Bitcoin Value Falls to $7000 As Good News Is Hard to Find

March 9, 2020 by Ramiro Burgos

Bitcoin Value Falls to $7000 as Good News Is Hard to Find. Many negative external factors are arising from market volatility during the COVID-19 virus spread. With so much uncertainty on how bad the virus will get, all markets are in free fall. Even traditional markets.

Also Read: Bitcoin Prices Losing Strength as COVID-19 Slows World Economies

Long Term Analysis

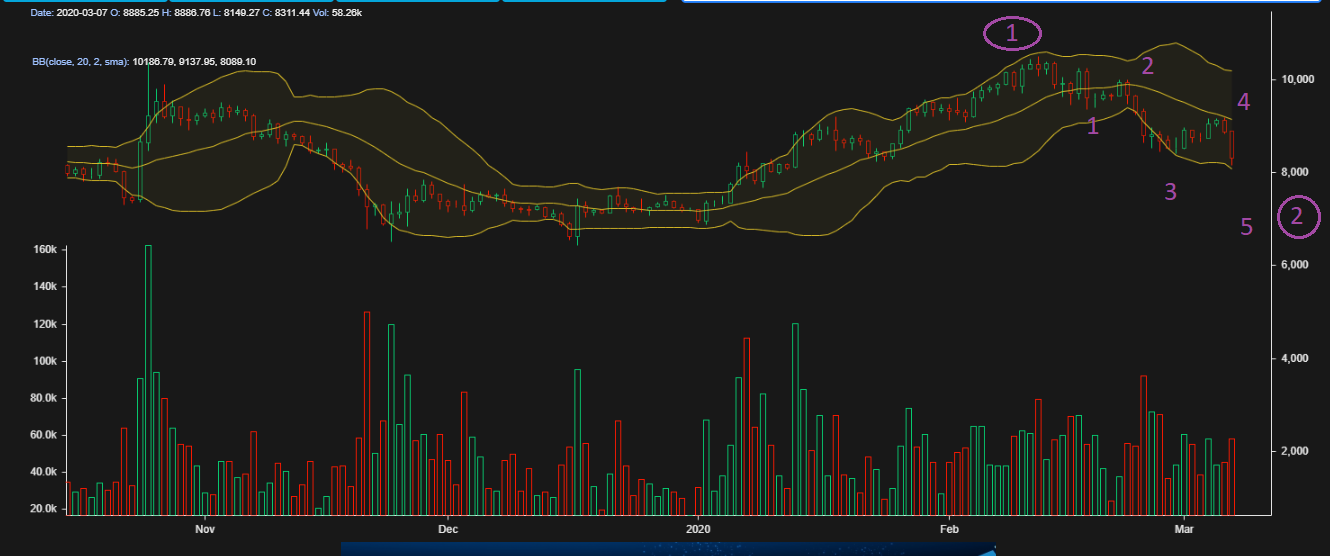

As bitcoin value falls to levels which are pushing the bear trend to the forefront, could drop to $7000 support levels. The current distribution area is consolidating in a selling off range. The enthusiastic public support from different industries like Fin-tech, who are sensitive were exposed to bullish reasoning. The reasoning comes from YouTubers or journalists on traditional media recently. They are then mentally driven to play the lambs against veteran market wolves.

Volatility should be much less these days while international trade slows down. Strayed or lost whichever the reason be, the current sell-off follows professional coverage. Bad news would speed values to lower levels if we add to the analysis some external factors. The external factors may cause confusion to venture decisions in favor of traditional financial refuges like Gold, Commodities, Real Estate or nothing but cash.

On the other hand, to sustain the bullish mood, among protectionist global political decisions, values would step back to $8000 or below $7000. Synchronizing prices with all development theories, and start marching into higher levels after the Bitcoin halving.

Mid-term Analysis

As a consequence of the distribution area settling between $8000 and $10000. Making the trend start to slip back below the current levels. By forming an inverted flag that has activated a bearish technical objective near $7000. Prices stopped drifting sidways to start falling, as most good news is lost among the COVID-19 global confusion.

Several development theories are taking place in popular mindsets and a bearish correction is in process. It could go a long way to canceling every rebound chance in the near term. Positive sentiment helping to possibly to head into the Hope phase. Coming from Mass Psychological Analysis to disbelief when halving´s now available offer arrives.

Favored by the Japanese Candlestick offers, the crows, which got stronger than ever then kicked demand soldiers out from fairy battlefield. The battle field recently defined between $8000 and $10000. Quotes entered while following Elliott´s bearish 5th Wave to $7000. When the Soldiers arrive at $8000, they could try to re-organize to strike back from support. They would then re-enter the action by clashing with the crows.

Victory doesn’t seem to be in sight even there. Those who survive should try to think of some emergency strategy from $6500 or below. Technical indicators are finally synchronizing with prices, but values are falling vertically to support a dignified defense of that level. This could only be available if and when a lateral market emerges. Reinstalling the former battlefield we have seen during December 2019, between $7000 and $9000.

On the other hand, bad global news and negative political factors like a breaking military war, further worsening of the COVID-19 virus could reinforce demand from $6500 intermediate levels. It would drive prices to higher levels.

Bitcoin is getting an opportunity to show how well it works as a store of value or not. How fast it recovers compared to the traditional markets will set the pace. If bitcoin’s recovery is faster than traditional markets it could be a sign of further confidence in it. We will have to keep an eye on the markets to see the results as time goes by.

What do you think will happen to the bitcoin price? Share your predictions in the comments below.

If you find Ramiro’s analyses interesting or helpful, you can find out more about how he comes to his conclusions by checking out his primer book. The Manual de Análisis Técnico Aplicado a los Mercados Bursátiles.

The text covers the whole range of technical analysis concepts, from introductory to advanced and everything in between. To order, send an email to [email protected]

Images via Pixabay, Ramiro Burgos

This technical analysis is meant for informational purposes only. Bitsonline is not responsible for any gains or losses incurred while trading bitcoin.