Bitcoin (BTC) has room to drop below $25,000 to flush out a recent influx of speculators, research shows.

In the latest edition of its weekly newsletter, “The Week On-Chain,” analytics firm Glassnode flagged the ongoing influence of “short-term holders” (STHs) on BTC price action.

Profitability reset point lies below $25,000

BTC/USD has struggled to overcome $30,000 resistance in recent weeks, and multiple fakeouts have frustrated Bitcoin bulls.

In its latest investigation into on-chain activity, Glassnode revealed that market newcomers may be responsible — speculative behavior, including profit-taking, has become prevalent in 2023.

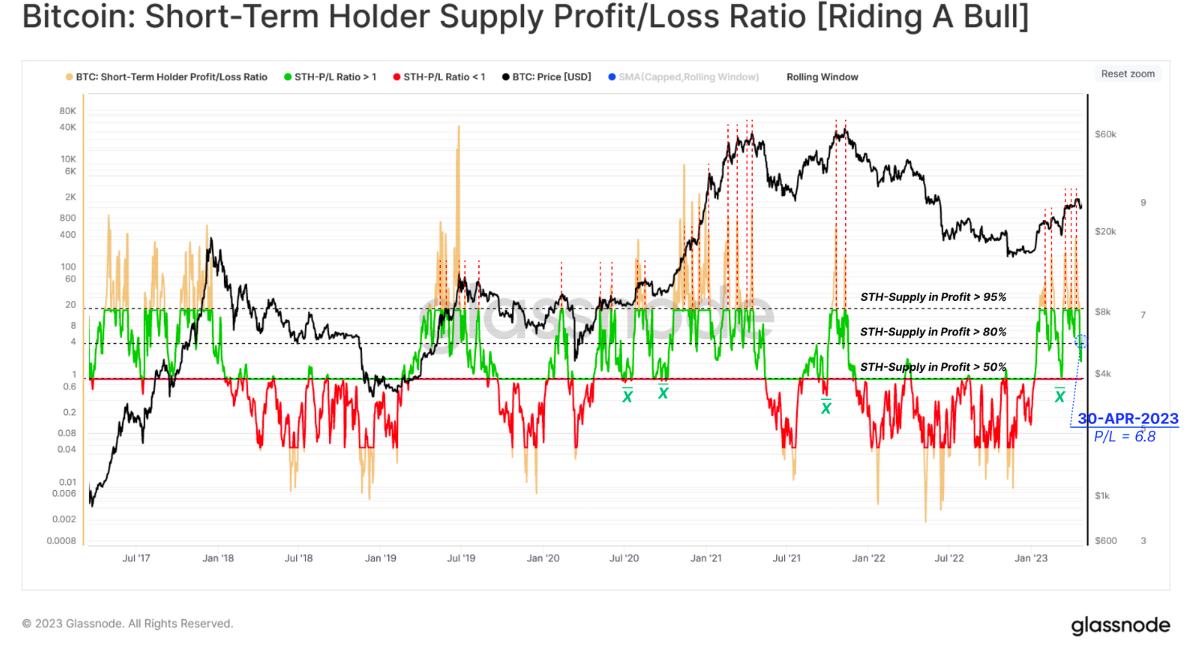

Among the metrics contributing evidence is market value to realized value (MVRV), which tracks spot price and the on-chain cost basis of specific investor segments. STH-MVRV reflects the relationship as it impacts STHs, defined as those hodling Bitcoin for 155 days or less.

“The weekly average of this indicator, helps to identify the possibility of short-term corrections, typically seen when STH-MVRV is above 1.2, signalling a 20% unrealized profit. Macro tops tend to see even higher values, often above 1.4,” it explained.

At its latest local peak in mid-March, STH-MVRV hit 1.37 — conspicuously close to “macro top” territory and the highest score since October 2021, just before BTC/USD hit its current all-time highs of $69,000.

As of May 2, however, STH-MVRV measured 1.15 and is falling toward its 1.0 point of equilibrium, where the spot price matches the cost basis.

For that to complete, however, BTC/USD would need to fall to $24,400.

“Recent resistance was found at the $30k level, corresponding with STH-MVRV hitting 1.33, and putting new investors at an average 33% profit,” Glassnode continued.

“Should a deeper market correction develop, a price of $24.4K level would bring a STH-MVRV back to a break-even value of 1.0, which has shown to be a point of support in up-trending markets.”

Backing up STH-MVRV is a similar trend in the ratio of short-term holder unrealized profit versus loss. This, too, favors $24,400 as a bullish inflection point.

BTC supply rejuvenates

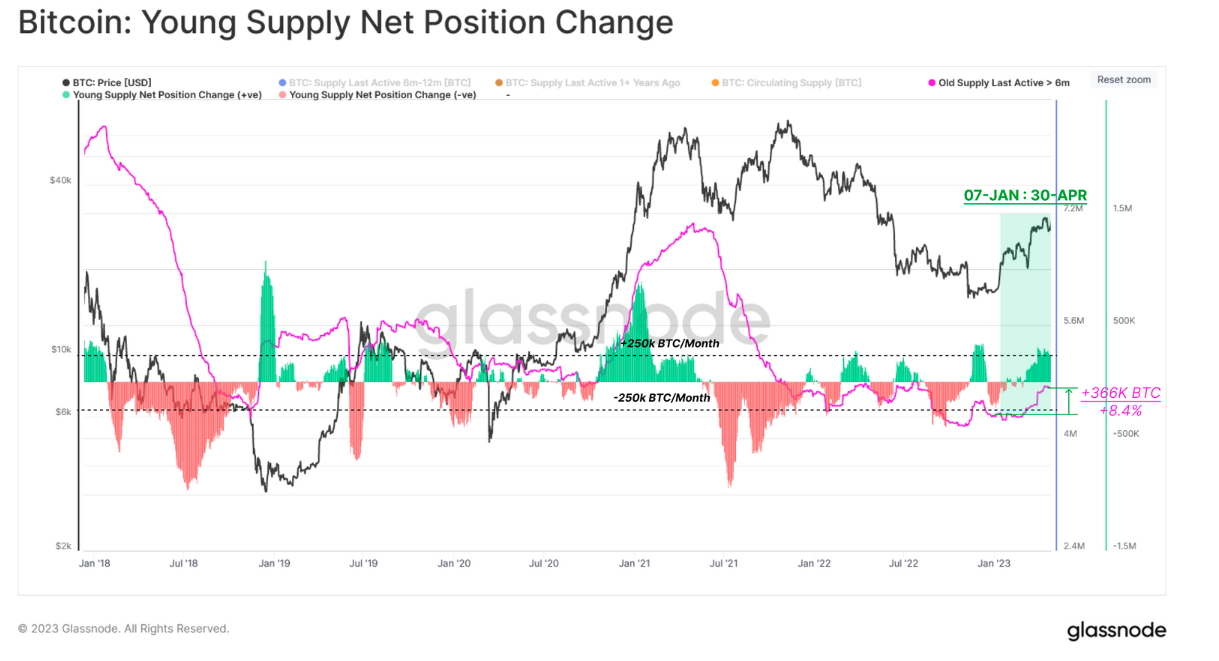

In 2023, however, it is not only short-term speculators engaging in opportunistic profiteering. Long-term holders (LTHs) have been selling into rallies, Glassnode said, unloading BTC supply onto those new market entrants.

Related: Bitcoin price sweeps lows, but analysis still predicts a $25K dive

This has increased the overall share of BTC classed as “young supply,” or that active at most six months prior.

“The rising share of younger supply during a rally is an indication of capital flowing into the market,” Glassnode stated.

“This also signals that Old Supply (> 6-months) is spending, often taking advantage of this demand liquidity, leading to a net transfer of cheap/old coins to new buyers at higher prices.”

Year-to-date, young supply has increased by 8.4%, or 366,000 BTC.

Overall, “The Week On-Chain” summarized that LTHs remain in control of the supply, with net new entries “relatively soft.”

Magazine: Whatever happened to EOS? Community shoots for unlikely comeback

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.