Bitcoin has been moving back and forth along the line between $22,500 and $23,500 with bears increasing their efforts over today’s trading session. The cryptocurrency has seen an increase in selling pressure from BTC whales.

At the time of writing, Bitcoin (BTC) trades at $22,900 with a 2% profit in the last 24 hours and a 4% loss over the past week. In the top 10 by market cap, BTC is lagging while Ethereum, Binance Coin, Cardano, and Polkadot managed to remain in the green with profits over these periods.

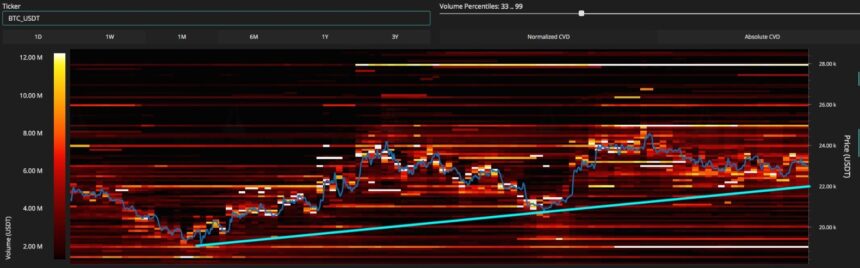

Data from Material Indicators, shared by a pseudonym user, signaled a shift in market dynamics for low timeframes. As seen below, Bitcoin investors with selling orders of around $100,000 to $1 million have begun offloading their coins into the market.

A whale who want to get out was/is controlling the market.

Purple ($100k – $1M) made these steps 👇

1. Bids below to support price

2. Market buying to drive price up

3. Price got pushed up into asks

4. Heavy market selling

5. Bids below are erasedData by @Mtrl_Scientist pic.twitter.com/XY8fezFHyd

— Maartunn (@JA_Maartun) August 5, 2022

As a result, BTC’s price has been losing momentum and could see further losses if these investors continue to exercise pressure over the coming days. An analyst at Material Indicators noted that investors with these orders (purple on the chart above) have had “the most influence over Bitcoin’s price”.

These investors selling pressure is preceded by a reduction in bid liquidity. In other words, as Bitcoin whales started dumping, there are fewer buying orders which could operate as support in case of further losses.

This leaves BTC’s price susceptible to volatility and with the weekend approaching, the cryptocurrency seems poised for potential sudden moves in either direction. The analyst at Material Indicators said the following on this possibility while sharing the chart below:

Expecting more volatility over the weekend. If the Bear Market Rally can push BTC above 25k there isn’t much friction to 26k – 28k range. Losing the trend line would be bad for bullish hopes and dreams. Mind the line (…).

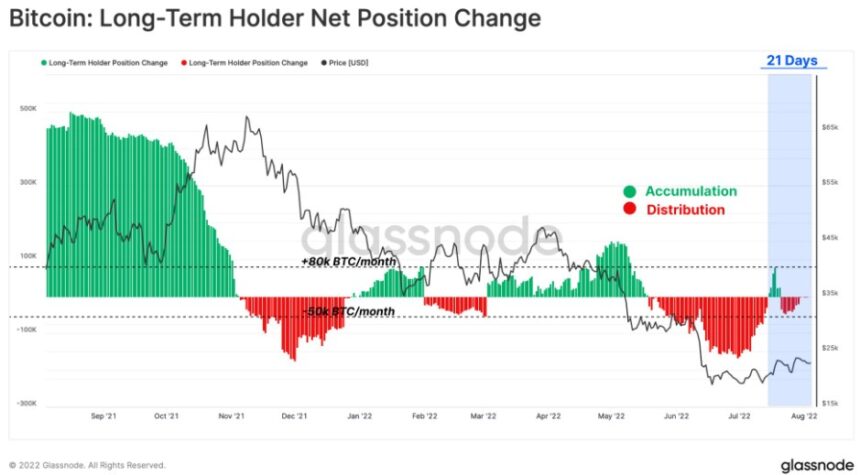

Bitcoin Long-Term Holders Take Profit

In support of the above, on-chain analyst firm Glassnode records an increase in selling pressure from Bitcoin long-term holders. These investors have been taking profit after a brief accumulation period.

The relief rally experienced by the crypto market provided these investors with an opportunity to take profits and breakeven with their initial investment:

The recent rally has given allowed Long-Term Holders an opportunity to exit a fraction of their holdings at their cost basis, at prices which essentially get their money back.