Bitcoin (BTC) currently sits at $6,370, a slight recovery from the March 27 pullback which saw the price drop nearly 9% in 4 hours. Despite showing some bullish signs, Bitcoin is still down nearly 30% since last Friday.

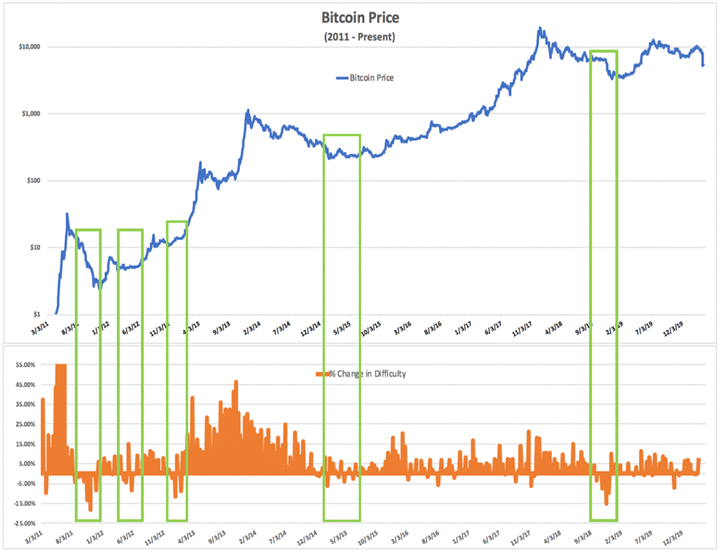

As previously reported by CryptoX, the crash may have been caused by the recent mining difficulty adjustment of nearly -16%. The difficulty adjustment is how the Bitcoin network adapts to the changing mining power on the network, keeping its issuance rate at a fairly steady level.

Cryptocurrency market performance since March 27th. Source: Coin360

The change in Bitcoin’s mining difficulty on March 26 was the biggest percentage drop the network has seen in 9 years and the adjustment makes Bitcoin production cheaper for all miners. It also aligns with previous correlations in difficulty drops and short-term losses for the price of BTC.

The recent nosedive is reminiscent of the previous price action occurring after the mining difficulty dropped by 7.10% on November 7, 2019. The price saw a 25.81% drop from $9,310.19 to $6,907.4 and this highlighted the strong correlation between the network’s hashrate and Bitcoin’s price action.

Bitcoin mining capitulation: A downward spiral

As explained in a recent report by Blockware Solutions, Bitcoin miners are one of the key players in the industry, collectively assuring the issuance of new coins and “distributing” them by selling each for fiat on exchanges. Miners are incentivized to liquidate their new coins to pay for operation costs like hosting and electricity. Every month, 54,000 BTC are mined which equals approximately $332 million at current prices.

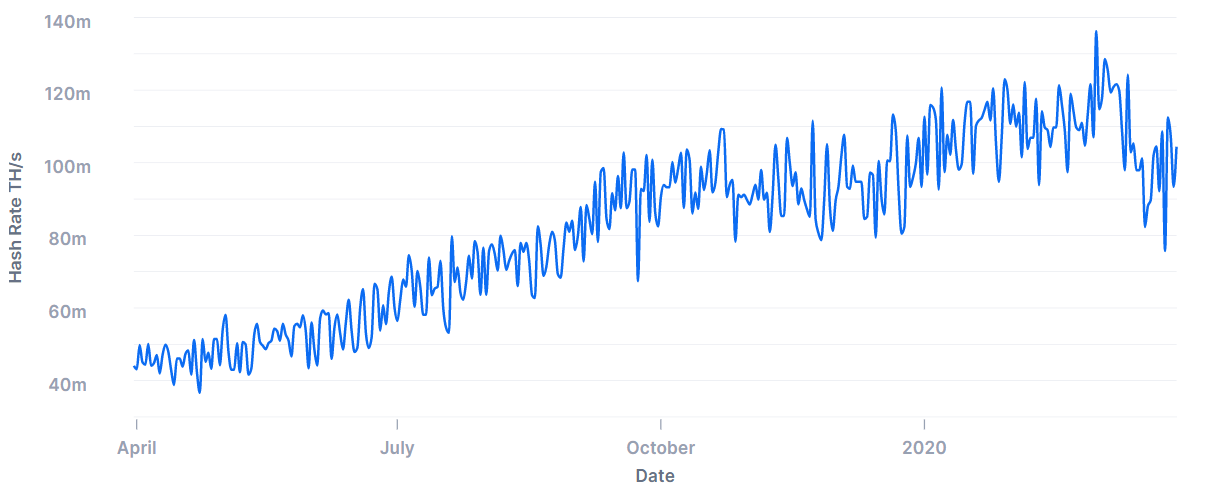

While the mining difficulty seems like the catalyst for the subsequent price move, it is rather a consequence of Bitcoin mining operations shutting down and increasing sell pressure to stay afloat. Mining difficulty is regulated by the total network hash rate, which means that if a lot of miners leave the network, then the difficulty reduces drastically.

This is exactly what happened following the price crash witnessed on March 12 when the price dropped to a 2020 low of $3,775. Mining operations with lower profit margins due to inefficient equipment or higher electricity costs were forced to halt operations as mining became unprofitable. Any Bitcoin held by the mining company may need to be liquidated, further accentuating sell pressure.

Unprofitability caused these mining operations to shut down, which in turn caused the mining difficulty to decrease. The network hashrate had been growing throughout 2020, leading to higher production costs and leaving miners unprepared for the BTC crash earlier this month.

Bitcoin network hash rate, April 19, 2019–March30, 2020, Source: blockchain.com

Survival of the fittest: Bitcoin’s recovery

This mining capitulation process doesn’t end there. As Blockware Solutions reported, companies that are better prepared and have access to additional capital and higher profit margins are able to stay on the network even with reduced profits or temporary losses.

As less experienced or poorly funded miners are faced with bankruptcy and log off the network, the difficulty adjustments allow for the ones that hold on to enjoy lower costs of production following the difficulty adjustment which takes place every 14 days.

This, in turn, allows these operations to become more profitable and to enjoy less selling pressure from other operations. Matt D’Souza explained via Twitter:

“After shutting off, Bitcoin they were receiving is allocated to the more efficient, experienced miners with excellent margins who are positioned to accumulate a larger percentage of the newly minted Bitcoin rather than having to sell it — significantly reducing sell pressure”

This means that while the short-term effects of the Bitcoin mining difficulty adjustment may be negative, they are likely to correct over time as shown in the chart below.

Bitcoin Price and mining difficulty correlation from 2011 to date. Source: Blockware Solutions

Miners and traders in the market

The selling pressure created by miners may seem like a drop in the ocean when compared to volume on exchanges. However, one must remember that falsified trading volume and wash trading practices are still commonplace in the industry. Furthermore, volume on exchanges does not equate to selling pressure given that much of it is back and forth trading rather than the actual liquidation of Bitcoin as miners selling for fiat do.

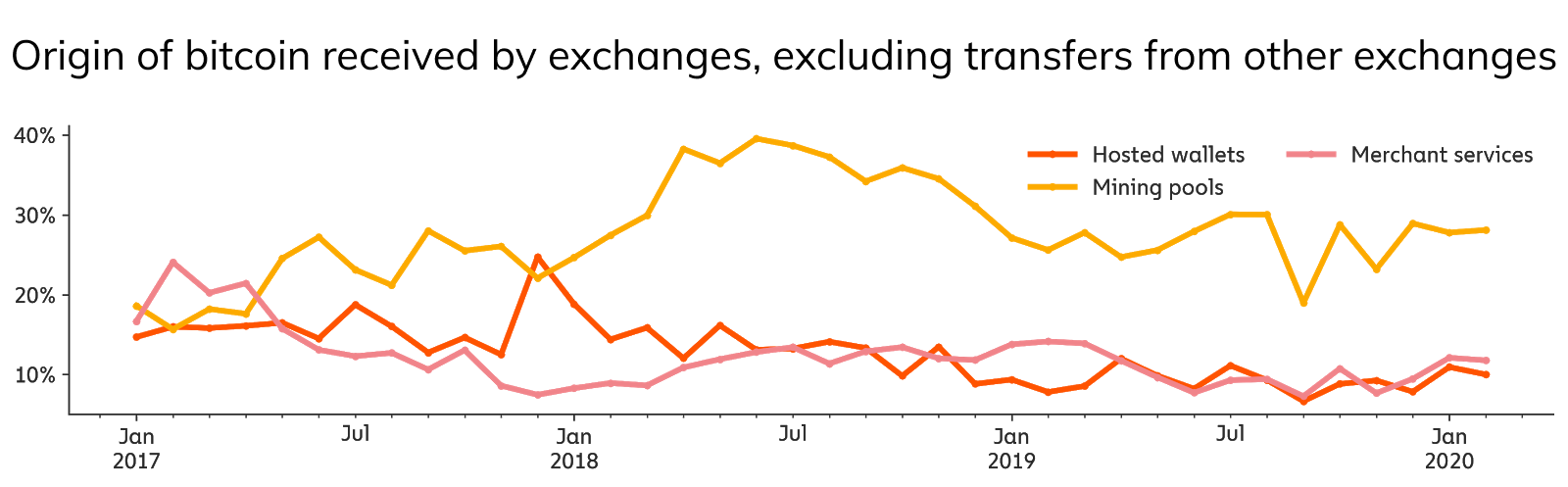

A recent report by Chainalysis shows that nearly 90% of the Bitcoin flowing into exchanges comes from other exchanges as traders leverage arbitrage opportunities and move funds between markets.

Excluding other exchanges, Mining pool operators (who are responsible for 92% of newly minted Bitcoins) have conducted 28% of the remaining on-chain transactions into exchanges since 2017. The Chainalysis report reads:

“When miners send to exchanges, they are adding new liquidity to the market. This increases the supply of Bitcoin available on the market, potentially lowering the price. Aside from Bitcoin received from other exchanges, mining pools are the most important source of Bitcoin flowing into exchanges, followed by hosted wallets and merchant services.”

Origin of Bitcoin received by exchanges, excluding transfers from other exchanges. Source: Chainalysis

The everchanging Bitcoin industry

While the information above makes a pretty good case for the correlation of the Bitcoin price and mining difficulty changes, there are many nuances that can disrupt this correlation. Take, for example, the sell pressure caused by holders in events like the Bitcoin crash earlier this month.

Moreover, miners’ behavior can also change over time as operations grow and explore other crypto-based investment opportunities like arbitrage, lending, staking and more.

As the mining industry matures, new players are likely to be drawn to mining, as is the case with Atlas Holding, a company that is leasing a New York-based power plant for a large-scale Bitcoin mining operation. When asked about industry developments that could point to a shift in these dynamics, D’Souza told CryptoX:

“If Bitcoin is further adopted in 10 years, mining will likely be more commoditized and institutionalized which will reduce volatility in the price of Bitcoin. Present commodities like gold, oil or soybeans have large, institutional suppliers while Bitcoin miners are the present suppliers.”

There’s a silver lining for miners

While Bitcoin’s crash on March 12 marked the end of some mining ventures and a giant drop in BTC’s hash rate, the network as a whole seems to be getting back to normal as difficulty adjusts downward, enabling the more efficient miners to gain more market share and thus, making the network more resilient in the long-term.

In the meantime, miners that have managed to stay afloat can mine with reduced difficulty and enjoy cheaper production costs due to reduced difficulty which will take nine more days to adjust to the hashrate growth. This may be short-lived as the upcoming Bitcoin halving will see production cut in half and may change the mining landscape going forward.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of CryptoX. Every investment and trading move involves risk. You should conduct your own research when making a decision.