Optimism price plunged to a 14-day low of $2.90 on Jan. 8, marking a 30% decline from the $4.18 all-time high recorded on Dec. 27.

The rapid price decline came on the back of $2.45 million LONG Optimism (OP) futures contracts liquidations within a frenetic 24-hours. Derivative market data trends provide key insights into how dramatic shifts in Optimism futures trading could impact OP spot price action in the days ahead.

Why is Optimism’s price down?

Optimism price reached an all-time high of $4.18 on Dec. 27 as Ethereum Layer-2 scaling protocols recorded groundbreaking network-usage milestones. But at the turn of the year, the altcoin market rally slowed, and OP holders began to book profits.

Remarkably, OP price tumbled below the $3 mark in the early hours of Jan. 8, triggering millions of losses in the derivatives markets. The latest OP price downswing brings it to a 30% decline from the $4.18 all-time high recorded on Dec. 27.

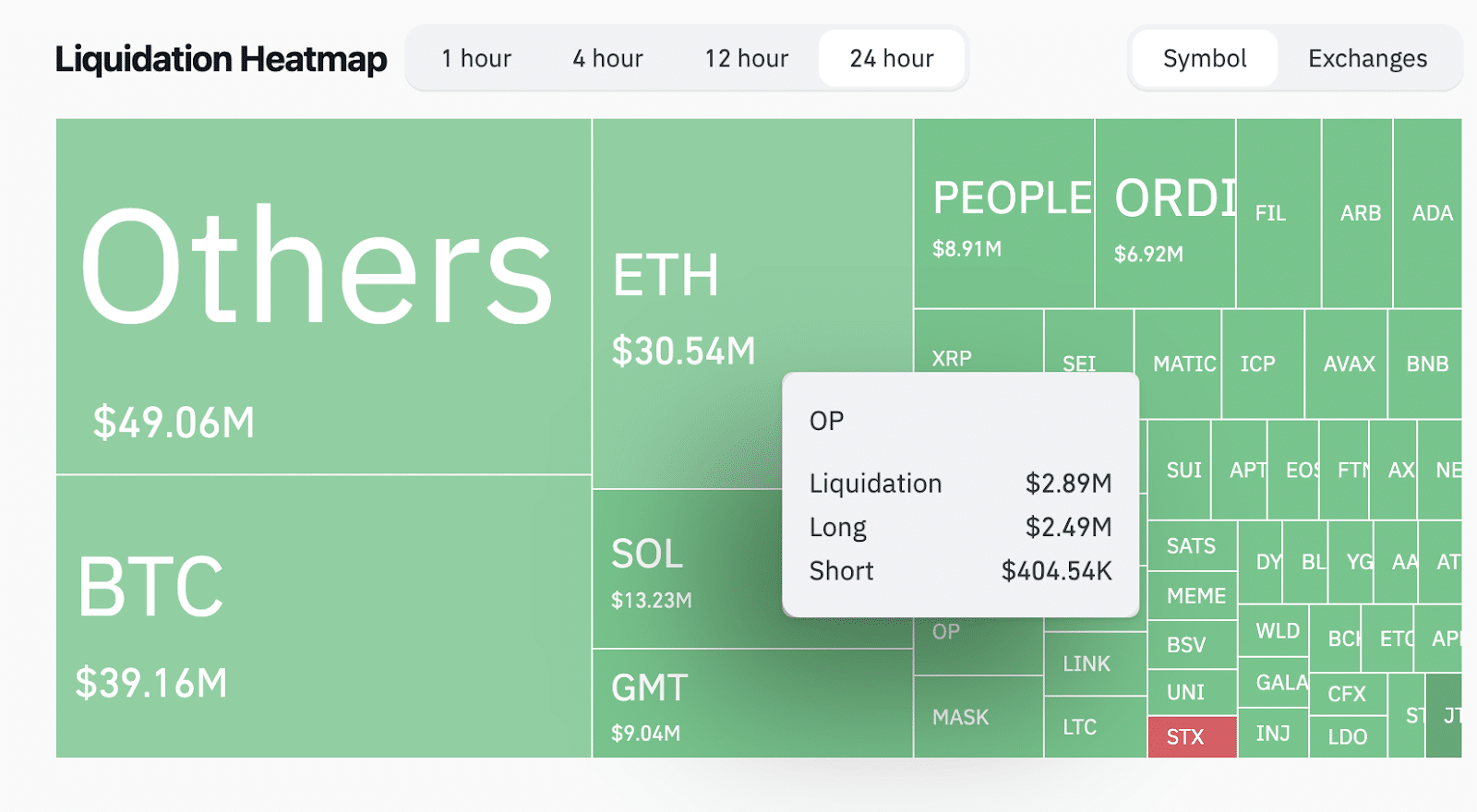

Optimism’s recent price downtrend appears to have caught bullish futures traders unaware. Indicatively, the price downswing on Monday was heralded by widespread liquidations in the derivative markets. The Coinglass’ Liquidation Heatmap chart shows that OP’s negative price action on Jan. 8 wiped out over $2.8 million of futures contracts.

A liquidation event occurs when adverse price movements force speculative traders to close due to insufficient margin cover. The Liquidation data heatmap from Coinglass shows a real-time snapshot of the dominant direction of losses.

The green bars above show LONG traders suffered a disproportionately high incidence of daily losses compared to bears. Notably, by midday Eastern Time on Jan. 8, the Optimism bulls bore 86% of the heat, with $2.49 million OP LONG positions erased.

Optimism open interest has shrunk in 12 Days

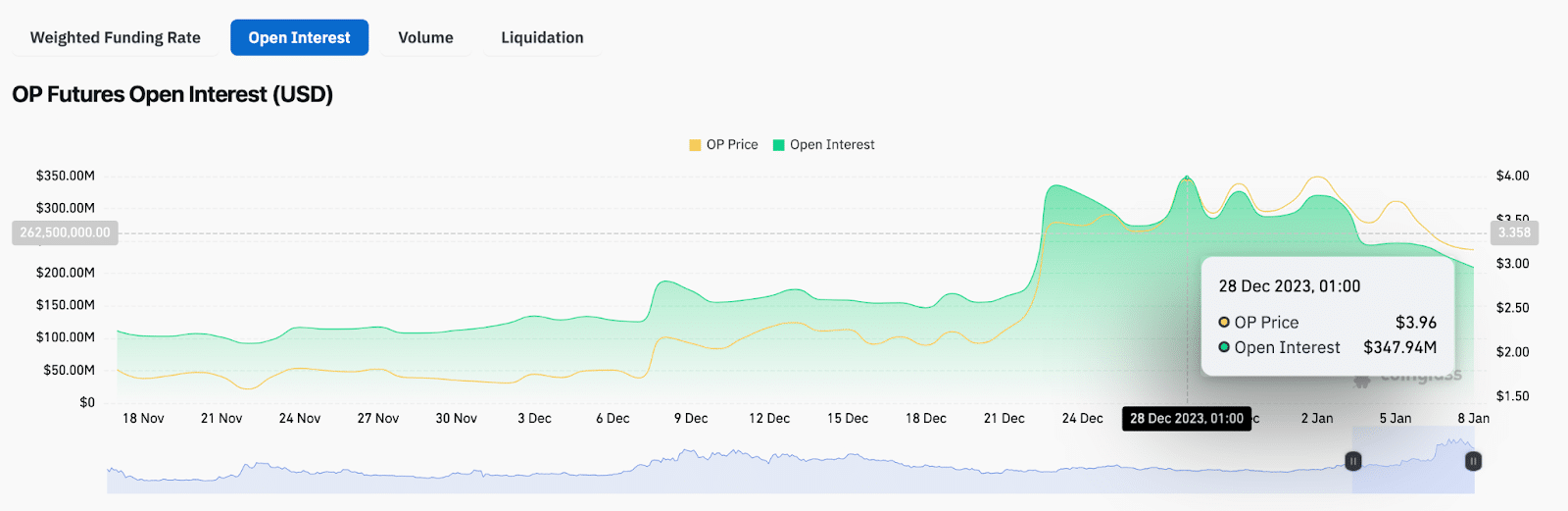

The rising spate of Optimism open interest relative to spot prices in the last 12 days is another critical market indicator highlighting the growing bearish pressure on OP. Since Dec. 27, Optimism open interest (OI) has plummeted 10% faster than price, signaling a wave of voluntary exits as market momentum flips bearish.

As illustrated below, Optimism open interest has declined 40% from $347.9 million to $209 million between Dec. 27 and Jan. 8. Comparatively, OP spot prices have only declined 30% from $4.11 to a local bottom of $2.90.

Open interest quantifies the total capital invested in active derivatives contracts for a specific crypto asset. Strategic investors consider it a bearish signal when open interest for an asset shrinks. It indicates that more capital flows out of the markets, than investors bringing fresh funds.

The current market dynamics illustrate a 30% drop in OP price since rejecting from the market top on Dec. 27. But on a more concerning note, capital stock in the Optimism futures contracts have shrunk 10% faster.

The $2.4 million spike in OP LONG liquidations on Jan. 8 indicates forced selling, where traders are compelled to exit their long positions due to adverse price movements. Additionally, open interest declining faster than Optimism price implies that not only are traders voluntarily closing positions, but also an accelerated liquidation effect.

This bearish alignment suggests further price downside, potentially driven by margin calls and stop-loss triggers.

OP Price Forecast: Can the $3 Support Hold?

Based on the current market data trends, OP price looks set for a retest of the $2.50 territory. But to fully capitalize on the growing negative momentum, the bears must first break down the psychological support level at $3.

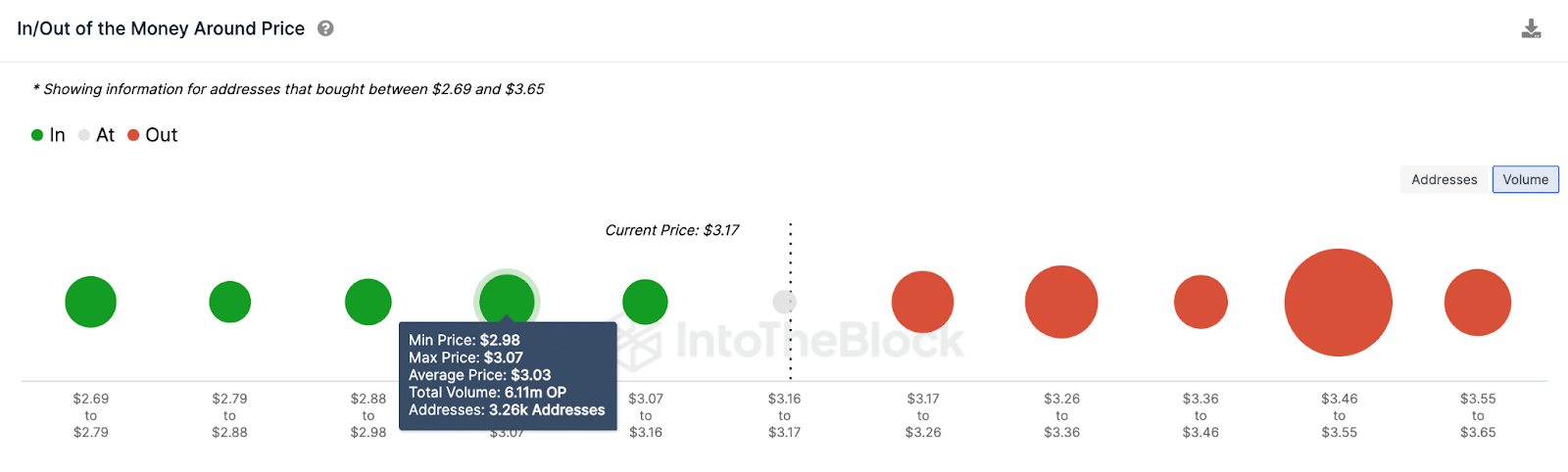

IntoTheBlock’s In/Out of the Money Around price (IOMAP) data uses current OP holders’ historical entry prices to outline key support and resistance zones. It shows that the bears could face significant pushback in the $3 area.

As seen below, 3,260 addresses had acquired 6.1 million OP tokens at an average price of $3.03. If this significant cluster of investors makes short-covering purchases to defend their positions, OP price could rebound.

However, a detour below $3 could set off another wave of margin calls and stop-loss triggers. As predicted, this bearish scenario will likely open the doors to a $2.50 OP price retest.

On the upside, the bulls could regain control of the market of Optimism price reclaims $4. But in that case, the 7,800 addresses acquired 44.3 million OP at the average price of $3.50. If investors choose to book early profits, OP price will retrace again.

However, a positive spot Bitcoin ETF could spread bullish headwinds to the altcoin markets. If this scenario, OP bulls could gain sufficient momentum to breach that $3.50 resistance sell-wall.