Bitcoin has been trading on the green side this Thanksgiving morning with a 4.1% profit in the 24-hour chart. Approaching a critical resistance level, BTC’s price stands at $59,042 and could see more appreciation in the short if it manages to flip $60,000 to support.

Bitcoin has been rangebound for the past week with low volatility for the most part as the price was rejected close to $60,000 on Monday. According to QCP Capital, an institutional investor is most likely responsible for the price action and suppression of any serious momentum on BTC’s price rally attempts.

Related Reading | TA: Bitcoin Breaking This Confluence Resistance Could Spark Recovery

This institutional investor has been increasing selling pressure when Bitcoin attempts to reclaim previous highs, the firm noted. QCP Capital suspects this player or players could be pushing BTC’s price down to place bearish put options on Bitcoin and Ethereum.

In that sense, the general sentiment in the market has taken a dive as NewsBTC reported. Most operators have gone into fear mode but could enter extreme fear if the selling pressure causes Bitcoin to break further down. QCP Capital added:

We are betting that the market will consolidate instead of breaking lower. So we are taking the opportunity to short vols in BTC and ETH as well as take profit on our downside risk reversal position and flip to a topside skew.

As of press time, Bitcoin’s current rally into $60,000 seems fairly strong with support in the $55,000 to $58,500 area. According to the In/Out of the Money Around Price metric, over 3 million addresses bought 2 million BTC on these levels.

#Bitcoin on stable support! 💪@intotheblock‘s IOMAP shows that more than 3.41M addresses acquired nearly 2M $BTC between $55,000 and $58,500.

Such a massive demand barrier is more significant than the few supply walls ahead, so #BTC downside potential appears to be capped. pic.twitter.com/uwQOpprsAA

— Ali Martinez (@ali_charts) November 25, 2021

A Great Capitulation Before A New Bitcoin Rally?

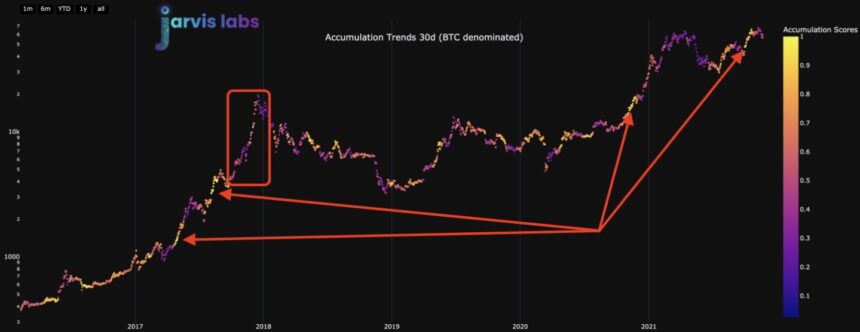

Jarvis Labs’ analyst Ben Lilly recently tried to answer the question that seems to be in every trader and investors’ mouth: has the Bitcoin bull-run ended? As seen below, BTC’s price bullish momentum is valid as long as it stays above $43,000.

In support of the bullish thesis, Jarvis Labs records heavy institutional demand for Bitcoin. Historically when BTC sees these levels of an accumulation from large investors, future price action experiences a strong push to the upside.

Conversely, when BTC sees low demand from whales, it suggests a cycle has been reached. Ben Lilly added on the whale accumulation pattern for the past week:

(…) whales are starting to step in. And this change will likely be reflected on the 30-day chart in a couple weeks.

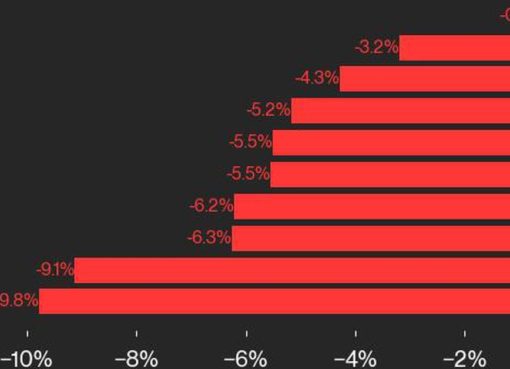

However, Jarvis Labs has been warning about the behavior in the Bitcoin derivatives sector during November. Funding rates across this sector have stayed highly positive and although they have decreased with the recent trend to the downside, they still suggest the market is overheated.

Related Reading | TA: Bitcoin Continues To Struggle, Why BTC Could Dive Below $55K

Therefore, another retest of the lows and a full market reset seems to still be in the cards. This could be the final sacrifice for Bitcoin to reach a new all-time high in 2021.