Bitcoin price keeps falling, now pushing down against support at $25,000 per coin. The recent sweep of lows has resulted in a perfected TD9 buy setup according to the weekly TD Sequential indicator.

Although this sounds positive for crypto, if the signal fails, there is risk of an extreme drop ahead. Here is a closer look at why.

Is The TD Sequential Telling Us To Buy The Dip In Bitcoin?

Things are improving for Bitcoin price action, but the situation surrounding altcoins and the increasingly negative macro environment has kept upside momentum at bay. The result over the last several weeks has been another BTCUSD downtrend. This series of down weeks has satisfied a specific sequence required to trigger a TD9 buy setup.

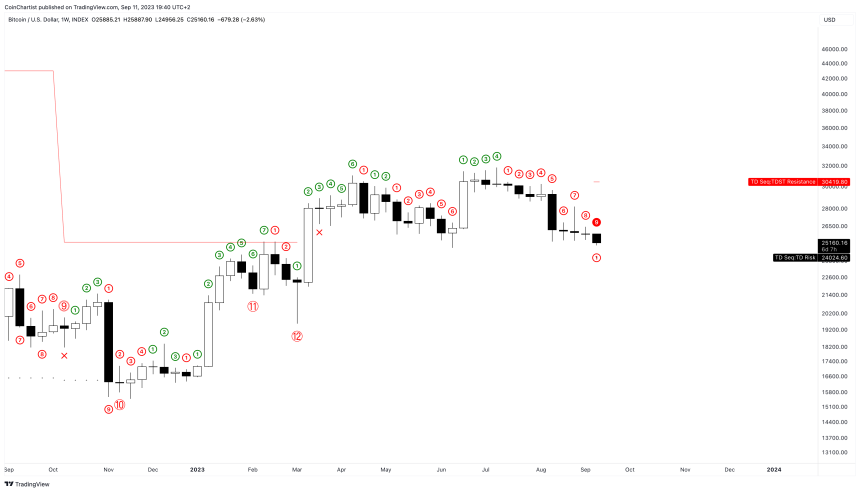

A perfected TD9 buy setup has appeared | BTCUSD on TradingView.com

Even more important, the signal has been “perfected” now that price has made a lower low on weekly timeframes. The TD Sequential is a market timing indicator created by Thomas DeMark, which can be used to potentially time reversals. However, when a buy signal fails, the move down can be dramatic.

The last time there was a perfected TD buy setup series in the same timeframe, Bitcoin was priced at $42,000 per coin. There was a short-lived recovery, but a more than 50% collapse followed due to the buy setup failure.

If the buy setup doesn’t fail here, Bitcoin should reverse before the week is over, resuming its prior bullish 2023 uptrend.

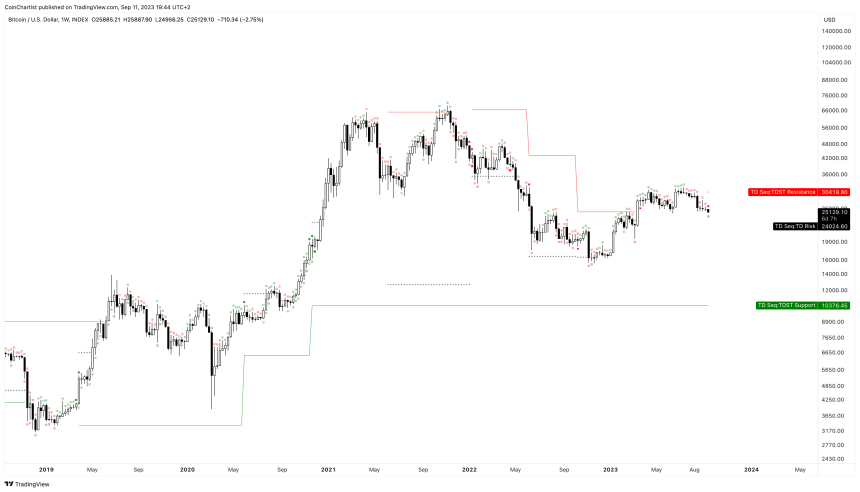

Bitcoin's uptrend is still intact, but a downtrend is forming | BTCUSD on TradingView.com

A Broader Look At The Brewing BTC Trend

Upon zooming out, we can also see that Bitcoin’s uptrend from $3,000 is still intact, according to TDST support located at $10,376. TDST support only moves up when a TD series is perfected to the upside and a sell setup triggered. Instead, the perfected TD9 buy setup has renewed TDST resistance at $30,419.

Former TDST resistance was located at $25,250, which is potentially being retested now. Based on what the technical indicator tells us, is that Bitcoin is facing a critical inflection point in terms of timing and price level combined. However the dust settles could determine the future trend for the remainder of the year.

Will this TD buy setup lead to a reversal, or further failure for bulls to establish a new bull market?