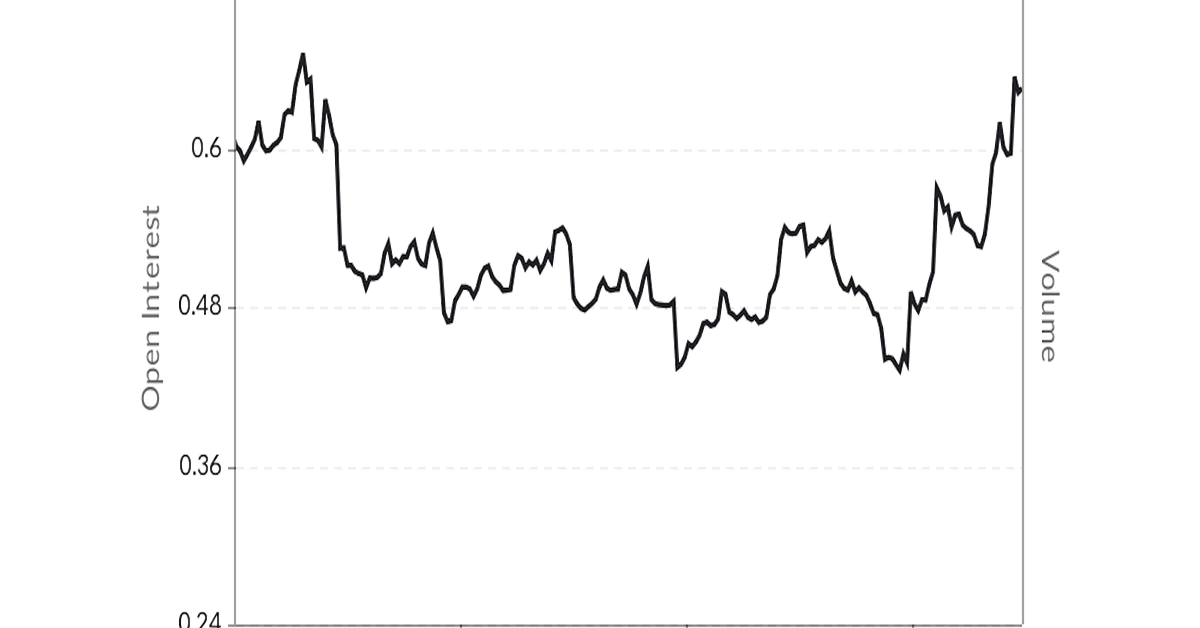

While both the put-call open interest ratio and the skew indicate the same thing, the latter is more reliable, according to Ardern, because it calculates real-time data and is not affected by open contracts. Historically, the six-month call-put skew has been more reliable as a contrary indicator, showing put bias near price bottoms, as observed after the March 2020 crash and the May 2021 slide.

Bitcoin’s Put-Call Ratio Hits 6-Month High as Negativity Rules