Bitcoin is back in the spotlight of the cryptocurrency market after taking a nearly 10% dum. The sudden bearish impulse saw the asset’s price drop from a high of $9,970 to a low of $9,050.

Alongside the price slump, over $80 million worth of long and short BTC positions were liquidated on BitMEX alone.

From a technical perspective, the recent price action seems to be part of an ascending triangle that has been developing since late April on BTC’s 1day chart. Now that the flagship cryptocurrency plunged to the hypothenuse of the triangle, it is reasonable to expect a move back to the horizontal resistance that lies around $10,000.

A further increase in demand around this price point may have the strength to push Bitcoin towards the 127% Fibonacci retracement levels at $12,400.

Nonetheless, there is a significant resistance barrier ahead of the pioneer cryptocurrency that may have the ability to prevent it from advancing further.

Strong Resistance Ahead

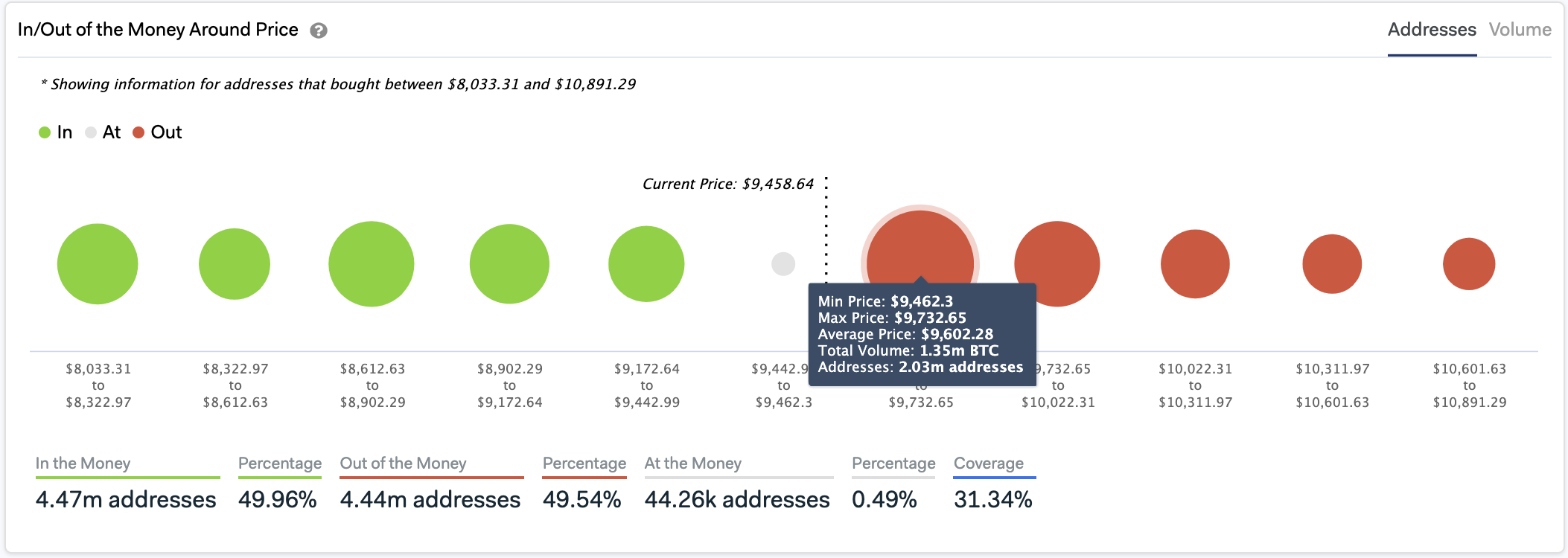

The price history of the past two months suggests that Bitcoin is poised to bounce off support and march towards the $10,000 resistance level once again. However, IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) model reveals that such a bullish impulse would be challenging to achieve.

Based on this on-chain metric, there is a massive supply barrier that sits between $9,460 and $9,730, which may reject any upside pressure. Here, the IOMAP cohorts show that over 2 million addresses bought nearly 1.35 million BTC.

On the flip side, IntoTheBlock maintains that if the bears were to step in, the $9,300 hurdle could serve as a significant support zone.

“The IOMAP analysis reveals that the next level support level is between $9,172 to $9,442, where almost 805 thousand addresses bought 509,000 BTC,” said the machine learning and statistical modeling firm.

Whales Are Accumulating Heavily

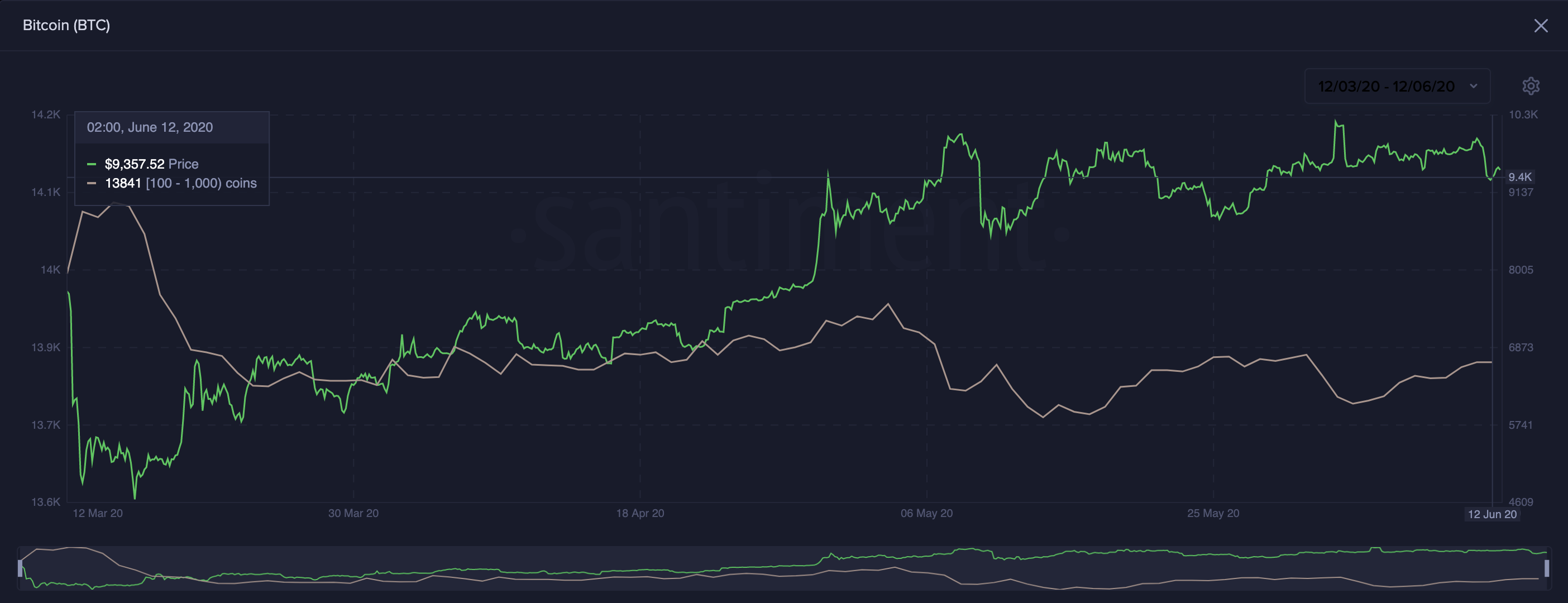

Even though resistance seems stronger than support based on the IOMAP cohorts, the number of addresses with millions of dollars in Bitcoin, colloquially known as “whales,” is steadily rising.

Data from Santiment reveals that the number of wallets holding between 100 and 1,000 BTC has been increasing in every dip Bitcoin has taken since the beginning of the month.

A growing number of BTC whales have usually led to short-term price rallies over the past three months. If history repeats itself, the buying spree that these large investors have gone through may allow the bellwether cryptocurrency to slice through the overhead resistance and retest the infamous $10,000 level.

With the current levels of volatility in the cryptocurrency market, it remains to be seen whether support or resistance will break first. It is worth mentioning that the bearish outlook cannot be taken out of the question as some of the most prominent analysts in the industry have talked about a potential 40% decline.

Featured Image from Shutterstock Tags: xbtusd, btcusd, btcusdt