Bitcoin Price Tour: The Road From $8K to $12K

November 11, 2019 by Ramiro Burgos

We all got an unpleasant surprise from that mini-slump just before the weekend, but the math still points to sunnier future times for the bitcoin price… maybe. Read our weekly technical analysis report to find out more.

Also read: Don’t Buy That Island Yet! Bitcoin Price Settles at $10K… for Now

Bitcoin Price Technical Analysis

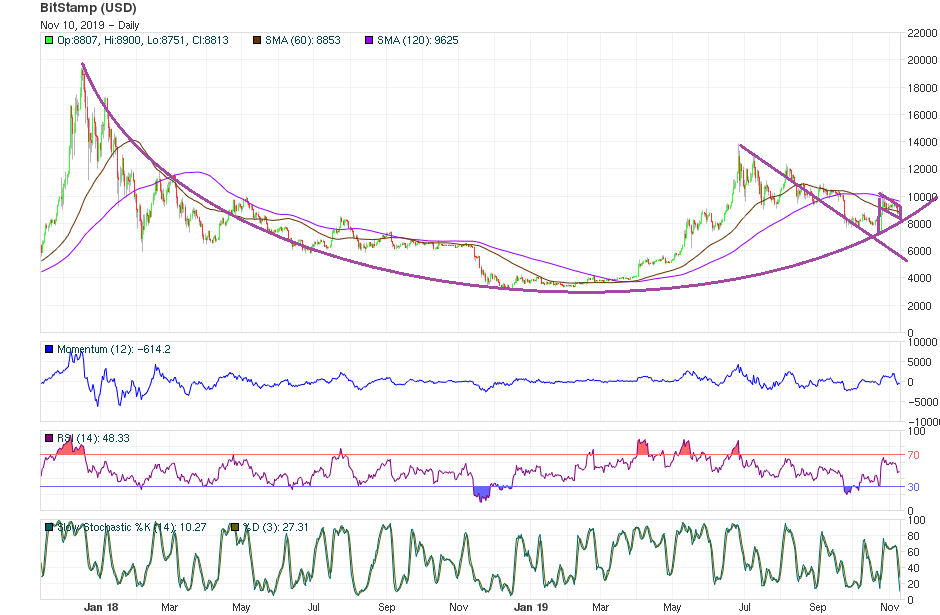

Long-Term Analysis

Considering the current $10,000 USD axis level as a theoretical scenario where the market tries to balance, prices are touring a 4,000 basis point range between $8,000 and $12,000. This recognizes a sensitive trigger level at $9,000, where the general will joins Bullish Consensus if (and when) values overcome it to test the resistance mark.

Even if a bearish pull-back drives the action down to an ascending Rounded Bottom curve near $8,000, the increasing volatility should boost an upward reaction to cover the most of a 4,000 basis point range from there to $12,000, speeding quotes up and down depending on News, Fundamentals and political data.

The lateral market contributes to consolidate a Hope phase which remains active, according to Mass Psychology Analysis.

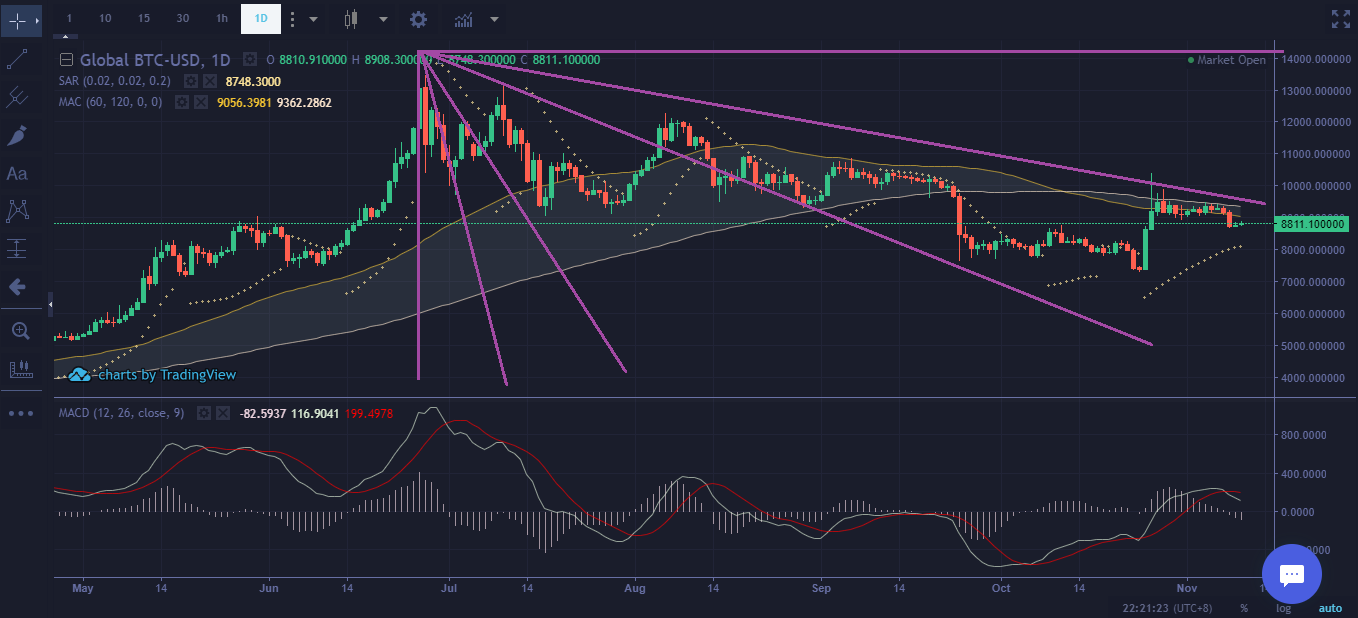

Mid-Term Analysis

The quotes are still walking away from their bearish channel influence, and a bullish Flag formation is taking place in the chart — probably to send the action to higher levels.

The former $9,000 support level plays a principal role, providing strong signals which should release the rise if and when prices enthusiastically head to the $10,000 axis. While the exhausted mathematical indicators go down, to be able to back the next upward movement, prices could stay lateral or even test $8,000 where the Rounded Bottom curve mark sits. They should bring technical reasons for a starting bounce which works as the spark that ignites a big rise to drive the activity over $10,000.

Short-Term Analysis

Following Japanese Candlesticks criteria, Offer’s crows’ ferocity re-entered their 4,000 basis point battlefield and were strong enough to scatter and defeat Demand’s soldiers at their former $9,000 support. Now crows could take hold of the whole range due to mathematical indicators needing to go down before they can logistically support soldiers to prevail in battle.

Even the main trend still points to a bullish frame. Bollinger Bands Analysis reflects the possibility that values could first test $8,000 and then $12,000 — before balancing near $10,000.

What do you think will happen to the bitcoin price? Share your predictions in the comments below.

If you find Ramiro’s analyses interesting or helpful, you can find out more about how he comes to his conclusions by checking out his primer book, the Manual de Análisis Técnico Aplicado a los Mercados Bursátiles. The text covers the whole range of technical analysis concepts, from introductory to advanced and everything in between. To order, send an email to [email protected]

Images via Pixabay, Ramiro Burgos

This technical analysis is meant for informational purposes only. Bitsonline is not responsible for any gains or losses incurred while trading bitcoin.