Saturday, Sept. 21 — crypto markets continued to trade sideways, with the majority of the top 20 coins by market cap seeing losses at press time.

Market visualization. Source: Coin360

Bitcoin dominance continues to slip

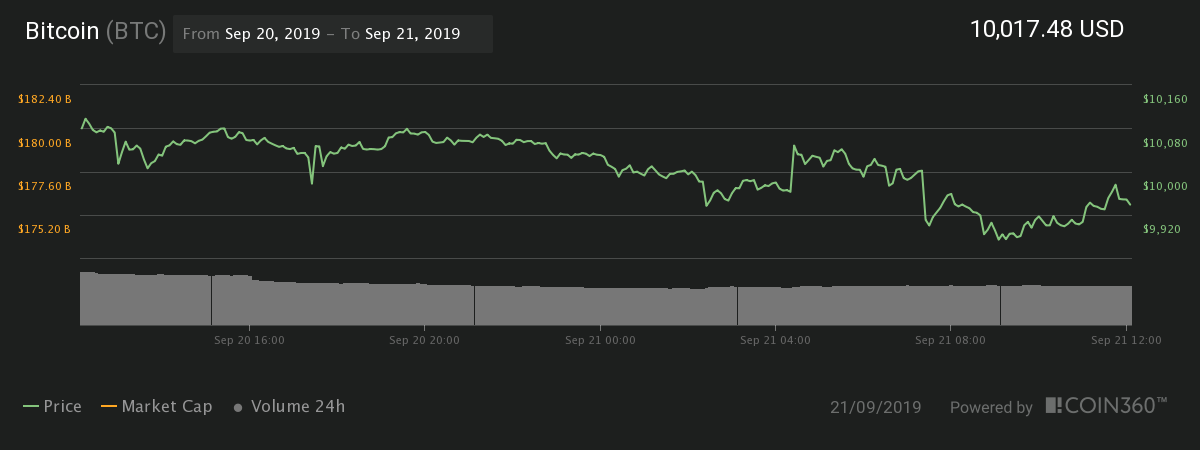

After briefly dipping below $10,000 threshold, Bitcoin (BTC) has broken back above $10,000 to trade at $10,041 at press time. The major cryptocurrency is down 1.1% over the past 24 hours, also seeing a nearly 3% loss over the past 7 days at press time.

Bitcoin’s dominance on the market has continued to drop, down from 67.7% at the beginning of the day to 67.5% at press time, according to CoinMarketCap.

Bitcoin 24-hour price chart. Source: Coin360

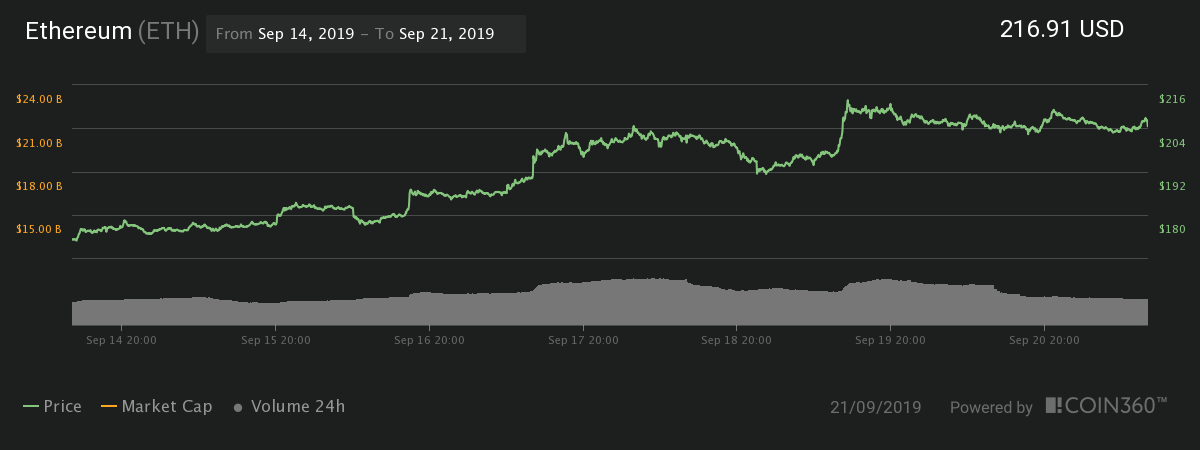

On the other hand, Ether (ETH), the second cryptocurrency by market cap and the top altcoin, is up 0.5% today to trade at $219 at press time. After seeing a bullish trend reversal earlier this week, Ether it up more than 18% over the past 7 days.

Ether 7-day price chart. Source: Coin360

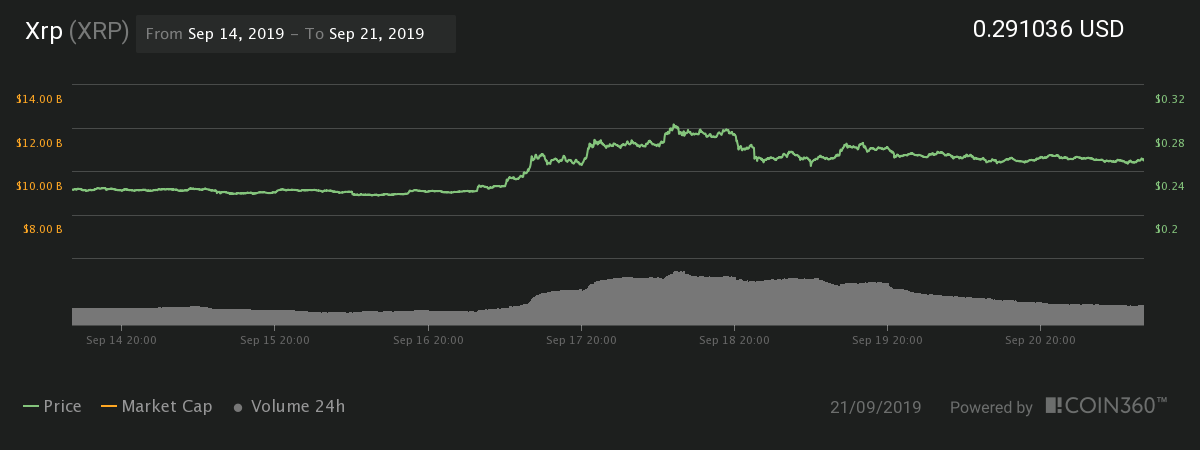

XRP, the third cryptocurrency by market cap, rose around 1.1% on the day to trade at $0.292. The second top altcoin is also seeing notable gains over the past 7 days, up 11.3% at press time.

Ripple 7-day price chart. Source: Coin360

Winners and losers

EOS, the seventh-largest crypto by market cap, is seeing the biggest gains over the past 24 hours at press time, up around 3.2%. As recently reported, EOS is expected to have its first hard fork on Monday, Sept. 23.

In contrast, privacy-focused coin Monero (XMR) slipped 2.6% over the day, which has led the coin to see the largest losses over the past 24 hours at press time.

Total market capitalization has seen a slight loss over the day, down from $269 billion at the beginning of the day to $267 billion at press time. Still, market cap is up on the week after crypto markets saw a notable sell-off to account for $261 billion earlier this week.

Meanwhile, the crypto community is eagerly anticipating a major industry event on Monday, Sept. 23, in the launch of Bakkt’s physically-delivered Bitcoin futures. On Sept. 19, Tom Lee, Fundstrat Global Advisors co-founder and major Bitcoin bull, expressed his bullish stance regarding the upcoming launch, claiming that it will lead to more trust in Bitcoin and crypto from institutional traders.