Eurekahedge’s index of crypto hedge funds have clocked 21.15% returns since the start of 2020 and this is the best performance from the firm since the index started in 2013. Even in 2017, which was the blockbuster year for cryptocurrencies, the January returns were a modest 4.85%. If the crypto hedge funds maintain their stellar performance this year, they are likely to attract further investments in this space.

Coinbase is now a Visa principal member, the first crypto pure-play company to receive the membership. This will help the company to offer more features and services to its customers of Coinbase cards that are available in 20 markets. Coinbase believes that this step would be “another significant milestone in the mainstream adoption of crypto as a genuine utility.”

Daily cryptocurrency market performance. Source: Coin360

After the recent dip, most major cryptocurrencies are attempting to resume their up move, with a couple close to new lifetime highs. This shows that the sentiment remains bullish and traders are willing to buy the dips. After every rise, expectations of a similar rally to the one seen in 2017 dominates the limelight.

Though anything is possible in crypto markets, it would be better to see a gradual rise to new highs, instead of the vertical rally, which is unsustainable. Let’s analyze the charts to see if there are any patterns pointing to a parabolic move.

BTC/USD

Though Bitcoin (BTC) dipped below the 20-day EMA on Feb. 17, the bears could not sustain the price below it. This shows that the bulls continue to buy the dips. The failure to drag prices lower has attracted buying and some short-covering by the aggressive bears.

BTC USD daily chart. Source: Tradingview

Currently, the price is back above $10,000 and the bulls are likely to attempt a breakout of the overhead resistance at $10,360.89.

If the BTC/USD pair can sustain above $10,360.89, it can move up to the long-term downtrend line at $11,400, which is likely to act as a stiff resistance. A break above this line will be a huge positive that can open the doors for a rally to $13,973.50.

However, if the bulls fail to push the price above 10,360.89, the pair might remain range-bound for a few days. It will turn negative on a break below the recent low of $9,456.78. Therefore, traders can trail their stop loss on the remaining long positions to $9,400.

ETH/USD

Ether (ETH) rebounded sharply from the critical support at $235.70, which shows that bulls bought the dips aggressively. If the momentum can carry the price above the recent high of $288.599, the uptrend is likely to resume. Above this level, the next target objective is $318 and above it $366.

ETH USD daily chart. Source: Tradingview

Contrary to our assumption, if the price turns down from $288.599, the ETH/USD pair will remain range-bound for a few days.

The pair will signal a deeper correction if the bears sink the price below $235.70. Therefore, the traders can trail the stops on the remaining long positions to $230. The stops can be moved up once again after the price sustains above $288.599.

XRP/USD

XRP has bounced off the support at $0.26362 but it is struggling to pick up momentum. The bears are likely to offer a stiff resistance at $0.31503. If the price turns down from this level, the altcoin is likely to remain range-bound for a few days.

XRP USD daily chart. Source: Tradingview

However, if the bulls can push the price above $0.31503, the XRP/USD pair can move up to $0.34229 and above it to $0.40.

Our view will be invalidated if the price turns down from the current levels or the overhead resistance and plummets below $0.26362. Therefore, the traders can protect their long positions with stops at $0.26.

BCH/USD

Bitcoin Cash (BCH) is currently facing resistance at the trendline of the ascending channel. If the bulls can push the price back into the channel, it will be a huge positive and will signal that the current breakdown was a bear trap.

BCH USD daily chart. Source: Tradingview

Once inside the channel, the bulls will again try to carry the price to $500. If the bulls can push the price above the $500-$515.35 resistance zone, a move to $600 is possible.

Conversely, if the price turns down from the trendline of the channel, the BCH/USD pair might remain range-bound for a few days. The flat 20-day EMA and the RSI close to the midpoint suggests a consolidation for the next few days. A break below $360 will turn the tables in favor of the bears.

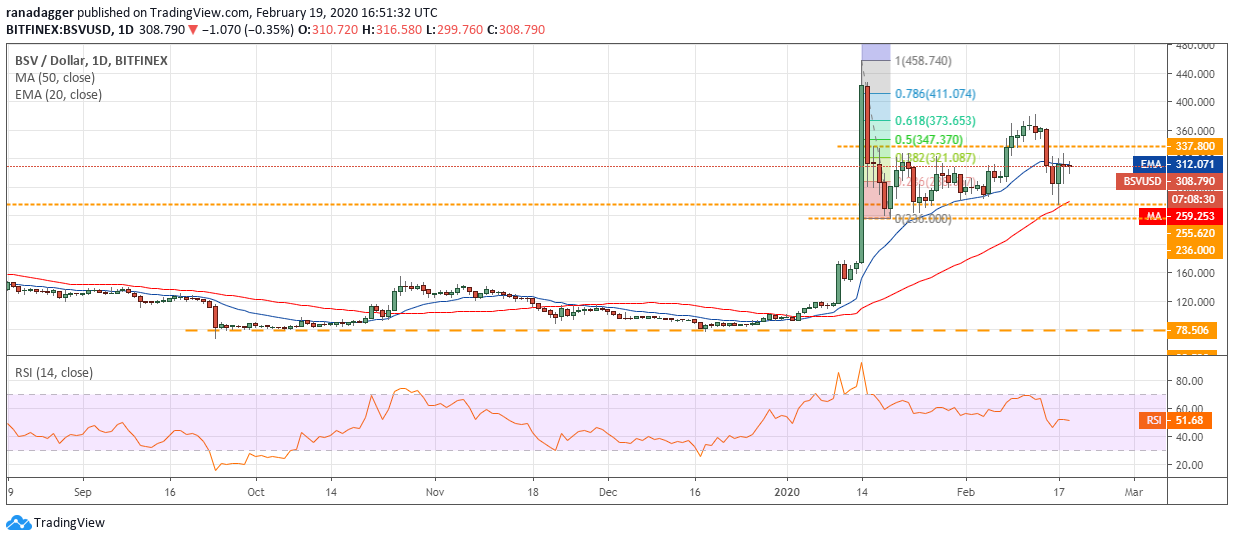

BSV/USD

The bulls are struggling to push the price above the 20-day EMA. This shows a lack of buyers at higher levels. Above the 20-day EMA, the bulls might again face resistance at $337.80. If the price turns down from this level, Bitcoin SV (BSV) might remain range-bound for the next few days.

BSV USD daily chart. Source: Tradingview

A break above $337.80 will be the first sign that bulls are back in action. If the buyers can propel the BSV/USD pair above $382.47, a retest of the lifetime highs will be on the cards. However, if the bears sink the price below $236, the pair will turn negative and can drop to $173.66.

LTC/USD

Litecoin (LTC) has risen close to the overhead resistance at $80.2731. We anticipate the bears to defend the $80.2731 to $84.3374 zone aggressively. However, if the bulls can scale above this zone, a rally to $100 is possible.

LTC USD daily chart. Source: Tradingview

Conversely, if the bulls fail to push the price above the overhead resistance zone, the LTC/USD pair might consolidate between $80.2731 and $66.1486 for the next few days. The pair will turn negative if the price dips below the critical support at $66.1486.

EOS/USD

The bulls are struggling to push the price above the 20-day EMA at $4.6. This shows a lack of buyers at higher levels. If the price turns down from the current levels, EOS might remain range-bound between $4.6 and $4.

EOS USD daily chart. Source: Tradingview

However, if the bulls push the price above the 20-day EMA, the EOS/USD pair can move up to $4.8719 and above it to $5.4861. Above this resistance, the next level to watch out for is $6.

On the other hand, if the bears sink the price below the critical support at $4 and the 50-day SMA at $3.88, the pair will turn negative.

BNB/USD

Binance Coin (BNB) bounced off the breakout level at $21.8 and the bulls have pushed the price above $23.5213. If the altcoin can move above $27.1905, it is likely to move up to $31.4889, which is the target objective of the breakout from the rounding bottom pattern.

BNB USD daily chart. Source: Tradingview

However, if the bulls fail to propel the price above $27.1905, the BNB/USD pair might remain range-bound for a few days.

The pair will turn negative on a break below the recent low at $21.5510. Therefore, the traders can protect their long positions with stops at $21.

XTZ/USD

The dip to $2.752, which was just below the 38.2% Fibonacci retracement level of $2.7809234 was purchased aggressively. This has pushed Tezos (XTZ) to a new high once again, which is a huge positive.

XTZ USD daily chart. Source: Tradingview

The next level to watch out for is the psychological resistance at $4. If this level is crossed, the up move can reach $4.8007036. Both moving averages are sloping up and the RSI is in the overbought zone, which suggests that the bulls are firmly in command.

However, if the bears defend the resistance at $4, the XTZ/USD pair might consolidate for a few days. As the rally is vertical, the traders should be careful before taking fresh positions and should keep a close stop loss.

LINK/USD

Chainlink (LINK) has risen to the tenth spot on market cap standings, hence, it has been included in our analysis. The altcoin has resumed its up move after the recent dip and is close to making a new lifetime high.

LINK USD daily chart. Source: Tradingview

If the bulls can scale and sustain the price above $4.8671, the LINK/USD pair can move up to $5.6934. The upsloping moving averages and the RSI in the positive territory suggest that the bulls are in command.

Our view will be invalidated if the price reverses direction and plummets below the 20-day EMA at $3.77.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of CryptoX. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Market data is provided by HitBTC exchange.