- Chainlink’s euphoric in the third quarter took its price to an all-time high of $8.53 on Monday.

- Nevertheless, the tenth-largest cryptocurrency corrected lower by up to 19 percent from its record level.

- Now a string of technical and fundamental catalysts hints that further bearish correction is underway.

Chainlink went to its own moon this week.

The tenth-largest cryptocurrency project (Ticker: LINK) established an all-time high at $8.53 on Monday. The gains appeared out of a parabolic uptrend that kicked off on June 6, 2020. Since then, the LINK/USD exchange rate has climbed by almost 80 percent.

Chainlink's LINK topped at $8.53 as on July 13. Source: TradingView.com

Chainlink Fundamentals

A large part of Chainlink’s gains came out of a renewed interest in altcoins. As bitcoin traded in a sideways range in the last two weeks, traders started migrating part of their top coin positions into its top rivals. As a result, almost all the top-10 coins surged higher against Bitcoin.

Other reasons that allegedly boosted buying demand in the Chainlink market are its high-profile partnerships and a mere fear-of-missing-out sentiment among traders. Small upside gains, coupled with a rise in volume, led individuals to anticipate a breakout. That received further assistance from growing social media trends.

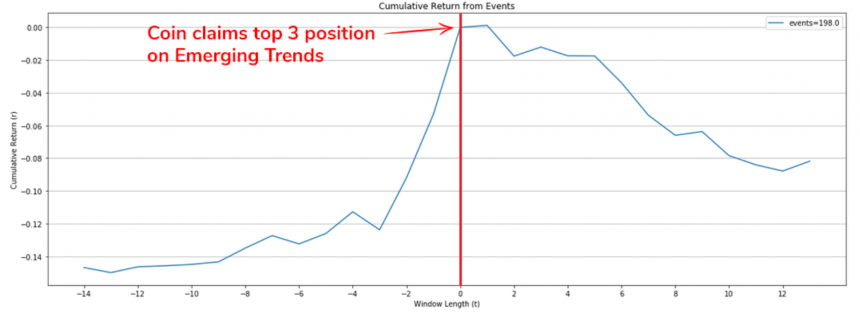

Santiment, a portal that tracks trends across the cryptocurrency sector, stated that Chainlink’s LINK token grabbed the top spot on their so-called Emerging Trends list. It stated that FOMO and FUD both played a crucial role in sending LINK to its all-time high.

“When a pumping asset like LINK went #1 on Santiment‘s Emerging Trends, it meant the mainstream became aware,” the portal tweeted Monday.

LINK FOMO may come to an end. Source: Santiment

But Santiment also warned about the drying-out phase of a cryptocurrency pump. The portal said coins that top their Emerging Trends list typically reaches a state of bullish exhaustion.

“Based on our study, once the increased crowd attention subsides (which usually happens in a matter of hours/days), a short-term price correction – or consolidation – is often a likely outcome,” Dino Ibisbegovic, head of content at Santiment, wrote in a blog post.

Further Correction Expected

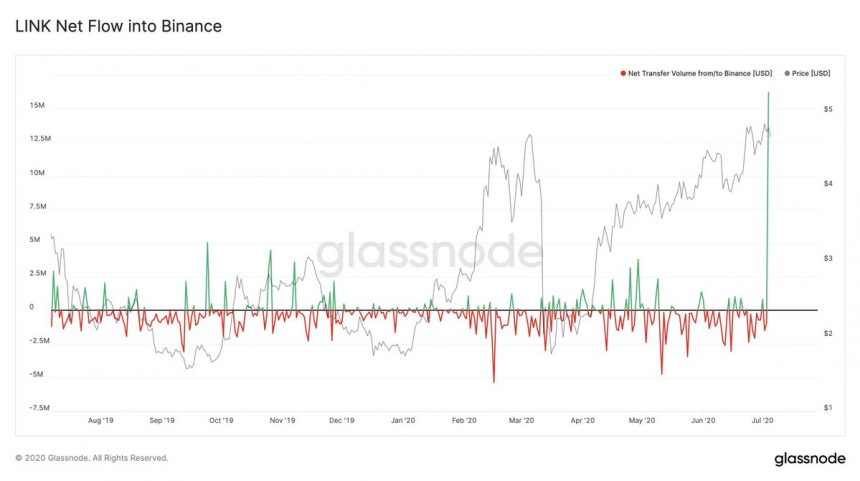

What Santiment feared has become reflective in the data provided by Glassnode. The blockchain analysis firm revealed that traders had transferred about $16 million worth of LINK tokens to different exchanges as of Monday, adding that it is the most massive LINK transfer “they have seen so far.”

Over 5,000 LINK tokens made way into the Binance wallets on Monday. Source: Glassnode

The spike points to traders’ inclination to trade the Chainlink token off for other assets – or merely sell it at its local top to secure short-term profits.

Technically, the token stands into an overbought territory that, too, hints a deeper bearish correction ahead.

Photo by Fabian Quintero on Unsplash