In an analysis released to his 280,000 followers on X, the renowned crypto analyst known as Cold Blooded Shiller (@ColdBloodShill) provided an in-depth look at the current state of Bitcoin amidst a volatile market environment. His commentary, titled “Ultimate BTC Simple Bias Guide,” unpacks the recent emotional reactions triggered by Bitcoin’s price movements and offers a strategic framework for interpreting these changes.

Buy Or Sell Bitcoin Now?

On Friday, the Bitcoin price plummeted from $71,900 to $68,500. This decline coincided with the release of the US Employment Situation Summary Report, a piece of economic data that typically influences market sentiments across various asset classes, including cryptocurrencies. “It’s very easy to forget that it was simply one red candle on Friday that caused a huge reaction in the emotion of the discussion on Twitter,” Shiller writes, emphasizing the often exaggerated emotional response to single events in the crypto markets.

Cold Blooded Shiller’s technical examination of Bitcoin reveals a strong underlying uptrend, despite recent price volatility. However, he identifies critical resistance and support levels that are pivotal to understanding the future movements of Bitcoin’s price.

Related Reading

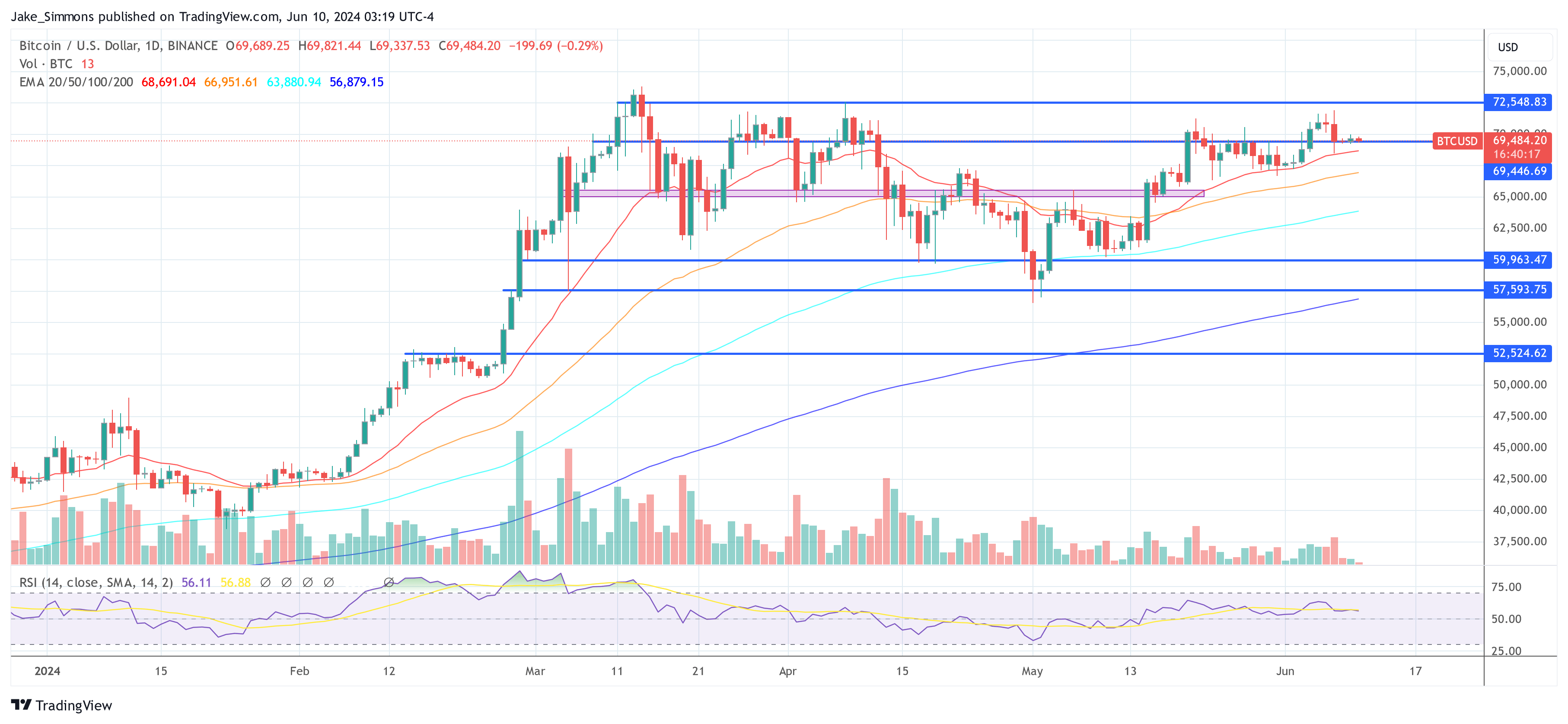

The $72,000 price level stands as a major resistance, having thwarted Bitcoin’s upward movement five times, including the most recent rejection last Friday. Shiller elaborates, “We have resistance of the range at $72k,” indicating that a breakout above this level could potentially lead to significant bullish momentum.

Conversely, the support levels at $67,000 and subsequently at $61,000 are described as crucial for maintaining the bullish scenario. Shiller warns, “BTC needs to hold the uptrend, if we lose $67k, we’re once again going to be in a downtrend with this being confirmed as a LH [Lower High] and therefore negative market conditions continuing.” The further loss of $61,000 could, according to him, signal the end of the current bullish cycle, with implications that could extend to a broader weekly downtrend.

Analyzing the broader market dynamics, Shiller points out the absence of high time frame (HTF) bearish divergences on the Relative Strength Index (RSI), a common indicator used to predict potential market reversals. “As a positive, there are no HTF bear divs, which have typically been a strong signal for cycle tops. We’re clean on RSI,” he notes. This observation suggests that despite the testing of critical resistance levels, the market might not yet be at a cyclical peak, providing some reassurance to investors concerned about potential downturns.

Related Reading

Shiller’s guidance for traders is to maintain a watchful eye on the key price levels that will dictate Bitcoin’s short-term market direction. “The Daily needs to make a fresh high and break $72k; otherwise, it’s at risk of losing the Daily trend below $67k,” he advises, highlighting the importance of these thresholds in shaping market sentiment and trading strategies. This advice suggests that while the broader trend may still support a bullish stance, readiness to pivot based on key technical indicators is crucial.

In light of these observations, Shiller advises his followers to use these insights to strategically manage their investment portfolios. The current market conditions, characterized by attempts to break resistance at $72,000 and support holding at key lower levels, imply a tactical approach to investment decisions. Traders and investors are advised to set clear markers for adjusting their positions, preparing for potential shifts in market dynamics that could influence their investment outcomes.

At press time, BTC traded at $69,484.

Featured image created with DALL·E, chart from TradingView.com