- Bitcoin plunged back towards $9,000 despite showing signs of upside correction in the early Friday session.

- The latest price correction coincided with the Federal Reserve’s balance sheet contraction that strengthened the US dollar.

- S&P 500 remained closed on Friday for the Independence Day holiday.

The past 24 hours saw Bitcoin breaking its short-term positive correlation with the S&P 500.

The benchmark cryptocurrency plunged to $9,068, down 2.44 percent from its weekly top established during the Thursday trading session. Its latest decline partially came because of high profit-taking sentiment near the local high. Meanwhile, the downside also took cues from a stronger US dollar.

Bitcoin and US Dollar Correlation

According to data fetched by TradingView.com, the US dollar index is on a two-day winning spree. It has climbed 0.56 percent from its weekly low. Meanwhile, the index’s rise almost coincides with the fall in the Bitcoin price.

Bitcoin's latest plunge surfaced as the US dollar rose against a basket of foreign currencies. Source: TradingView.com

Demand for the US dollar rose as the California, Texas, and Florida reported a daily resurgence in COVID cases by tens of thousands. Investors preferred to move back into the greenback, fearing extended lockdown periods and a potential fall in the US stock market.

Nevertheless, the S&P 500 offset those concerns and closed Thursday 0.45 percent higher. The benchmark index rose on optimistic jobs report by the Department of Labor. It showed that the unemployment rate from 13. percent in May to 11.1 percent in June.

Fed’s Balance Sheet

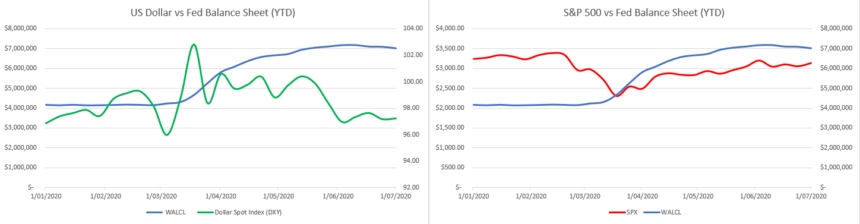

Despite its rise, the S&P 500 risks falling back on a multitude of macroeconomic concerns. The most important among them all is the Federal Reserve’s contracting balance sheet.

Bitcoin and every small and big index on Wall Street recovered from their March 2020 nadir only after the US central bank announced an unprecedented monetary aid. It injected more than $2 trillion into the economy via the purchase of government and corporate bonds.

But it now appears that the Fed has slowed down it’s spending. Official data shows that the central bank’s balance sheet has contracted by 2.3 percent in the last three weeks. Since June 17, the Fed has reduced its purchasing by as much as $160 billion.

Fed balance sheet against the US dollar and SPX. Source: Federal Reserve

It is the same period that has seen Bitcoin trapped inside a narrow trading range. The cryptocurrency failed to secure a breakout above $9,500 and below $9,000.

The Fed’s stimulus policy will expire at the end of July.