypto-focused investment firm Galaxy Digital, said in phone interviews the company recently started installing more cryptocurrency-mining computers at the facility and expects the additional capacity to be ready by the start of May, just in time for the halving.

Last month, Coinmint revisited the idea of selling hashpower. It turned to BitOoda, a crypto-focused brokerage firm based in Jersey City, N.J., to arrange a financial contract with an unnamed counterparty for “the purchase and sale of large blocks of physically-delivered bitcoin hashpower,” according to a Jan. 27 press release. Similar to commodity futures, the contracts allow mining firms to hedge against the risk of price drops while raising new financing in the short term.

Terms of the contract weren’t disclosed, but Maloney said the hashpower contracts should bring in funds to support the Massena expansion. BitOoda’s CEO, Tim Kelly, said in a phone interview he has investors lined up to buy “tens of millions of dollars” of the contracts.

“It’s difficult to get a loan from a traditional financial company like a bank,” Maloney said. “They don’t understand the nature of bitcoin.”

Leary, who wasn’t consulted on the BitOoda contract, says he really just wants a court-mediated solution to the whole affair.

“These partner-friend breakups can be the most unfortunate,” Leary said. “At the end of the day, my goal is to work this out. Hopefully he’ll read this article.”

Disclosure Read More

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.